Inflation at levels not seen since the 1970s and 80s, rising interest rates and even the prospect of stagflation – a combination of inflation and low or no economic growth. Add the conflict in the Ukraine, and is it any wonder that markets have experienced a bit of a wobble in 2022?

As Gary says in his latest CIO Talk, “If you didn’t get your asset allocation right, you got hit pretty hard.” Particularly investors, who held long-dated gilts, who will have seen them lose 18% of their capital value, while anyone holding stocks tracking the Nasdaq will have lost well over 20%.

Gary acknowledges that he entered 2022 “with some trepidation.” But the good news for Courtiers investors is that through a combination of a judicious approach to asset allocation and by adopting a cautious approach, “relative to our peers Courtiers Funds have done extraordinarily well.”

“The Cautious and Balanced Funds didn’t get caught out by the drop in bond prices, and we’ve been reducing our exposure to the S&P 500 Index because of its heavy weighting towards high-priced tech stocks,” Gary explains. In addition, the FTSE 100, with its preponderance of financial, pharma and materials stocks has been “quite a good place to be this year.”

Volatility

Volatility, the extent to which stocks go up and down, is a key metric for the Investment Team, and one that it carefully monitors and controls. “Volatility is a measure of the risk we carry,” explains Gary. While Beta, another key metric for the Investment Team, “is a measure of your exposure to the market.”

Beta is calculated by dividing the volatility of your own fund by the volatility of the market (in this case the MSCI World Index), with a Beta below 1 indicating that volatility is lower than the market and Beta of more than 1 signifying that a fund is more volatile than the market.

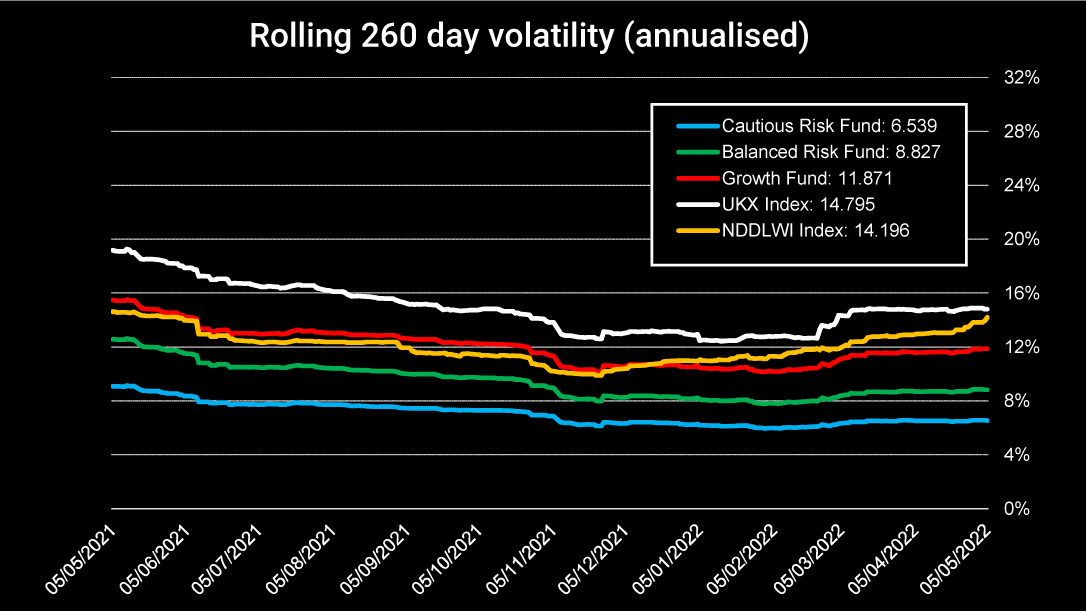

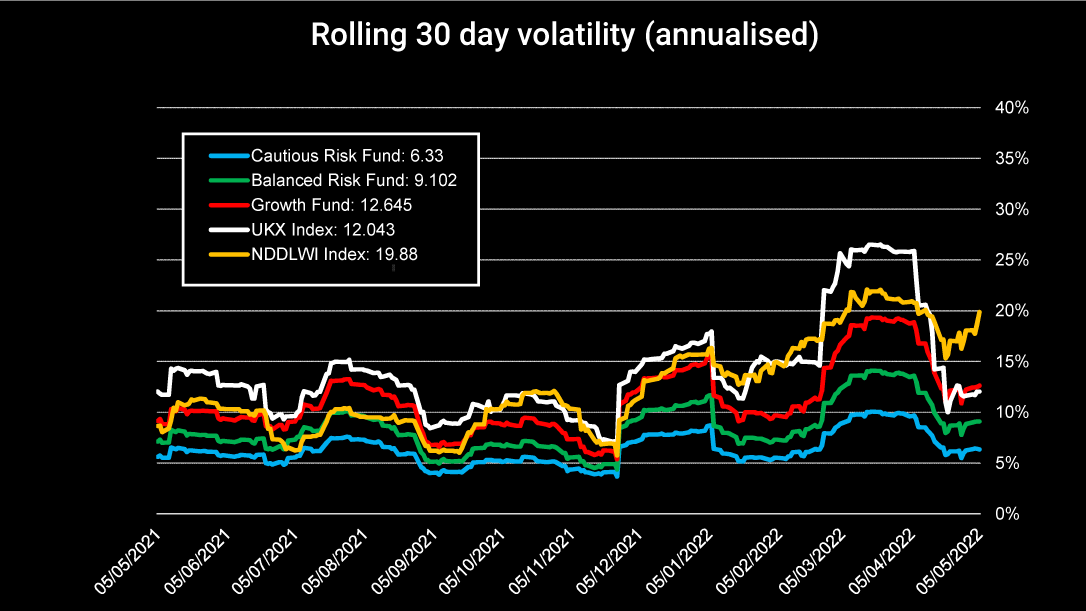

Both volatility and Beta are typically measured over 30 days and 260 days, the latter figure being roughly the number of trading days in a year, with both represented by charts like the one below. Other charts showing both Beta and volatility for the Courtiers Multi-Asset funds over the two time periods appear in the video. Because of the longer time-period, the lines on the 260-day charts tend to be smoother than those covering the shorter period.

Source: Bloomberg & Courtiers Period 05/05/2021 to 05/05/2022

So, what do the charts tell us about Courtiers funds?

“What they tell us is that we have been plotting a pretty careful course over the last year or so, and one that has been consistent with me saying ‘it’s less certain now than it was in the summer of 2020’.”

This is somewhat ironic and in marked contrast to two years ago, when the shock to the markets caused by Covid meant “there was loads and loads of value in markets and we just went around with our buckets and scooped it up.” That period has well and truly passed, and “it’s much more difficult to find it now, so we’re being much more cautious in the way we are positioning the portfolio.”

The charts also show that each of Courtiers Multi-Asset Funds are behaving as they are designed to do, with the Cautious Fund showing the lowest volatility and Beta, followed by the Balanced Fund and finally the Growth Fund.

Currency

As we approach the peak season for holidays abroad, the recent weakness of the pound against the dollar and to a lesser extent against the euro may be a concern for some. Gary acknowledges the pound’s fall against the dollar, but says, “the truth is that the dollar has been strong with the Fed (Federal Reserve) increasing interest rates, so there’s been a bit of a renaissance in demand for US assets.”

What would he do if he was going abroad on holiday? For anyone who craves certainty, “get your currency bought now”, Gary advises. However, those in a position to take the risk of the currency going against them may benefit from a drop in the dollar over the next two or three months. Anyone going to Europe should buy their currency now.

Gary acknowledges that he is making himself a hostage to fortune and is ‘breaking all the rules’ for forecasters. No doubt in another CIO Talk later in the year, Leo will remind him of his advice.