James Timpson stood at the front of the 2025 Client Seminars to detail how Courtiers Funds have responded to global events, from President Trump’s Tariffs to the Mag 7.

The big reveal

“And now, the moment of truth. These next ten seconds are what keeps me awake for most of the year.” – James Timpson, Head of Asset Management and Fund Manager

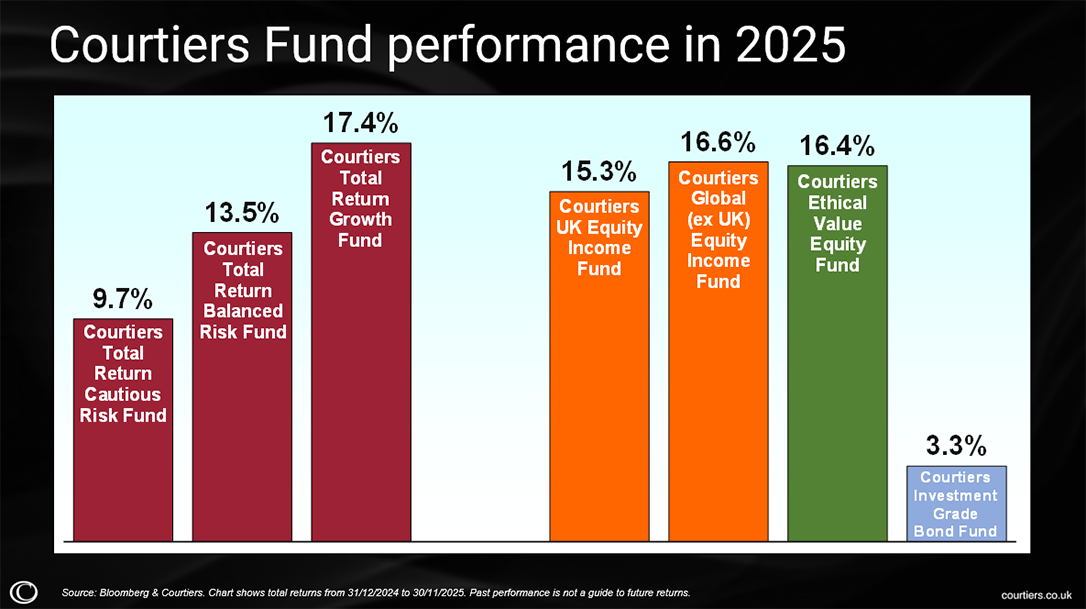

Starting now with the last part of James’s presentation – how the Courtiers funds performed over this year – you can see for yourself below:

In the multi-asset funds, the Courtiers Total Return Cautious Fund returned 9.7%; Balanced 13.5%; and the Growth Fund 17.4%.

The Equity Funds are all within 15% to 17% and the Investment Bond Fund did its job as a low risk holding at 3%.

“We are really pleased with how the Funds have done this year. It’s been a really positive year even with that big spike in volatility we saw earlier on. We are very pleased indeed.”– James Timpson, Head of Asset Management and Fund Manager

So what factors across the global impacted fund performance and markets in general, and how we did fare at mitigating any negative impacts on the Courtiers funds?

The value of diversification

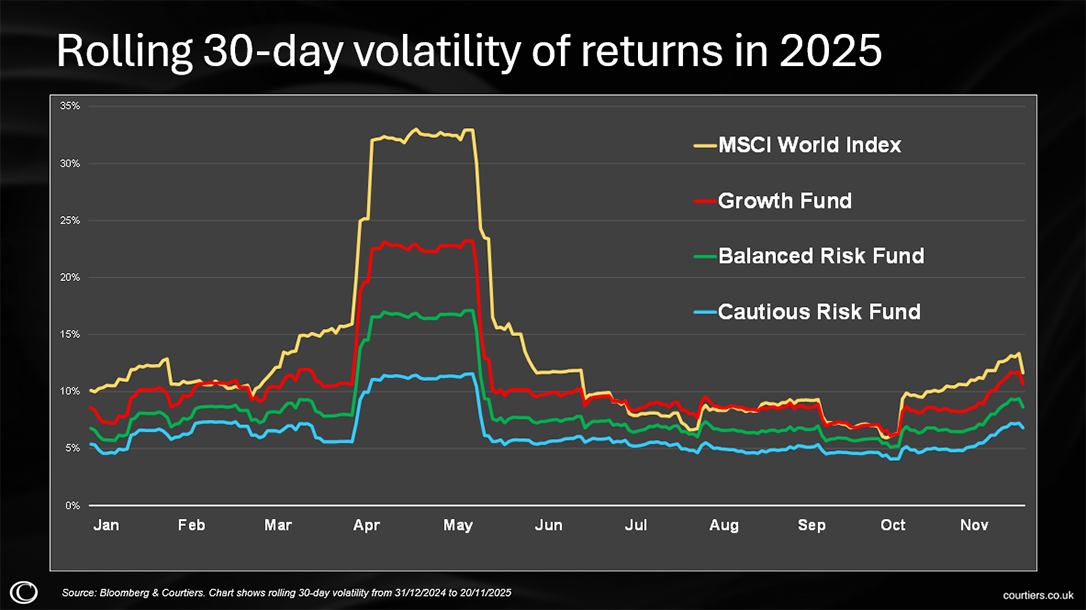

Volatility is something we try to manage, which you can see in action when you look at the Courtiers fund responses to President Trump’s Tariff announcements (before the 90-day pause) earlier in 2025. The below chart looks at the rolling 30-day volatility of returns across 2025, showing the variation of the day-to-day price movement within the funds in the last 30 days.

You can see a huge spike at the start of April, shadowing the MSCI World Index global stock market – effectively 100% equities. Although the Growth fund went into the crash with more than 100% equity exposure, it suffered less due to how we diversify. It shows how concentrated the market is on the tech companies of the Mag 7.

This chart demonstrates that the funds are behaving in a commensurate manner to their individual risk profiles in terms of volatility: the Courtiers Multi-Asset Cautious Risk Fund (blue) is below the Courtiers Multi-Asset Balanced Risk Fund (green), which is below the Courtiers Multi-Asset Growth Risk Fund (Red).

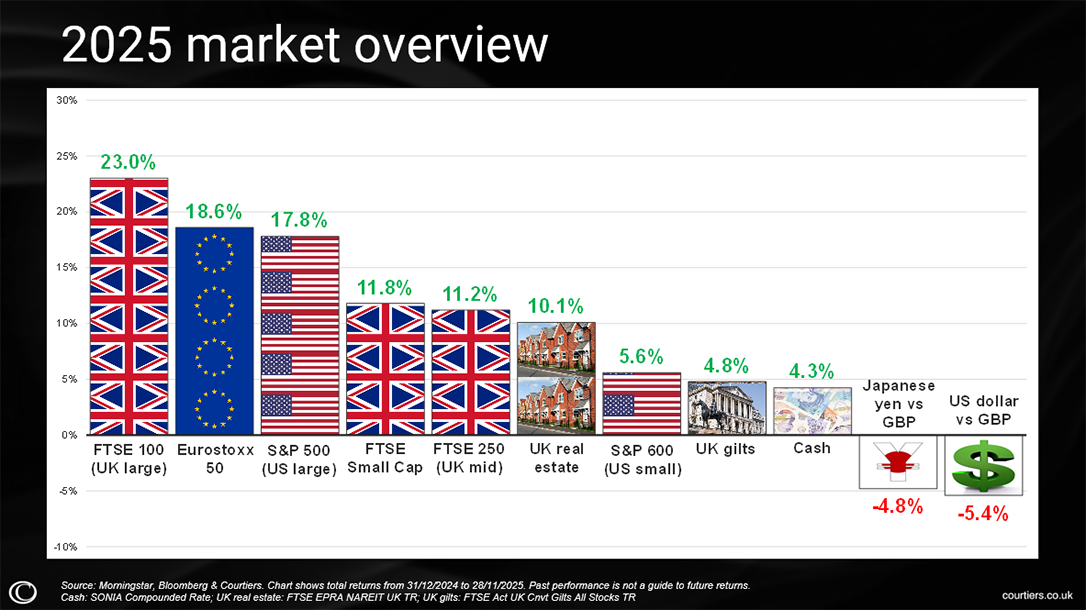

How did the market fare over the past year?

The FTSE 500 had a good year, due to its large exposure to materials. However mid and small caps haven’t fared so well. The strength of the pound has also meant that foreign currency hasn’t done so well.

Read more Client Seminar articles

Jake Reynolds talks equities and stocks in Attacking the difficult questions we had this year.

Gary Reynolds covers The Invisible Black Hole and How our Growth fund outperformed the Mag 7 in 2025.

If you have any questions or would like to know when we will run the Client Seminars again, contact your Courtiers Financial Adviser or get in touch through the Contact Us page.