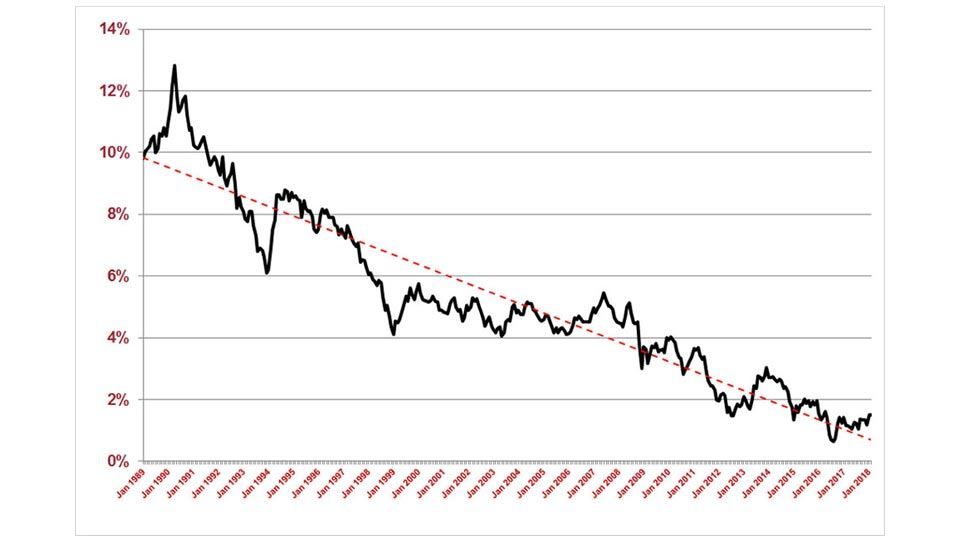

Anyone holding long-dated bonds is betting that the government of the country of issue can keep inflation under control for the next half century and resist fiscal profligacy. I could not bring myself to buy 30 Year UK Government Bonds for a paltry return of just 1.9% per annum when, with RPI inflation already at 4% (see Chart 2), it will crucify the purchasing power of my capital, and especially not when I can buy the FTSE 100 with a dividend yield of around 4%.

Three decades of falling interest rates have made bond investors complacent, so complacent in fact that in places like Japan, Germany, France, Switzerland, Holland and Spain you pay the government for the pleasure of lending them money (3 year bond yields in these countries are negative). Even in the UK, with a long-term history of chronic price pressures, investors are prepared to lend the British government money for a return of less than half the current rate of inflation.

Chart 1: UK 10 Year Bond (Gilt) Yields from 1989

Source: Bloomberg & Courtiers

To someone like me, who cut their teeth in investment markets in the ‘80s and ‘90s when mortgage rates were constantly in double digits, bond values look bloated and fit to burst.

The reasons for over a quarter of a century of rising bond prices and falling interest rates are:-

- The success in the ‘80s of US President Ronald Reagan and Federal Reserve Chairman Paul Volker in targeting lower inflation and achieving it through tighter monetary policy.

- The granting of independence to major central banks (the Bank of England was given independence in 1997).

- A number of countries adopting export-driven growth as a core economic policy – this created huge trade surpluses and a glut of savings which had to be recycled throughout the globe, boosting demand for safe assets (bonds).

- The “flight to safety” that occurred after the 2008 credit crisis had ravaged financial markets.

- The discrediting of Keynesian policies which advocated intervention during times of recession and which had been used through the 60s, 70s and 80s by many governments around the world as an excuse for fiscal profligacy.

The above created a belief that interest rates would remain perpetually low. This is grossly misplaced, especially among younger borrowers and investors. To have experienced investing and borrowing in times of high interest rates you would need to be around my age (60) or older. From a rough poll, the majority of people in our office have mortgages at rates less than 1/5th of what my wife and I paid when we bought our first home way back in 1981.

What will prick the current bond bubble? There are a few possibilities:-

- Ten years on from the chaos of the global financial crisis, banks have re-built their balance sheets. They are now much stronger than they were in 2008, which has restored confidence and started credit flowing again.

- The rise in inflation has gone almost unnoticed. UK base rate is still just 0.5%, and yet inflation is up to 3% (4% using the RPI).

- Growth is picking up globally, and the Trump stimulus may push it along a lot quicker, especially in the US. Global inflationary trends are building.

- Populism will encourage governments to loosen fiscal policy and spend more to placate an electorate which, on the whole, has had 10 miserable years of falling real incomes. If you are a UK graduate, the chances are you will enter the job market with worse prospects than your parents and with around £50,000 of debt. No wonder so many twenty-somethings have declared for Corbyn.

Chart 2: UK Inflation %

Source: Bloomberg & ONS

Bond busts are not new. In their classic 1951 edition of “Security Analysis”, Benjamin Graham and David Dodd showed how the yield on high grade AAA bonds varied between 1936 and 1948. They also showed that some high grade bonds, following a “….moderate change in interest rates between 1946 and 1948…” (the rate on Moody’s AAA bonds rose from 2.48% to 2.86%), saw a decline of 20% in their principle value.

For those non-Courtiers private investors that have been tempted into long-dated bonds, I suggest you speak to either your investment manager or a psychiatrist. If your investment manager insists on holding 30 year gilts, take them to the psychiatrist with you!