Courtiers has been safeguarding wealth for over four decades. The trust clients place in our stewardship and the custodial partners we carefully select is at the heart of everything we do. We take seriously our duty as a Financial Services organisation to comply with strict regulation, exercising due diligence to ensure robust business continuity and client asset safety.

One initiative we are obliged to uphold are the rules governing the Client Money and Asset rules as outlined in the FCA’s Client Asset Sourcebook (CASS) The CASS rules are designed to protect client money and assets held by UK financial firms.

CASS and Courtiers

All firms authorised and regulated by the Financial Conduct Authority (FCA) to hold and control client money are subject to the Client Money and Asset rules (CASS), as laid out by the FCA. Courtiers (both Courtiers Investment Services Limited and Courtiers Asset Management Limited) is no exception.

What is CASS and what is its purpose?

CASS sets strict rules every Financial Services firm needs to follow, specifying what steps must be in place to protect clients’ money and assets. In simple terms, the requirements are:

- To segregate client money from Courtiers’ own money.

- To segregate client assets from Courtiers’ own assets.

- To keep accurate and complete records, identifying owners of client money and assets, to enable the reconciliation of money and assets.

- To maintain records and procedures, to support the swift return of client money and assets in the event of business failure.

- To conduct regular checking and reporting that confirms CASS compliance.

How is client money segregated from Courtiers?

The FCA authorises Courtiers to hold and control client money.

Client money refers to money not invested. It may be just-received money, money awaiting investment into Courtiers’ funds, money waiting to be paid out as a withdrawal or income, or funds held in cash, ready to cover fees.

CASS rules require firms to completely separate client money from the firm’s own money. In this way, Courtiers is not allowed to use client money in the course of its own business activities.

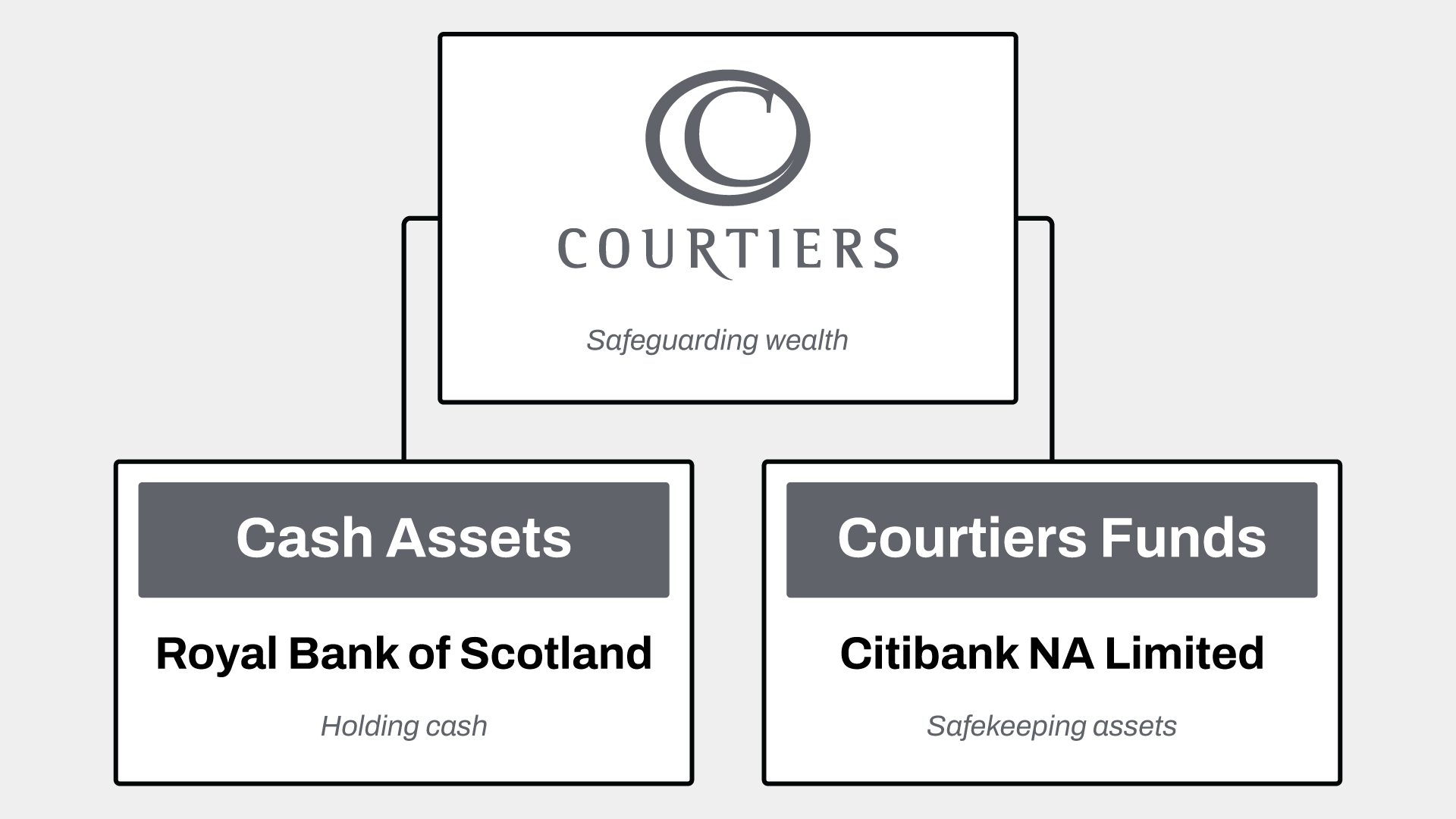

Client money not yet invested, or kept to pay for fees, is held in the client bank accounts with Royal Bank of Scotland (RBS), who were selected by Courtiers in accordance with the FCA’s rules. These accounts are designated client ‘omnibus’ (an investment account shared by multiple clients) accounts with ‘statutory trust status’. The money within the accounts is recognised by RBS as belonging to Courtiers’ clients.

The CASS rules also set out the obligation for Courtiers to undertake regular reconciliations of client money and to maintain records which determine the total amount of client money it should be holding for each of its clients. Careful calculations are conducted frequently with reports submitted to satisfy internal governance.

Further protection through the Depositary

Through the FCA, Courtiers Asset Management Limited is required to appoint an independent Depositary (i.e. a bank or credit union) to safeguard the assets of the Courtiers funds. As part of their safekeeping obligations, Courtiers uses Citibank UK (Limited) to record all cash assets held by the funds.

In addition, all non-cash assets (safekeeping assets) are held in custody by our appointed Custodian Bank (Citibank NA Limited) and are held in segregated accounts opened in Citibank’s name. This means these accounts can be clearly identified as always belonging to the fund, in accordance with UK legislation.

This has the effect of ringfencing the fund’s assets from Courtiers Asset Management Limited’s own assets, ensuring client assets are protected.

How are client assets segregated from Courtiers?

Clients with assets held by Courtiers Investment Services Limited similarly benefit from the safeguards set out in the CASS rules. As mentioned above, CASS rules require firms to completely separate client assets from the firm’s own assets.

The CASS rules also mean that Courtiers Investment Services Limited are able to identify the total amount held for each client and regularly check records to ensure all money holdings match.

Between RBS and Citibank, any cash holdings are ringfenced from Courtiers. Courtiers acts as the custodian, providing you with the knowledge and resources you require to effectively manage your wealth and plan for the future while your money and assets are held safely.

What else does Courtiers do to protect client money and assets?

Discretionary Investment Management

Discretionary Investment Management (DIM) allows clients to benefit from their investments being managed.

By having prior approval within the client agreement, the Discretionary Manager can quickly respond to changes in the markets. This reduces delays for any time-critical investment decisions that could affect a client’s investment value.

Protecting Clients from Financial Crime

Courtiers protects client assets from fraudulent activity, with processes in place to ensure security through certainty. For example, some procedures are subject to identity verification checks. If you request information about your investments or any changes to your account details, Courtiers may ask for you to take additional steps to confirm your identity. By working together, we can be certain that your request is genuine.

In accordance with prevailing data protection legislation (GDPR) Courtiers also seeks to actively ensure that all electronically-stored client data is fully protected. System security undergoes constant scrutiny, internally and via commissioned third parties.

Our procedures are designed to ensure Courtiers complies with the appropriate regulations relating to fraud prevention, anti-money laundering, anti-bribery and corruption.

Wealth protection into the future

Courtiers continues to focus on protecting your wealth into the future. In addition to safeguarding and diversifying your investments amid ongoing volatility in global markets, protecting your wealth involves continually assessing and developing our people, resources, technology and internal frameworks. All this serves to improve our overall ability to continue supporting you, the client, most efficiently.

Want more information?

If you have any questions or queries on the information covered in this article, please speak to your Courtiers Financial Adviser, or contact us.