In 2018, I stated 10 reasons why you should be wary of investing in timber and forestry. Nothing has changed.

- Timber investments are illiquid. Actual forests are hard to sell quickly if you need your money. Pooling your investment with others doesn’t solve the problem. Typical lock-ins are 10 years or more.

- Income is sporadic. Forestry provides income when the trees are harvested. When the timber price falls it is normal to delay harvesting and then your income stops.

- Growth can take years (literally!). Capital growth comes from the tree growth or planting bare land. You need to be a patient investor, and be happy to receive no income (and likely incurring costs) whilst your trees grow.

- Minimum investment amounts can be high. Direct investors typically need £3m or more. Investing with others in actual forests still requires around £100K or more.

- Diversification is difficult. To balance income and growth you need a portfolio of forests of differing maturities. This requires huge sums to achieve directly. It is simpler to pool your money with others but then you lose some control of the actual assets held.

- Forestry investments carry currency risks and costs. The world’s forest rich countries are Russia, Brazil, Canada, the US and China. The UK is only 13% forested, the most sparsely forested country in Europe. A forest investment is likely to be overseas. Legal and environmental fees may be incurred and disposal costs may be high.

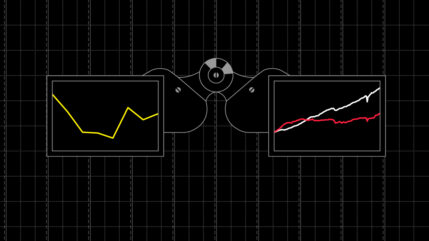

- “Timber” exchange traded funds (ETFs) provide exposure to the equity markets not the timber price. The choice of timber ETFs is limited (there are only two) and both exhibit a high correlation with global equity market returns.

- Liquidity “illusions” exist. There remains only one UK listed closed ended forestry funds and it has been selling assets to return money to shareholders since 2012. Nine years of illiquidity. Investors have lost a lot of money. Such funds, with a daily “price” yet still investing in forests directly, provided an illusion of liquidity.

- The timber price is volatile. Data is opaque and infrequent. Forestry valuations are subjective. The provider of the only forestry index in the UK, measuring the changing value of UK forests, terminated its index in 2019, partly due to limitations obtaining valuation data. There was no correlation between the timber price movements and the value of the UK forests between 2012 and 2017, the last time index data was produced.

- Tax breaks are conditional. There are capital gains tax and inheritance tax advantages for a UK investor but the forest must be commercially managed. Buying woodland for personal use does not confer the tax breaks.

I maintain my view that buying a woodland for enjoyment is perfectly reasonable. However, investing in commercial forestry, and benefiting from the tax breaks, carries a lot of risks and is likely to be a roller coaster ride. We do not invest in timber or forestry directly for Courtiers clients.