“We think in generalities, but we live in detail”

Alfred North Whitehead OM FRS (1861 – 1947)

Winning takes effort and the rewards make it worthwhile. Losing takes a slight misjudgement and can cause damage beyond repair. There’s a fine line and mankind has pushed the boundaries in every walk of life trying to win.

Some entities are so powerful that they collect the great and the good as trophies. A force that can wreak havoc in the hearts and minds of the bravest and most fearless is HMRC. Ask Ingenious and the members of its Enterprise Investment Scheme who find themselves with a bill that could potentially hit £800million.

Enterprise Investment Schemes – broken down

An Enterprise Investment Scheme (EIS) offers a way for small, and potentially higher risk companies to raise capital from investors by offering investment opportunities that come with tremendous tax incentives in exchange for their investment. The tax relief on offer comes in two key forms:

- Income tax relief

This is given to individuals who purchase (either directly or through a nominee) shares in a company running a “qualifying” EIS. The relief comes in the form of 30% relief on the income tax bill, meaning £100,000 invested could reduce an income tax bill of £30,000 to zero. Sounds positive so far. The stipulation is that the shares issued must be invested for three years from the date of issue or from the date of purchase and the scheme must continue to “qualify”. - Capital gains tax relief

As long as the income tax incentive is claimed and the shares are held in the EIS for three years, capital gains tax need not be paid on any gains on the shares once disposed of. This relief is not available to those who do not take the Income Tax relief, simply to avoid years of backtracking through the schemes to ensure that they still “qualify” and that they continued to do so several years after the investment. The message therein is, ‘we’ll give you lots of tax relief or none at all!’

Tax treatment depends on individual circumstances and may be subject to change in the future

Enterprise Investment Schemes and their siblings that make up the Venture Capital Trust family were actually designed with the best of intentions. The idea that people could invest in a fledgling company to help them grow and blossom into the Apple or Microsoft of tomorrow is no bad thing… but in this circumstance one could consider the road to hell and good intentions. To call it altruistic may alas be a step too far but an EIS was something that could originally offer an investor some very lucrative returns as well as genuinely benefitting the national economy.

The word “qualify” and its variants are in quotes for a reason (as investors in a failed EIS could likely tell you all too well). HMRC in their guidance note state that ‘both investors & companies should note that no relief will be given (or if it has been given, will be withdrawn) if any scheme has as its main purpose or one of its main purposes the avoidance of tax.’ This is where things can start to get “Messi” (although his and his father’s €3.5M tax penalty wasn’t related to an EIS).

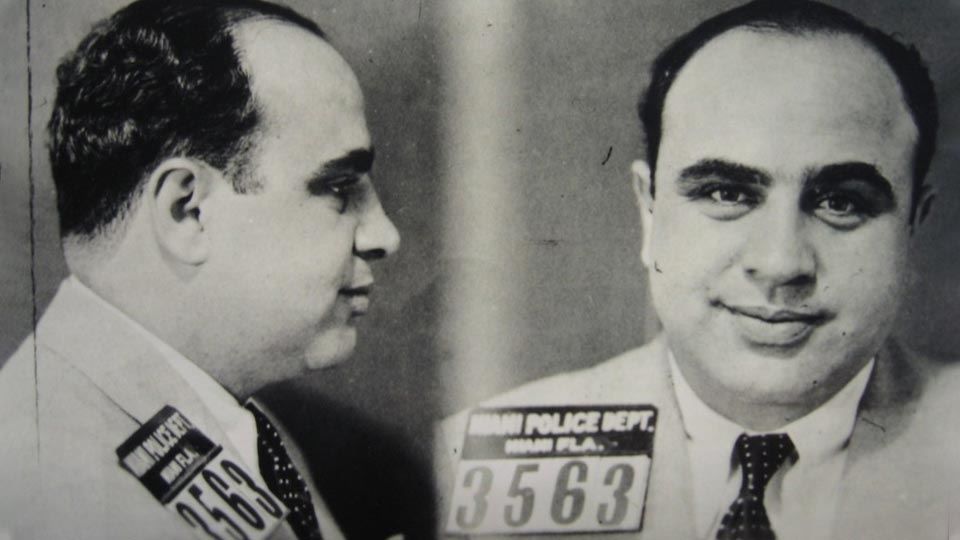

Mug Shot of Capone’s Arrest in Miami in May of 1930. Source: Miami-history.com

Much like any opportunity, there are those who choose to exploit it. From Charles Ponzi to Bernard Madoff and Allen Stanford, there are those who wish to exploit and defraud people, governments, tax offices and anyone or anything else they think they can make a buck out of. This is a sad state of affairs but a reality of life. And just a brief warning for those that think they can go up against the tax man and win, just remember how in 1931 they finally locked up one Alphonse Gabriel “Al” Capone.

While this article may seem like a harsh attack on companies offering Enterprise Investment Schemes, a certain sense of indignation could be put down to the facts that:

- The original concept of an EIS was to help small companies grow and prosper and help the economy as a whole, not for the sole purpose of tax avoidance. Tax relief was a benefit, not the whole point.

- These schemes have often been subject to misselling or misrepresentation. They involve small firms which, by their nature, are more susceptible to shocks in the market, cash flow problems and other potential pitfalls smaller businesses face.

- The risks around the schemes themselves and the complexity of the tax law that needs to be understood and followed every step of the way in order to qualify for the relief are often not made clear to the investor, nor are the dangers if they fail.

- The most unforgivable of all; the emotional and financial turmoil these schemes can create for people for many years. Some prices are just too high.

Here we assume the position of a typical target EIS investor and look ahead over time:

Chapter One: Accumulation

You work for years, building a business or working your way up the career ladder, the kids are at university or standing on their own feet, you’ve a good disposable income, plans formed and a substantial amount of money saved or invested. Things are looking good.

Chapter Two: Enticement

The sales pitch. “You don’t need to be paying all that tax…there are ways around that.” You trust and eventually believe you could successfully invest in films and garner a huge sum of money through income and capital gains tax relief. It all sounds great, but the fine print doesn’t read with such encouragement, if read at all…

Chapter Three: The honeymoon period

You’ve applied for and received your relief from HMRC. It’s all looking on track for success. Life is good. You even consider investing in another scheme next year to gain even more relief.

Chapter Four: A moment of clarity

A letter arrives on your doormat explaining that HMRC are taking the administrators of the scheme to court as they feel it does not meet the qualifying criteria of an Enterprise Investment Scheme. You are given a choice; pay the relief back with penalties and interest or club together with the rest of your fellow investors and fight the behemoth that is HMRC. This will drag through the courts for potentially upwards of 10 years, while your funds invested in the scheme are frozen and you are allowed no access to them while they form part of the investigation. You will receive regular updates telling you how the case is progressing.

You lose the case in one court but fear not, the right to appeal to higher court is won. Two years later, and you’ve lost in that court too. Chapter 5: The aftermath You are less well off than you were at the outset. Your trust of financial institutions and their advice is left in tatters. The stress and anguish of this having been hung over your head for so many years has taken its toll. Any future financial plans are in ruins while a significant portion of funds invested are tied up with the potential for a vast bill, hanging like the proverbial anvil over your head.

Courtiers – built from the ground up

Courtiers focuses on building long-term relationships to help clients identify and achieve their goals. Clearly understood, the laws of this land offer enough scope to allow just, legal and moral financial planning which can assist in successfully targeting future goals and objectives.

The temptation to invest in an EIS or other similar scheme should be met with a clear understanding that there are far more transparent ways to mitigate tax through efficient financial advice. The government offers information about them, and Courtiers exists to understand, comply and use its knowledge to guide clients towards their objectives.

The ISA

The government allows £15,240 per tax year (2016-17 allowance) to be paid into an ISA with the gains being free from Income Tax & Capital Gains Tax.

Pensions

Each tax year if you are under age 75 it is possible to receive tax relief on pension contributions up to £40,000, or the maximum of your relevant earnings if they are less than this figure, or up to £3,600 if you have no earnings. Those with adjusted earnings over £150,000 receive a reduced allowance, as do those who have flexibly accessed their pension. You can receive tax relief on each contribution up to your personal limit, so for every £1 paid, a basic rate taxpayer will actually get £1.25. Higher rate tax payers can receive £1.66 and additional rate tax payers can receive £1.81. Worth knowing…

What else can we do?

A lot. As part of our Discretionary Investment Services, clients can always contact their Courtiers Adviser with any questions or just for a general catch up meeting.

Courtiers is “vertically integrated”, which means that our investment fund management business forms an important part of the organisation. The businesses work together to help clients build, protect, enjoy and pass on their wealth. The Investment Team shares information on the state of the markets and ongoing strategies and Advisers remain informed as do our clients, with interesting information without the technicalities shared annually at Courtiers Client Seminars.

Great minds can work together to ensure everything possible is explored and acted on accordingly to help clients hit their targets. We can utilise unused Capital Gains Tax allowances each year where possible to help clients to realise more gains in a tax efficient manner. We can ISA wrap funds to allow clients to benefit from gains in the most tax efficient manner.

By understanding objectives we can plan tax efficiently. Inheritance Tax (IHT) is something that causes many people anguish and Courtiers works within the legal frame work set out by HMRC and the government to help mitigate a potential IHT bill. We utilise trusts (none of which are set up using a Panamanian law firm by the way) as well as gifts and nil rate bands to help clients pass on wealth to loved ones via an effective IHT strategy.

Summary

For the F1 driver in their pursuit of pole position, an extra 1/1000th of a second can make or break a win. The controls on an absurdly complicated steering wheel reveal a glimpse of a complex science behind success on the track and the fine line between winning or losing. While many a retired driver can now joke and reminisce about losing to the “The Wall of Champions” at the Circuit Gilles Villeneuve, the reality is that everyday life seldom rewards a foolhardy reckless approach.

Nobody at Courtiers is expertly trained to drive an F1 racing car, so we’ll just say go easy on the accelerator – get to know the track intricately.

Sharing knowledge to guide each other towards understanding realistic options and potential consequences is one formula for breaking boundaries, and one COURTIERS takes pleasure in applying to the goals which can improve the lives of clients and those who matter to them the most.