An eventful 2017 has been neatly wrapped up in three days of Courtiers Client Seminars across the UK.

First in Derby, then twice in Henley-on-Thames, Courtiers’ Chief Executive Officer Jamie Shepperd welcomed audiences to Courtiers’ Annual Client Seminar, before introducing Analyst James Timpson to take us through the last 12 months.

Positive Performance and ‘Dodgy Haircuts’

Fixed on the ups and downs of global markets, James touched on prominent political figures over the year, highlighting the unpopularity of Donald Trump as the only president in 60 years to begin his tenure with a negative approval rating. Lowest approval ratings, highest disapproval rating and interestingly, the smallest ‘unsure’ percentage, showing how divisive Trump is. What would it take for Trump to hit ratings as low as Richard Nixon or George W Bush? We’re not sure, but we are sure it takes more than a man with a dodgy haircut to stop US Markets performing, as James showed the S&P 500 index returned +18.3% over the year.

Closer to home, Theresa May’s decision for a snap general election saw Tory seats drop while Labour’s climbed. It didn’t go to plan for the Prime Minister, she’s had some challenges; within her party and of course with Brexit. We have more than a year for Brexit to unfold so we’ll keep interested eyes on the markets as it happens.

Across 2017, the UK base interest rate rose. It was a strong year for the pound with sterling up +9.6% against the dollar and the FTSE saw a +2.6% return.

Playing the Markets Right

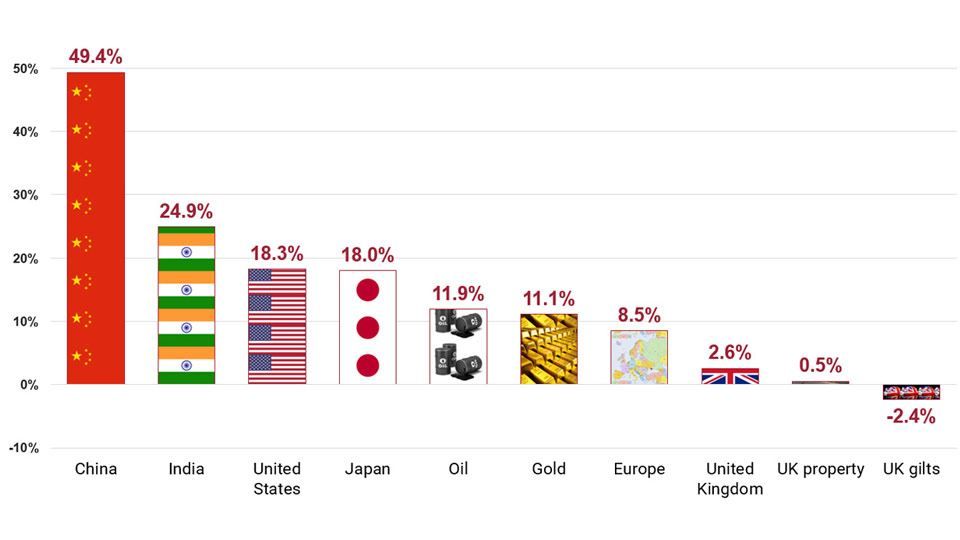

Ask anyone in the office and they’ll tell you James is a huge game show fan. As a worthy tribute to the late Sir Bruce Forsyth, James invited the audience to help close his presentation with a game of “Play Your Markets Right”. Thoughtfully constructed, informative global market insight was well delivered and the audience participation was excellent. Most surprising of all the ‘cards’ was China with a +49.4% increase in the markets. Our emerging market equity portfolio has seen positive returns as a result.

Chart 1: 2017 Market Summary (total returns)

(Source: Bloomberg and Courtiers, 30/12/2016 – 30/11/2017)

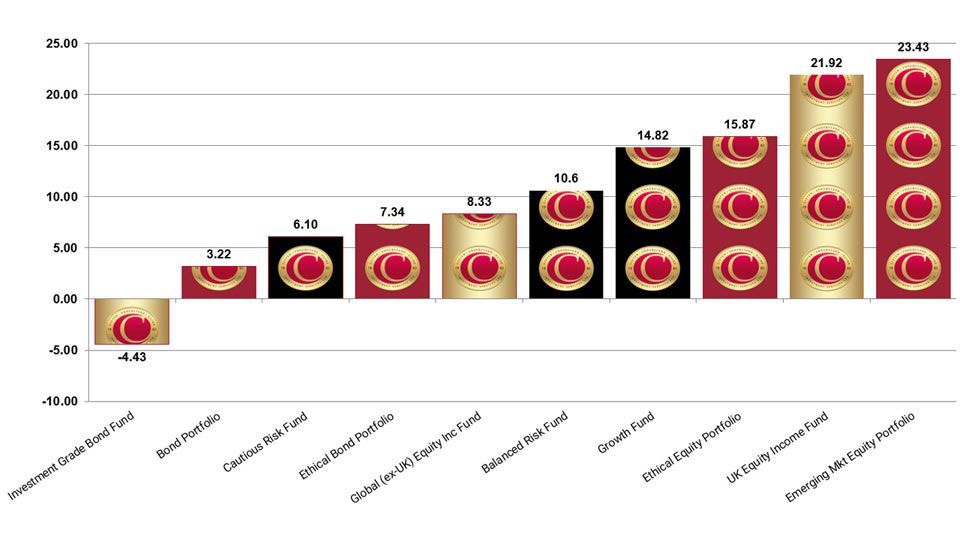

Courtiers Fund Performance

Caroline Shaw, Head of Courtiers Funds and Asset Management, took us through Courtiers Fund performance in 2017.

It’s been a difficult year for bonds and we’ve heard Chief Investment Officer, Gary Reynolds warning about bonds for some time. While the Courtiers Investment Grade Bond Fund returned -4.43%, all other Courtiers Funds and portfolios delivered positive returns with an excellent +21.92% on the Courtiers UK Equity Income Fund. We currently hold equity exposure in US, UK, Europe, Asia and Emerging Markets (the latter also performed well across the year):

Chart 2: Courtiers Portfolios – Last 12 Months (total returns)

(Source: Morningstar and Courtiers, 30/11/2016 – 30/11/2017)

Credible Companies

How do we find companies to help make all this happen? How do we know what’s worth investing in? Courtiers looks for companies with strong financial characteristics including rising dividends and robust cash flow. We also consider corporate governance as part of an analyst “sanity check”. Caroline explained what the Investment Team looks for and what they try to avoid, with dual share class listings being one example of bad. “We don’t like share structures leaning heavily in favour of particular shareholders. They are designed to limit the overall shareholder voice and while I’m not saying dual share class structures don’t perform well, we like to be aware of what we have got. The S&P index is barring businesses with dual class share structures from now on and FTSE & MSCI have also done the same.”

For those businesses we do invest in, Caroline gave us a glimpse into a handful of shares we own, how they perform and how we’ve sold shares in businesses at a time that’s helped maximise the investment returns throughout the year.

Crypto-crazy

There are now over 1,300 digital currencies, or cryptocurrencies, with Bitcoin dominating the finance headlines. Cryptocurrencies are decentralised which means they are not regulated. They instead use a “blockchain” which is a way of digitally recording event-based information, in order of occurrence. Information added to a blockchain cannot be manipulated and this provides a sequence of events that can be deemed true. Imagine a fine diner being able to retrieve accurate, trustworthy information on the journey of a salmon from catch to their plate at the table. Imagine being able to obtain the transactional history of a luxury property or classic car…details of sales, modifications etc. Blockchain could evolve business transparency across a whole host of industries.

Back to ‘money’, is Bitcoin a fertile ground for returns? Caroline explained that Bitcoin cannot be treated as a currency or an investment. It is simply speculation. Transactions are costly and commissions on trading are high. Caroline left us to ponder the power consumption of Bitcoin with each transaction consuming more electricity than most households consume in three weeks. Suffice to say we are not invested in Bitcoin right now.

Wrapping up, Caroline explained that the Courtiers multi-asset funds are well diversified across equities, bonds and defensive positions such as equity index put options, cash and infrastructure.

Has the UK economy gone stagnant?

Chief Investment Officer Gary Reynolds kick-started with some depressing statistics, first highlighting that the forecast from the UK Office for Budget Responsibility (OBR) for gross domestic product growth dropped from 2.4% pa in March 2015 to 1.4% in Nov 2017.

There’s been a reduction in productivity. More young adults live with their parents for more years than ever before. Why? Is the housing market broken? Are wages stagnant? Is there a problem with trade imbalance?

The cost of buying a property against income showed that an adult today would be looking on average at an outlay of 443% of annual income to get on the property ladder. Add to this the fact many students walk into ‘the real world’ already in significant debt, and there’s little wonder Labour attracted a great volume of young voters in the recent snap election. Younger generations are disenfranchised by the lack of opportunity compared to those in previous years.

Where are we going?

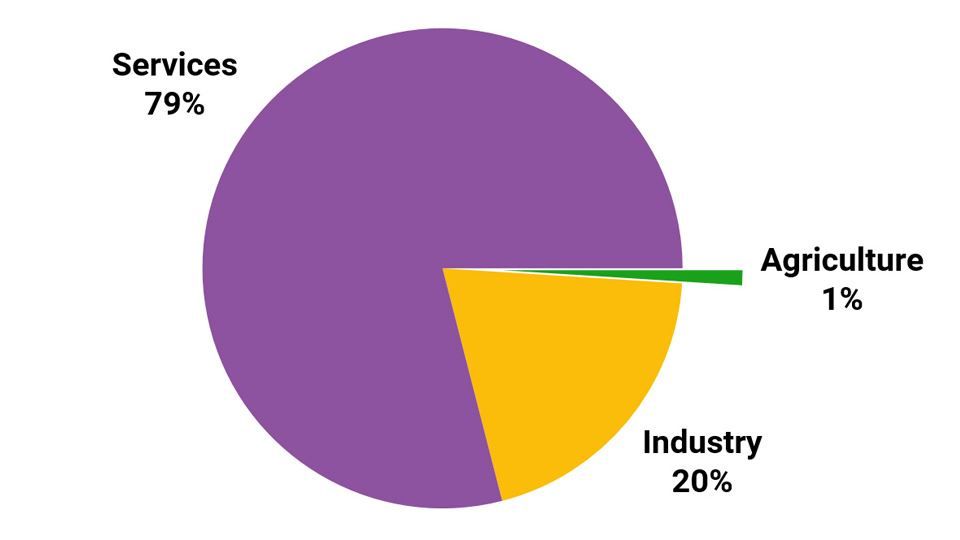

In the 1700s, agriculture made up 56% of the entire UK workforce. Agricultural innovation over the following three centuries reduced this down to just 1% in 2015.

Chart 3: Composition of UK Workforce in 2015

Industry covered 22% of the workforce in 1700s, reducing to 20% in 2015 while services took the lion’s share with 79% in 2015, up 57% over 300 years.

This continues. Technology is now driving evolution of the industrial workforce: machine-learning and AI based electronics are reducing the need for manual labour within factories and warehouses. We continue to move towards a service based future.

Serving the Future, by Inventing it

Humans are incredibly innovative and will shape the future of the UK and our world (China, Europe and the US are all experiencing growth). With around 1/3rd of global innovations over the last 200 years sparking from Great Britain…from streetlights and railroad tracks in the early 1800s to biological scientific breakthroughs and the world wide web in the mid-late 90s, we have the ambition and the skill sets to bounce back.

While change is far-reaching across many industries at the moment, it will all come together to change the whole world in motion. This makes fertile ground for intelligent minds to help steer the inevitable evolution of humankind.

Gary covers his presentation in more detail. Read now

Looking Forward

Thanks to all our presenters and clients who attended and shared feedback (by email and post) following this year’s seminars. We appreciate it very much and look forward to presenting again in 2018. Dates will be announced once confirmed.

Pictured left to right: James Timpson, Analyst – Caroline Shaw, Head of Fund & Asset Management – Gary Reynolds, Chief Investment Officer & Jamie Shepperd, Chief Executive Officer.