Ever since 2008 when Warren Buffet famously issued a challenge to the hedge fund industry, betting that an S&P 500 Index fund would produce better returns than they could, the active versus passive debate has been bubbling away.

Despite being an active fund manager himself, Buffet eventually won that bet. In doing so, not only did the legendary investor raise the profile of index funds – a list of securities of a region, country, or market usually weighted by the value or size of those securities, but he helped to usher in what has become an increasingly popular way for retail investors to access markets.

According to Bloomberg, passive’s share of US fund assets has risen by 2.3 percentage points a year since 2013, at which rate it says it could overtake active within five years. In the US domestic equity fund market, passive overtook active “around August 2018”, and now has a 54% share of the market.

Outside the US, active equity funds remain in the ascendancy, at least for now, with almost 60% of the market. However, all the indications are that where the US goes, the rest of the world will follow.

Before continuing considering the merits of each type of the debate, it’s important to lay out a few of the most basic points.

| Active Investing | Passive Investing |

|---|---|

| Free to invest in whatever assets they choose, subject to following the fund’s mandate |

Restricted to assets that enable them to track the relevant index |

| Aims to outperform the market | Aims to match the performance of the market |

| Performance depends on the capability of the fund manager | Subject to tracking errors, with performance in line with the index |

| Fees can eat into performance | Fees are generally lower |

The aim of a passive index fund is to track the relevant index, such as the FTSE 100 Index as closely as possible. This is done in a number of ways.

- The fund manager buys shares in proportion to the market capitalisation of each of the shares in the index. So if the market capitalisation of company ‘A’ makes up 10% of the index, the aim of the fund manager is that 10% of the tracker fund’s value will be made up of that company’s shares. This is what is known as a weighted index fund.

- However, some equity fund trackers are unweighted, with each company given equal weighting in the portfolio. An unweighted version of the S&P 500 is one example.

- Index funds come in two main categories:

- Equity funds – similar to open-ended investment companies. Priced daily.

- Exchange traded funds (ETFs) – provide access to a diverse range of markets, including smart beta ETFs that use specific criteria such as low volatility as the basis for inclusion, as well as themes, such as AI. Listed like companies on the stock exchange.

For more details of passive funds and how they work, please see “How index funds work” below.

Weighing up active and passive funds

If you are an investor who is happy to accept the returns generated by the market, then there is probably no point looking beyond a passive index fund. There are a huge range of index trackers to choose from, some of the most popular are the FTSE 100 and the S&P 500.

However, if you are someone who is looking to get a better return than provided by the market, there are thousands of funds out there with the aim of achieving just that.

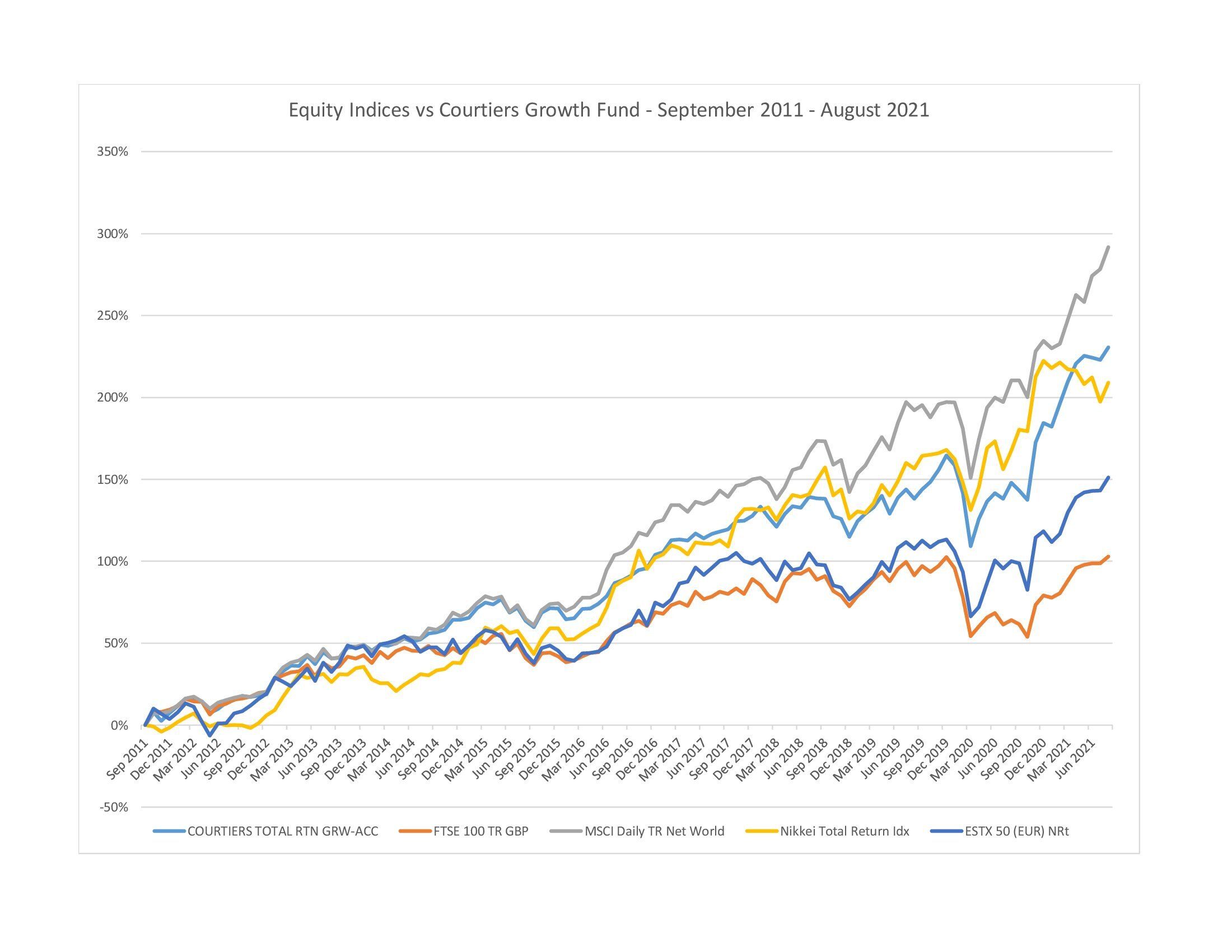

Some actively managed funds, such as the Courtiers Total Return Growth Fund, have an impressive record of long-term outperformance against many of the indexes that passive equity funds track, though past performance is of course no guarantee of future returns.

Source: Bloomberg/Courtiers

Source: Bloomberg/Courtiers

There are a number of reasons why active funds may be better suited to meeting the needs of investors than passive funds. The knowledge, expertise and skill of the fund manager is one.

Investing in a weighted passive equity fund means holding shares on the basis of a company’s size rather than its fundamentals.

By choosing weighted funds, you may also be denying yourself access to excellent investment opportunities in companies which are excluded from the index.

Passive funds can provide diversification, however some passive funds such as the MSCI World Index, have a heavy reliance on US stocks, with Apple and Microsoft making up nearly 8% of the portfolio. If either of these firms were to fail, it would have a significant impact on returns.

Similarly, the FTSE 100 Index is dominated by large international organisations with oil majors, mining stocks, tobacco firms, pharmaceutical companies and banks being strongly represented, making investors in a FTSE 100 index fund susceptible to a downturn in these sectors.

It is an obvious point, but worth making nonetheless, that when markets fall, the value of passive funds falls with them. However, through skillful management of their fund’s assets, managers of actively managed funds can potentially avoid such falls.

Similarly when markets rise, actively managed funds have the potential to outperform.

Active fund managers can have a particular advantage in markets that are under-researched, providing them with the opportunity to discover ‘hidden gems’. One reason why active funds have generally underperformed the S&P 500 is that the US is one of the best-researched markets in the world, making it difficult for active fund managers to get ‘an edge’ in the market.

Active managers can develop knowledge and expertise in a particular area of the market, such as a certain country, or sector.

Smaller companies, which again is an under-researched area, provides knowledgeable active fund managers with an opportunity to gain an edge.

The difference between active and passive investing is sometimes exaggerated with some fund managers using ETFs in a way that mirrors the behaviour of active fund managers.

Active fund managers also have the opportunity to follow a particular investment style, such as value investing favoured by Courtiers, which is difficult for passive funds to replicate successfully.

| How index funds work

In order to track the index, managers of tracker funds have to constantly adjust their holdings to reflect the index. They will also need to adjust their portfolio when a company drops out of the index, joins it, issues new shares or cancels shares, or when investors invest new money or withdraw their money from the fund. Some passive funds, especially ETFs, don’t actually invest in shares or buy the assets in the index, but use synthetic funds. This is effectively an IOU from a counterparty, often an investment bank, to pay the fund manager the exact return from that market. With the large number of companies in some indexes, the time and cost involved makes it difficult to replicate the index. To get around this, some tracker funds hold a sample of companies with performance closely resembling the performance of the index. This is known as partial replication. One point to bear in mind is that perfect replication of an index is unlikely. The difference between the performance of a passive equity fund and the index it is tracking, is known as its tracking error. |

Conclusion

Although passive funds are growing in popularity and now provide stiff competition to traditional fund managers, there is undoubtedly still room for active fund managers who can provide something different, while manoeuvring through ups and downs in the markets to deliver valuable investment protection and returns.