Key take-aways:

- The world and the way we interact with it has evolved

- There’s a new industry sector in town called Communication Services

- Some of the world’s biggest companies are to be reclassified

- Global markets will be affected (possibly involving an increase in volatility)

- Courtiers funds are appropriately positioned and we are monitoring for opportunities

The biggest change to industry sectors in 20 years is officially happening now. We live in a changing world and it’s being driven by a shift in the way we consume goods and services.

New shopping habits have contributed to both House of Fraser’s administration and John Lewis’ recent profit warnings. All while Amazon continues to rapidly increase its share of the retail market.

Online and on 24/7

Here’s one big smile in the making over recent years…

Notice the .com has disappeared from the Amazon logo since Bezos founded the company in ‘94. It’s a subtle sign that more and more of the way we interact with the world is facilitated online…we don’t need telling it’s “dot com” – we already know and industries recognise this. In fact how many of us still type “.com”? Apps and search engines allow us to find and access information quickly and through 24/7 connectivity to the internet, businesses can respond seamlessly. New and innovative ways to provide goods and services more conveniently have emerged that were never before possible. Fresh opportunities and change are both inevitable and exciting.

GICS® and the official “biggest change to industry sectors”

From today, the Global Industry Classification Standard (GICS®) will undergo the biggest change since its inception almost 20 years ago. MSCI (an independent provider of research-driven insights and tools for institutional investors) and S&P Global Ratings (the world’s leading provider of credit ratings), both responsible for the GICS®, have recognised shifting consumer trends as companies have evolved the way we shop for goods, consume food and watch television.

Say hello to “Communication Services”

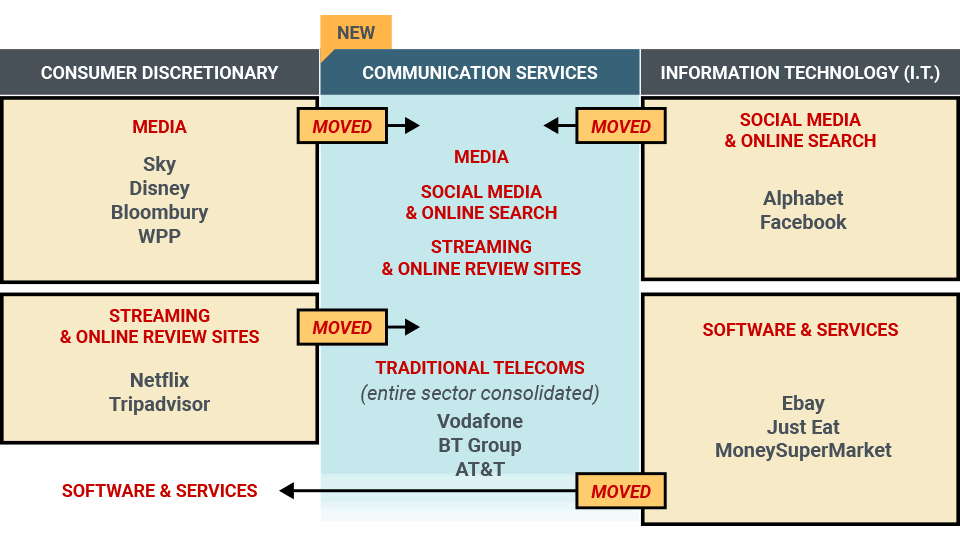

As a result of our changing habits, a new sector, Communication Services, will include companies in the soon to be dissolved Telecommunication Services (‘Telecoms’) sector as well as some Information Technology (‘IT’) and Consumer Discretionary companies.

In the US, which represents 62.14% of the MSCI World Index2, some of the biggest technology brands including Facebook and Alphabet (Google’s parent company) will be removed from the IT sector into the new Communication Services sector.

Note: the above is a simple generalisation not intended to depict the exact GICS nomenclature and changes. Source: Credit Suisse Trading Strategy

New Market Dynamics

As Facebook and Alphabet are two of the world’s largest companies, the new Communication Services sector is set to represent 10% of the S&P 500 index, up from the 2% weight of the current Telecoms sector3.

For the FTSE All Share, which represents 98% of all UK listed companies4, the new Communication Services sector will represent 5.20% of the index, an increase of just under 3% compared to the current Telecoms sector as companies such as GoCompare, Moneysupermarket and WPP move to the new sector. (Source: Bloomberg / Courtiers)

Does this affect Courtiers funds?

As usual we are monitoring markets and will act should any opportunities arise. We don’t expect there to be large share price moves but an increase in volatility is possible.

How does it affect us all?

For markets and investors: a possible increase in volatility but no major changes.

Sector-specific tracker funds, particularly those that have tracked the IT sector will be losing big names such as eBay, Facebook and Alphabet. We are not expecting large movements in share prices but an increase in volatility is possible.

The bigger picture: a changing world

In the last decade the way we, as consumers, purchase goods, interact with media and read our news has changed significantly and this has been driven largely by advances in technology.

Companies such as Apple and Alphabet, through the introduction of the iPhone, iPad and Android devices, have allowed us to watch television and browse the web on the go. Moneysupermarket and GoCompare have created an easy way to browse and compare prices for holidays, insurance and other products from the comfort of our own living rooms. Amazon has grown into the largest online retailer which many of us rely on to buy all our goods ranging from groceries to computers.

Just Eat and Netflix have transformed the cinema experience. The excitement of sharing a box of popcorn, whilst watching the latest blockbuster film with our friends and family has been replaced by banquets from local restaurants delivered to our doors, while we watch brand new series and films from the luxury of our own lounges while discussing the drama with the entire world through Facebook.

The success of these companies can be seen by the change in their share prices over the last decade compared to their domestic market indices.

Source: Bloomberg. Returns are net of charges. Past performance is not a reliable indicator of future returns.

The forthcoming sector changes also recognise how these companies have changed our daily habits. This is likely to continue as new, innovative ideas are embraced by the masses and disruptors enter the market.