While Catherine Mann and Megan Greene at the Monetary Policy Committee have put forward their views on interest rates and UK spending, Gary Reynolds, CIO, discusses how taking a more Keynesian approach could help the economy. His advice has history on its side, with the New Deal and Great Recession showing how Keynesian economics works.

The Monetary Policy Committee’s stance

Recently, Catherine Mann and Megan Greene of the Monetary Policy Committee (MPC) published papers on UK inflation, focused around how to get the rate to 2%. While Mann suggested raising the Bank Rate by 0.25%, Greene suggests maintaining it at 5.25%. Gary calls these views ‘conservative with a small c’, with the MPC citing that an increase in real incomes is an inflationary threat. Tell that to the van driver with two kids and trying to make ends meet!

The MPC’s response is to keep interest rates high, which doesn’t make sense to Gary. Instead, Gary suggests we look to America, where they are doing more for the average worker, and getting economic growth because of it. They have the Inflation Reduction Act and Medicare (although we have the NHS our side of the pond), and have invested in businesses, boosting jobs – and those jobs have better pay. When you give working families money, they spend it, funnelling it back into the economy because they need that new car, better phone, holiday, or essentials.

US’ economic growth works on Keynes’ theory.

What is Keynes’ theory?

John Maynard Keynes, an early 20th-century British economist was the father of modern macroeconomics and Keynesian economics. He published his theory in “The General Theory of Employment, Interest, and Money.” in February 1936, stating that governments should be increasing spending (in infrastructure, unemployment benefits and education), stimulating demand and boosting growth as consumer demand is the primary driver for an economy.

Historic examples:

New Deal

The Great Depression was the catalyst for Keynes’ economic theories, and the US New Deal is arguably the most famous example of Keynesian economics in play.

President Franklin D Roosevelt increased debt by $3 billion to create 15 new agencies and laws in his first 100 days in office. With the Works Progress Administration putting 8.5 million people to work and the Civil Works Administration creating four million new construction jobs, it shows how government intervention can stimulate the national economy.

Great Recession

Between 2007 – 2009, Presidents George W Bush and then Barack Obama reflected Keynesian economic theory in several ways, including the Economic Stimulus Act. Spending $224 billion covering extended unemployment benefits, healthcare (as well as introducing Obamacare to slow the growth of healthcare costs) and education, and creating jobs through $275 billion of federal contracts, grants and loans while cutting taxes by $288 billion.

What should we be doing?

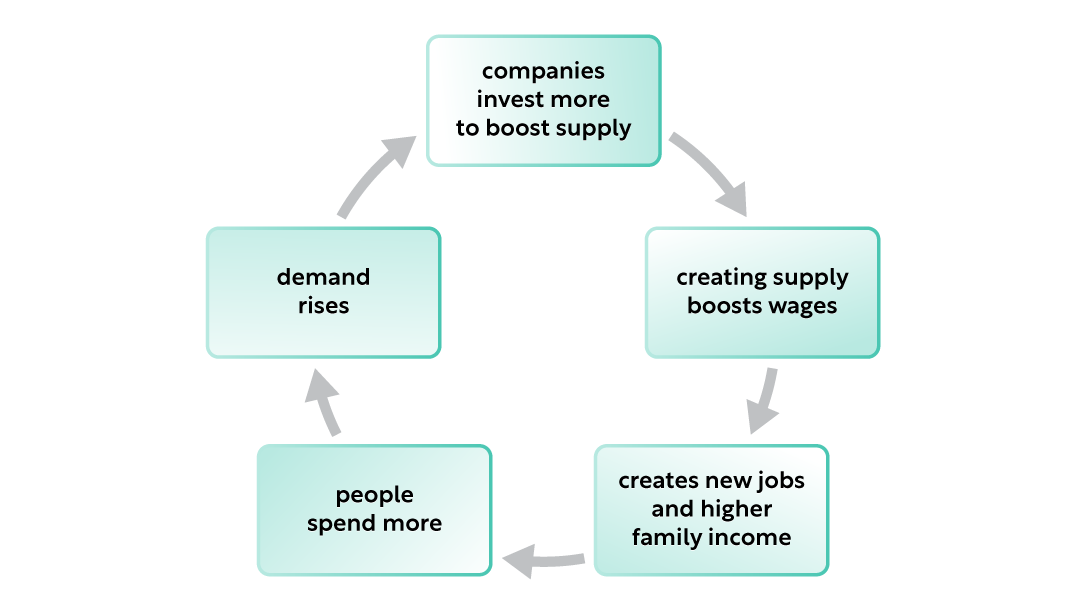

Gary offers an easy cycle for what the Government and MPC could be doing to help the economy and families using Keynesian Economics, which he coins the ‘Virtuous Economic Cycle’:

Unfortunately, we currently have an ‘unvirtuous’ economic circle with an MPC that doesn’t see spending like this as at all positive.

“They [the MPC] don’t see themselves as having real responsibility for trying to improve the average output per head in this country. They see their sole responsibility as getting inflation to –and staying at – 2%.” Gary Reynolds, CIO.

In summary:

We were in a technical recession at the end of last year with two quarters of negative growth, so the Government have put some legislation in place to push things along and help – for example, cutting employee National Insurance means cutting tax on jobs, which is a good thing and will put more money in people’s pockets, but it would be helpful if the Government and MPC did more, maybe taking some tips from Keynes in the process.