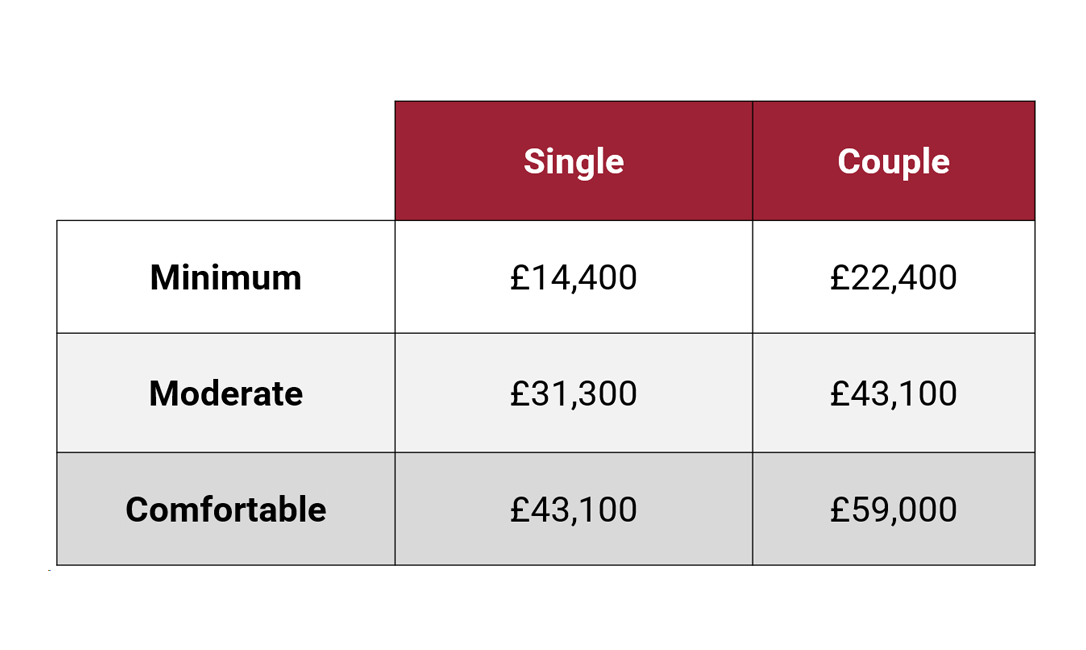

According to the Pension and Lifetime Savings Association (PLSA) 2023 report, there are ‘three retirement living standards’ that you can use to understand where your current pension pot is likely to fall. If you have the time or additional resources, you can also use it as a guide of where to aim.

Structured as ‘Minimum’, ‘Moderate’ and ‘Comfortable’, the following chart suggests how much you want to have as an annual income from your pension(s) for each standard as a single person or as a couple:

While this includes your £11,500 State Pension (as per 2024/25 figures), it does not factor in any other aspects of your pension savings, like ISAs or lifetime savings.

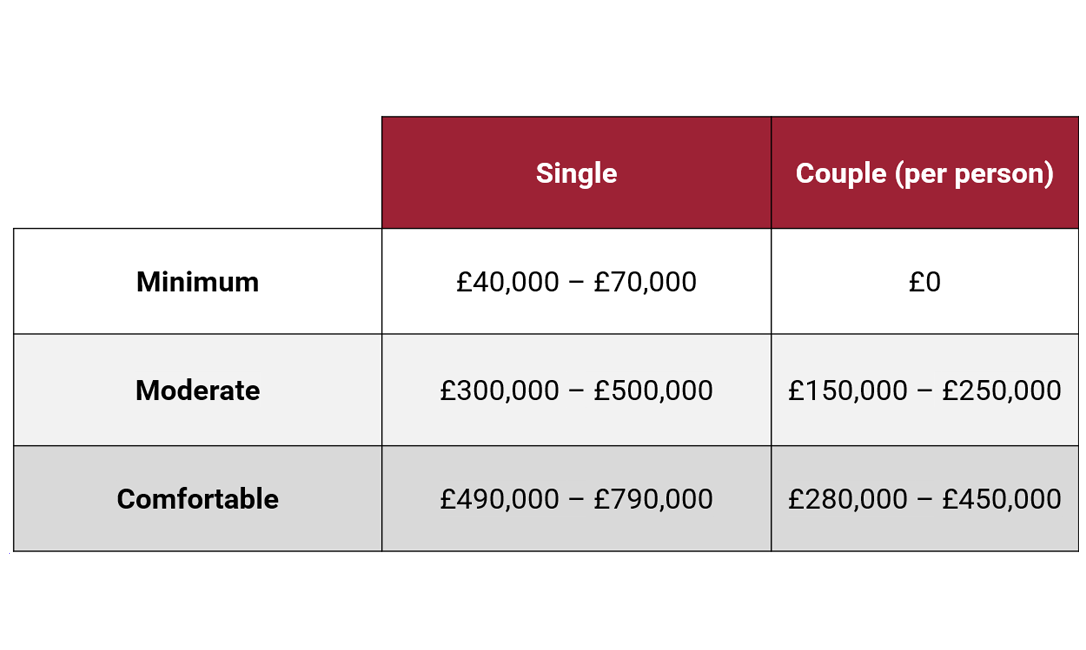

As an annuity (i.e. Purchasing a secure income for life with your pension fund), this equates to the following bands (depending on what aspects of an annuity you include, and your own personal circumstances):

The targets for single people may seem high – especially compared to couples – but it’s an example of ‘the singles tax’. Many costs (electricity, broadband and utilities, for example) are still required no matter how many people there are using them.

The figures are based on an annuity of an amount of income per £100,000 (e.g. a single standard basis level rate in the illustration may provide an annual pot income of £7,900).

Hargraves Lansdown’s research

This comes alongside Hargreaves Lansdown research using their own, but relatable, variables. Their research shows that only 39% (two out of five) of its highest-earning clients are in line to earn a ‘comfortable’ retirement income, with 69% on track for a ‘moderate’ retirement income.

How far does your retirement income stretch?

This is the sixth year the PLSA have run this survey, asking the same questions to retirees or those of retirement age in London and Urban UK outside of London. These standards are intended to reflect a specific basket of goods and services found and needed in these areas. They described the three levels as:

- “A minimum standard of living in the UK today includes, but is more than just, food, clothes and shelter. It is about having what you need to have the opportunities and choices necessary to participate in society.

- A moderate standard of living in retirement in the UK is about more than just meeting your basic needs. It means being able to access a range of opportunities and choices, having a sense of security and the option to do some of the things that you would like to do.

- A comfortable standard of living in retirement in the UK is about more than just meeting your basic needs; it is about having a broad range of opportunities and choices, peace of mind and the flexibility to do a lot of the things that you would like to do.

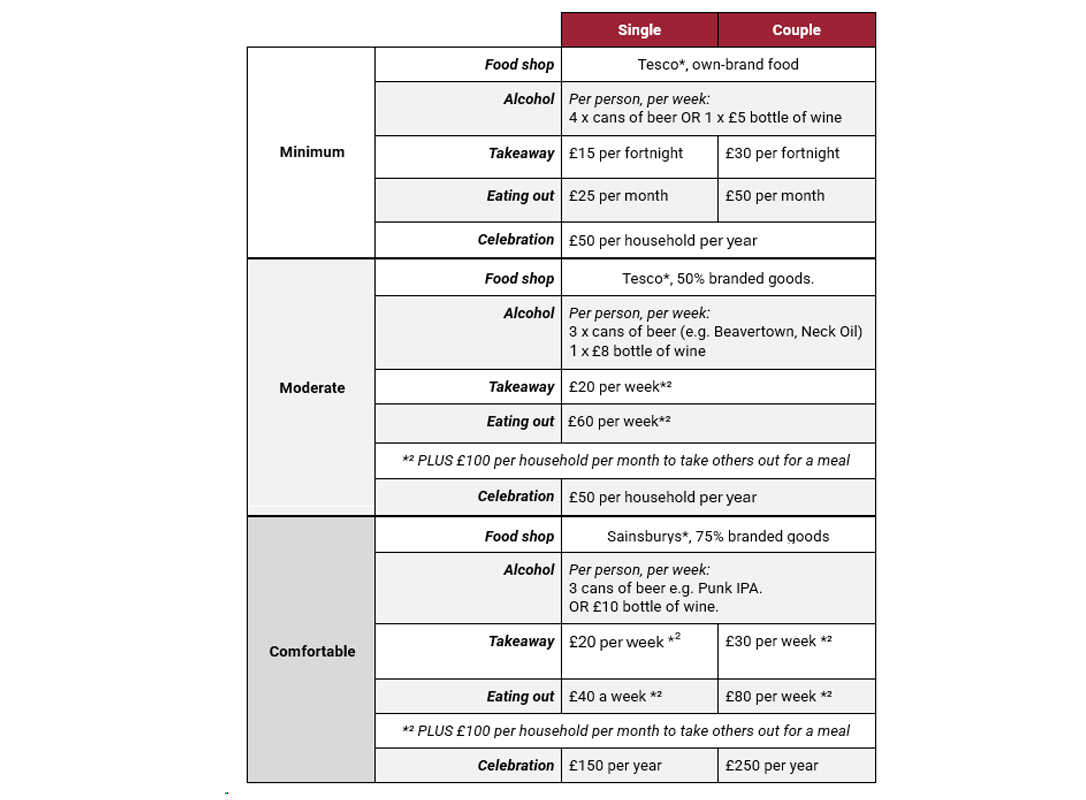

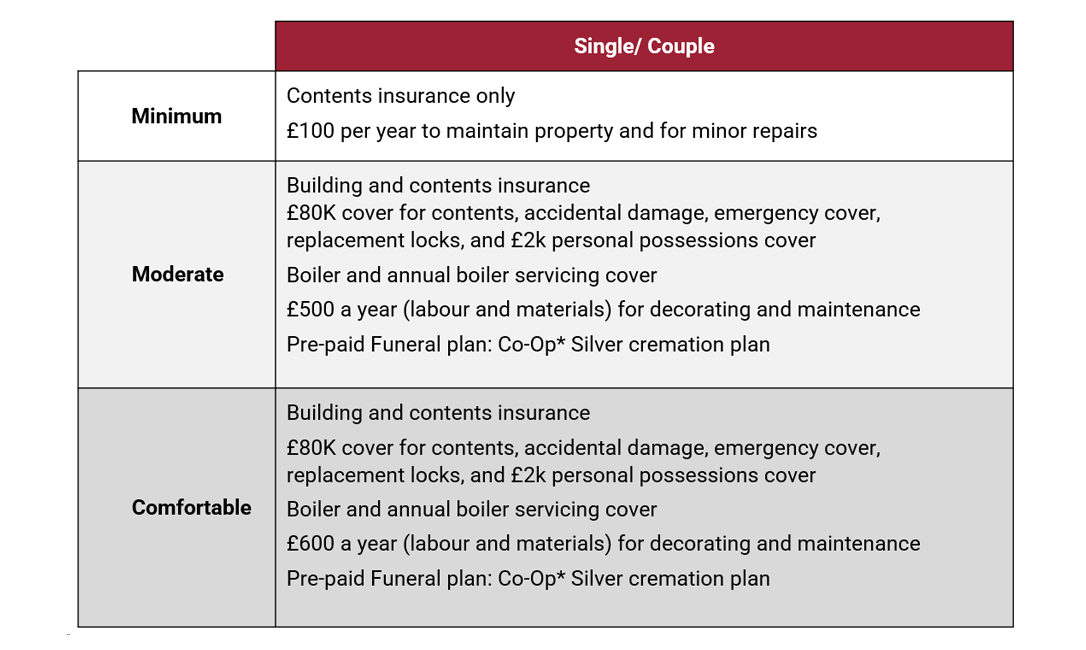

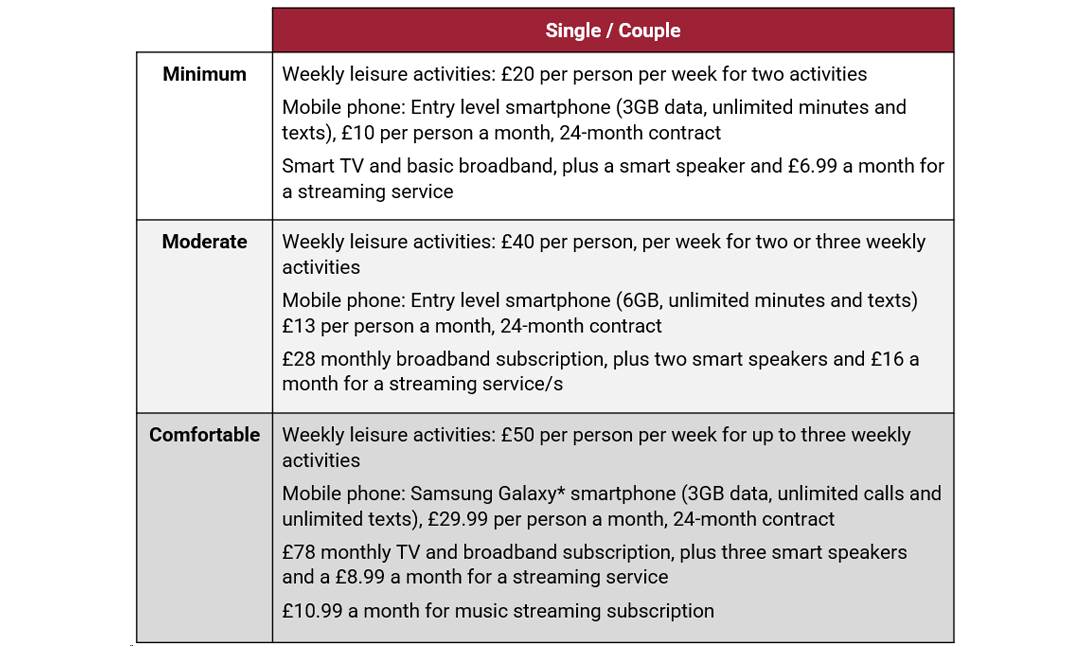

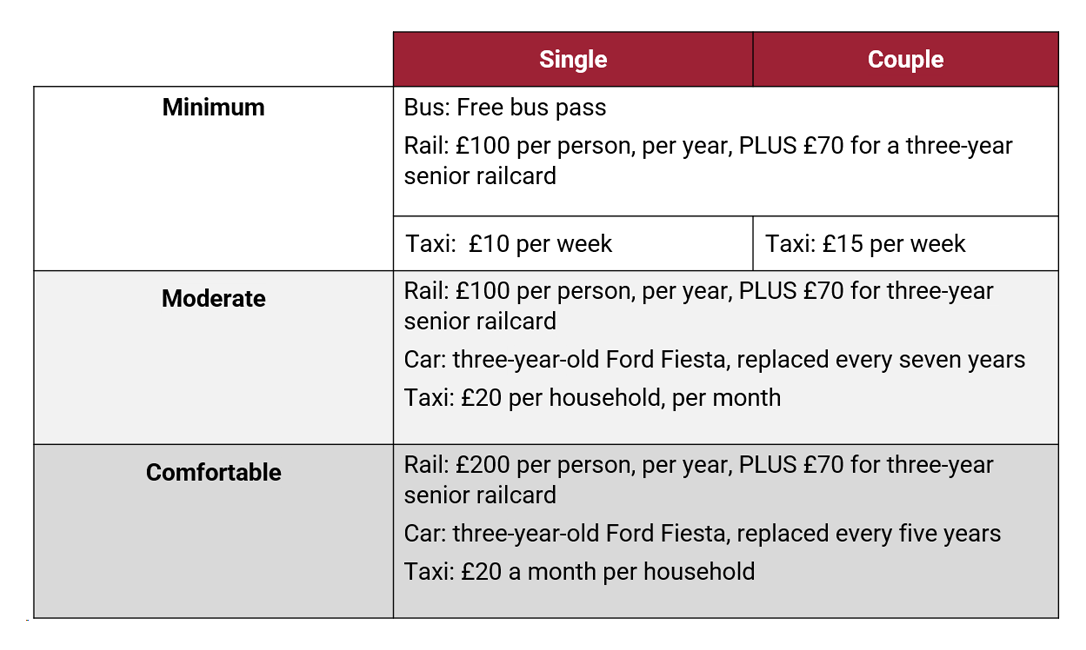

These standards and this income can look different for the varied parts of a retiree’s lifestyle. Below are some examples of how this breakdown could spread across each category for each standard:

Food and Drink

Housing and maintenance

Social Participation

Holidays

Transport

So how can you plan for a good retirement?

In general, the more you plan, the better your retirement will be, but there is a lot of help available to ensure you work on what’s best for you.

While real life makes planning for retirement hard, the earlier you start to plan, the more likely you are to be able to afford the lifestyle you want when you finish your career.

Tips:

- Confirm you are automatically enrolled in a pension as part of your employment. And while the minimum amount to contribute is 5%, consider putting away as much as possible for the long run.

- Clear as many debts as you can (including any student loans or mortgage you may have).

- Set up a personal pension if you’re self-employed

- Keep your pension contributions going despite other priorities (I.e. getting married, buying a house, supporting or having children).

- Track down all your pension pots from previous employments. These may be a combination of different pension types, with different interest rates and benefits. While combining them into one or two pots may be beneficial, make sure you understand the best combination for you.

- Talk to a Financial Adviser to help you understand how your pension would work best for you. This can include how and where to invest (depending on your levels of risk) as well as the holistic view of when you could reasonably expect to retire – and what your retirement may look like.

If you would like help to work out when you could feasibly retire, or where in these standards you are likely to fall or want to aim for, you can contact Courtiers through our contact us page or reach out to your Courtiers Financial Adviser through their own page.

*All brands are used for illustration purposes only. Courtiers does not endorse any brand or product used in the examples