House prices are a barometer of the financial health of the nation and a touchstone for individual and family wealth. According to the Bank of England, when house prices go up, “Homeowners become better off and feel more confident. Some people will borrow against the value of their home, either to spend on goods and services, renovate their house, supplement their pension, or pay off other debt.”

Rising property prices can have other important financial repercussions, including for Inheritance Tax and estate planning. They also feed into concerns about intergenerational fairness. While existing homeowners tend to benefit from rising house prices, younger people find it difficult to get onto the property ladder. According to one survey, 50% of first-time buyers report not being able to afford a home without help from parents.

From boom to bust?

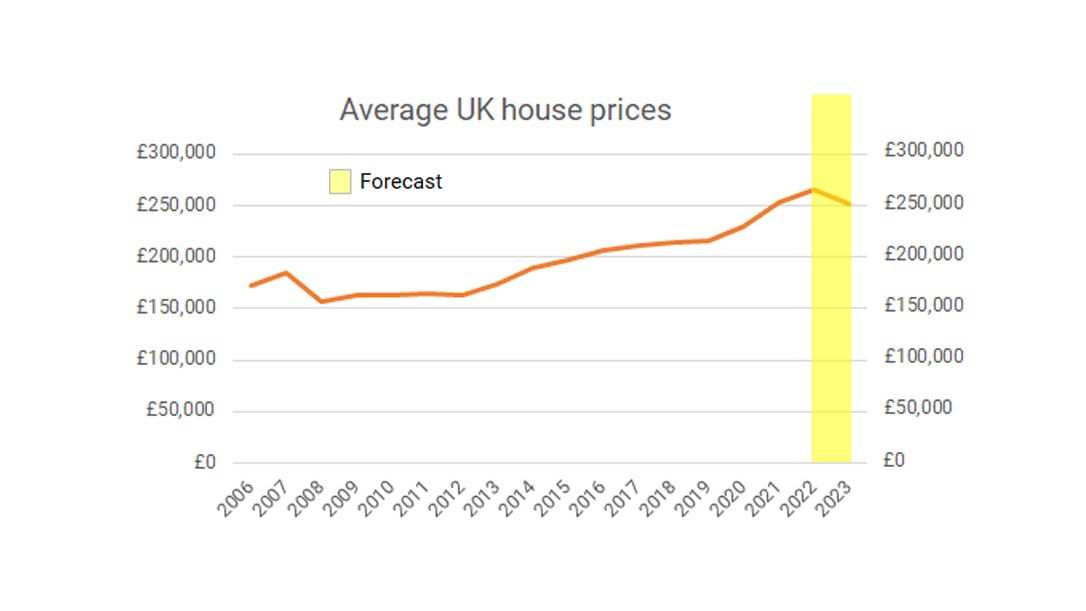

In November 2022, after a year when the annual growth rate of house prices was 10.3 per cent, the price of the average UK house had risen to £295,000, which was higher than before the start of the pandemic. In terms of affordability, the average first-time buyer in 2022 paid 5.6 times their earnings for their property, the highest it’s ever been according to this particular measure. Meanwhile, according to Halifax, the average cost of a first home in 2022 was more than £300,000, a 13 per cent rise on the previous year.

The UK housing market has long appeared to have an uncanny ability to defy perceived economic reality. But after years of house price growth, there are signs that this particular house party is coming to an end. Not only is house price growth slowing, but prices may even be going into reverse. According to Halifax, prices fell by 1.5% in December, the 4th consecutive month prices have dipped. The Office for National Statistics (ONS) said house prices dipped 0.3% between October and November, the first decline since October 2021.

The big question

The big question is whether this is just a blip or the beginning of a more serious and longer downturn. Looking ahead, Halifax predicts that house prices will fall around 8% over the course of 2023, Nationwide predicts a more modest decline of around 5%. The chart below indicates how the health of the housing market has deteriorated.

Source: Nationwide & Courtiers

A look back at the aftermath of the great financial crash of 2008/09 may offer some clues. Between January 2008 to May 2009, the ONS said that the average UK house price declined by 15%.

Economists attributed the fall to a combination of lenders’ reluctance to lend and lower loan to value ratios. Compounding this, the economy went into recession shrinking by more than 6%, between the first quarter of 2008 and the second quarter of 2009.

In the past, rising interest rates have often been a precursor of falling house prices. For example, both the 1981 and the 1991 house price crashes were preceded by interest rate rises.

On the other hand, when the economy is booming and incomes are rising, higher interest rates don’t necessarily lead to a fall in house prices, as was the case at the start of the Lawson boom years of the eighties.

Could history repeat itself?

After last Autumn’s mini-Budget spooked the markets, there was a surge in mortgage rates, with the average rate of a two-year fixed deal climbing from 4.74% to 6.16%. Since then, mortgage rates have started to come down with the average cost of a fixed rate deal falling to 5.08% according to mortgage provider Better.co.uk. Lenders also withdrew products from the market, leaving buyers in the lurch, although since then the number of available mortgage deals has risen to around 4,000, which is still a long way off the more than 5,000 available in December 2021 before interest rates began to rise.

One factor likely to dampen house prices is the end of the government’s Help to Buy Scheme. This equity loan scheme closed to new applicants on 31 October 2022. A House of Lords Committee concluded that the scheme for first-time buyers inflated house prices, especially in wealthy areas.

Repossessions could also come into play. In October last year, Compare the Market estimated that 55 per cent of homeowners will finish their current fixed deal within three years, increasing mortgage payments for many as they are forced onto their lender’s standard variable rate or to re-mortgage.

The trajectory

When considering the trajectory of house prices, much will depend on what the Bank of England decides on interest rates. The Bank has already raised rates from 0.1 percent in November 2021 to its current level of 3.5 per cent. There is much speculation on what the Bank’s Monetary Policy Committee (MPC) will decide to do at its next meeting in February. However, with inflation still running at over 10%, the consensus is that another rise is on the cards, with implications for mortgage rates and the housing market.

The health of the economy will also be a key factor, with a recession likely to have a dampening effect. Earnings growth and the impact of inflation on real earnings will continue to matter in terms of affordability, as will the extent that mortgage lenders loosen or restrict their lending.

Caveats

It looks certain there will be a drop in house prices during 2023. However, putting a figure on it is difficult because of the number of factors at play over which there is a huge amount of uncertainty. There are also some important caveats. The housing market is not homogeneous. In terms of future house prices, there are certain to be variations both in terms of geography and market sector. For example, there may be more of a retrenchment in prices in places like London, where (un)affordability rates are highest.

It’s also important to recognise that even if house price values decline by 8% this would only take them back to roughly what they were in April 2021. Anyone who bought their homes before then will generally still be benefitting from the prolonged boom in property and would have to see property values drop by significantly more before it became a concern.

If there is silver lining, a reduction in house prices would make buying a home more affordable for younger people. This may also come as a relief for parents and grandparents who are intending to support them financially. In summary, whether you are dismayed or pleased at the prospect of house prices falling, they will continue to matter.