2022 has been an eventful year to say the least, so there were plenty of topics to cover and discuss at the Courtiers 2022 Client Seminar. This year’s Seminar took place at four venues across England between December 7 and December 16, including in Exeter for the very first time.

The first Seminar was held in Derby, the second in Gerrards Cross, followed by Exeter. The final Seminar took place at the Courtiers Auditorium in Witney, Oxfordshire. Around 300 clients attended the four venues, with over 100 participating online.

After their presentations, members of the Investment Team returned to the stage to take questions from the audience. To enable clients who could not make the Seminar in person to participate, the Client Seminar held at the Courtiers Auditorium in Witney was broadcast live online (the on demand livestream’s available above). This allowed clients to tune in and ask questions virtually during the Seminar.

The Seminars were well received by clients. Doug Stuart, who attended the Seminar in Gerrards Cross, said; “The presentations were good. Not only did I come away seeing how Courtiers’ investments have performed, I know that compared to their peers they are doing a good job.”

Heather Stuart said that attending the Seminar “gave me a feeling of confidence that I know what’s going on in the company.”

Julie Harrod said; “It was entertaining as usual. We have come to expect a high level of entertainment and not much that’s boring. I always come away thinking far more positively about the state of the economy than when listening to Radio 4 news programmes.”

Peter McCarter said; “Gary does an excellent job of painting the big picture and pointing out that things aren’t as dreadful as sometimes made out.”

Thank you to everyone who attended the Seminars either in person or online and to everyone who submitted comments or asked questions. All questions, including those we didn’t get around to answering during the Seminar, are with the Investment Team and responses will be published soon.

Summary of Presentations

It’s a Mad, Mad, Mad, Vlad World – a review of markets in 2022

James Timpson, Deputy Fund Manager, Courtiers Multi-Asset Funds

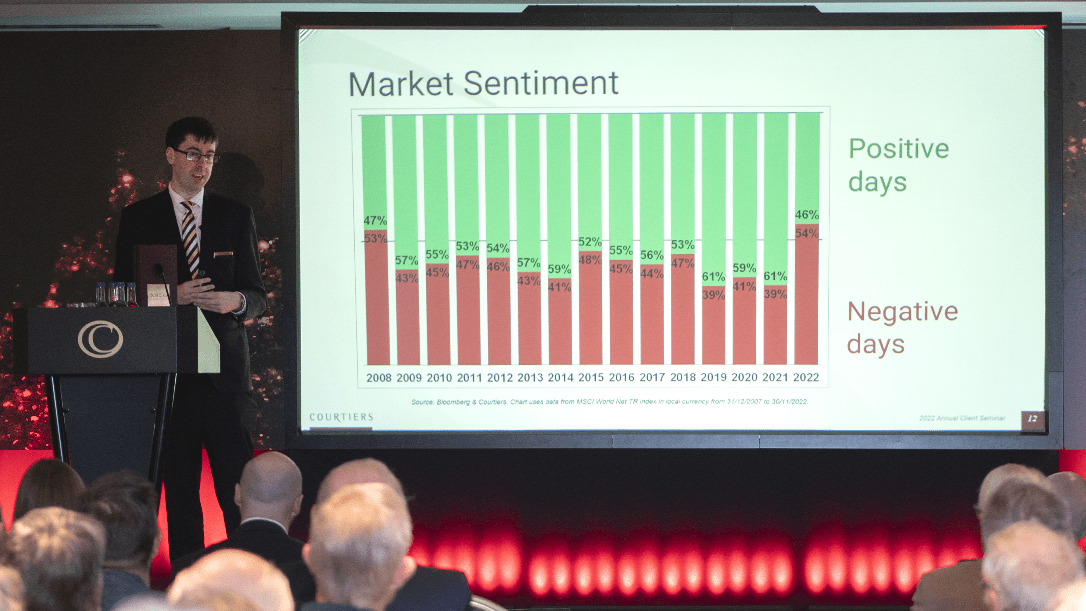

James began his presentation by noting that the Christmas wish he made at last year’s Seminar for a calmer, less volatile year had not been granted. In fact, 2022 had turned out quite the reverse. Whereas in 2021 the market moved by more than 2% in a single day on just four occasions, in 2022 this had happened on 28 days. This is not a million miles away from the 40 such occurrences in 2020, the year that the pandemic began. The proportion of days when markets fell compared to the number of days when they rose was even greater than during the 2008 global financial crisis.

Where did it all go wrong?

2022 got off to a shaky start, said James, as the pandemic continued to have an impact on global markets leading to disruptions to global supply chains, which then pushed up inflation. Central Banks around the world responded by raising interest rates, which in turn hit stocks, particularly large US tech stocks. Putin’s invasion of Ukraine only made things worse, pushing up not only oil and gas costs but also food prices. As a consequence, the annual inflation rate in the UK in November stood at 10.7%. Rising interest rates also hit the bond market, with longer dated bills down by about 35%. The performance was so bad that James Bond was considering changing his name to James Alternative Assets, James quipped. Finally, September’s notorious mini budget pushed the pound to an all-time low against the dollar, although it has since made a bit of a recovery. All in all, James said 2022 had been the worst year for global equities since 2008.

Courtiers Fund Performance

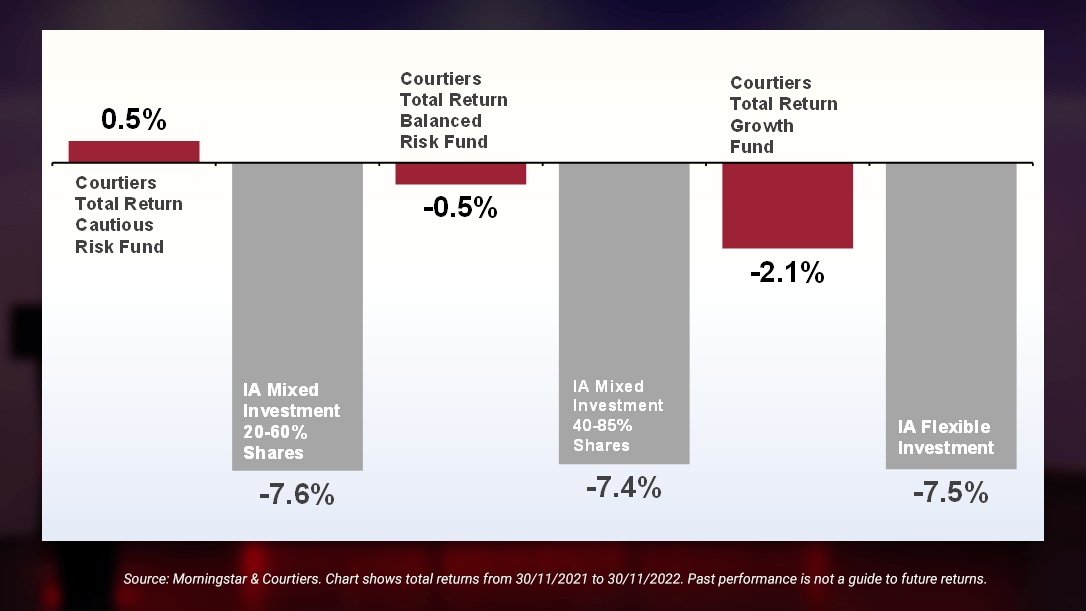

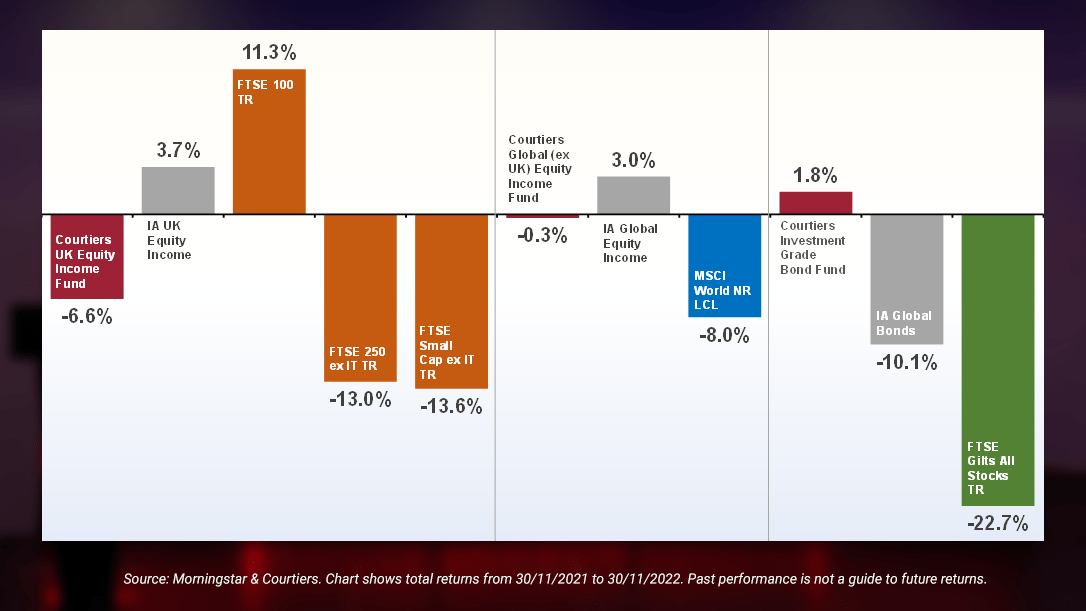

Given the how difficult a year 2022 had been for markets, James said the Investment Team were delighted with the performance of the Courtiers Multi-Asset Funds, which had all outperformed their peer group, as had the Courtiers Investment Grade Bond fund.

Play Your Markets Right

As someone who once appeared on Countdown, James loves game shows, so the next part of his presentation in which he tested the audience’s knowledge of how different markets and assets performed during 2022 was right up his street. Some questions such as whether the return on Shell’s share price was higher or lower than that of the Chinese market proved quite easy for the audiences (Shell’s return was higher; up 55% v a decline of 28.1% for MSCI China). Opinions were more divided on the relative performance of Tesla and Amazon. “This one’s quite close,” James admitted as he revealed declines of 49% and 44.9% respectively.

Active Management – All eyes on your investments

Jacob Reynolds, Head of Asset Management

How much would you give someone today if they promised to give you £100 in 100 years’ time? This was the rather tricky question at the heart of the early part of Jacob’s presentation. It all depends on interest rates Jacob explained as he illustrated how even very low interest rates reduced what in the investment world is called “the present value of a future income stream”.

Jacob illustrated how the impact of interest rates on present value could be devastating particularly for assets where the interest rate is fixed. The classic case is government bonds, where the interest rate and the price of the bond are inversely related.

Whereas an interest rate of just 0.5% reduces the present value of £100 in 100 years’ time to £60, when interest rate goes up to 4% this figure crashes to just £1.98, a reduction of almost 98%.

This isn’t just fictional said Jacob. In 2019 and 2020 the Austrian government issued 100 year zero coupon bonds (i.e. bonds that don’t pay any interest to bond holders). So, although interest rates have only risen to 2.5% since they were issued, the price of these bonds had plummeted by 92% meaning that bondholders have seen the value of their assets collapse.

Jacob explained that the ultra-low interest rates of much of the period since the global financial crisis had led many investors to overlook the devastating impact on bond prices, particularly on the price of long-dated government debt when as they have done interest rates start to normalise i.e. they are returning to the sort of levels seen before central banks intervened after the great financial crisis to keep them ultra-low. While the desperate hunt for yield led some investors to buy government debt of longer and longer durations, Courtiers was aware of the risk of bond prices collapsing. As a result, the Investment Team adopted a different approach to getting a return on the portfolio’s more cautious assets. In 2018, Jacob said the Investment Team began to purchase three-month and six-month duration government debt at good yields.

The Courtiers portfolio had also benefitted from the weakness of the pound, which made UK assets very cheap, especially for foreign buyers. Jacob said that seven UK companies within the Courtiers portfolio had been acquired by foreign entrants, with the share price often going up about 40% in a day. The latest was Devro, a sausage casing manufacturer, whose share price went up by 60% and led to Courtiers exiting its position. Returns had also been boosted by not having positions in US tech stocks on massive premiums.

Taking a close look – The Courtiers Ethical Value Equity Fund (EVE)

Katie Crook, Product Specialist

In November, Courtiers launched its Ethical Value Equity (EVE) Fund. Katie took the audience through the thinking behind the new fund, how stocks are selected for it as well as some of the grey areas and complications.

Katie said that although Courtiers has offered clients ethical strategies since 2005 through using third-party funds, the thinking was that Courtiers could provide a consistent investment approach to all clients by launching its own ethical fund.

Selecting stocks for the Ethical Value Equity Fund was a rigorous process involving several stages of screening, said Katie.

There are 12 blanket exclusions, including no animal testing, armaments, fossil fuels, GM crops and nuclear.

There are also revenue exclusions, which means that any company that derives more than 10% of its revenue from alcohol, gambling, non-weapon related military support services and tobacco is barred from the fund. The 10% revenue threshold was put in place because the Investment Team doesn’t want to penalise companies like supermarkets that sell cigarettes, where those products or activities are not their main revenue driver.

Courtiers uses processes aligned with the Financial Conduct Authority to screen and rate companies based on different types of risk – Environmental Social and Governmental (ESG) risk, carbon risk, and finally a company’s controversy rating.

Companies that have “high or severe” risk scores are automatically barred from inclusion in the Ethical Value Equity Fund, while companies that score “low, medium and negligible” are reviewed in further detail by Courtiers’ own analysts.

The analysts will look at five specific areas such as whether a company is involved in an environmentally destructive industry. The reason for having this “analyst overlay” is because these decisions aren’t always straightforward, Katie explained.

For example, she said that last year Marks & Spencer installed 1,000 beehives on 25 farms across the UK. While this sounds like a fantastic way to help the bee population, things became more complicated when conservationists suggested it would have been better for Marks & Spencer to have put the money into restoring pollinator habitat instead. Katie said the Investment Team try to adopt a common-sense approach, and in this case the Investment Team decided they weren’t going to exclude Marks & Spencer from the Ethical Value Equity Fund.

The Ethical Value Equity Fund is a global fund that is mandated to hold between 30 and 50 holdings. It currently has around 38. Although the fund is understandably underweight in some fossil fuel heavy sectors like energy production, Katie explained that this doesn’t mean that the fund doesn’t have any exposure to the energy sector. Among its holdings is Bluefield Solar, an income fund that focuses primarily on solar assets.

Katie acknowledged that not everybody’s going to have the same view about which companies should and shouldn’t be held in the Ethical Value Equity Fund. The idea is to offer clients another choice, while also remaining true to Courtiers’ value investing style and ethos. The main thing is that it does exactly what it says on the tin.

Bubbles, Liars and Leverage – Through 685 years

Gary Reynolds, Chief Investment Officer

In the first part of his presentation, Gary took the audience on a colourful, entertaining and informative journey through nearly 700 years of financial mismanagement, dishonesty and often criminal behaviour. From the Florentine banking crisis to the recent arrest and charging with fraud of Sam Bankman-Fried, the founder of FTX, the now defunct cryptocurrency exchange, he revealed a litany of failed companies, too good to be true schemes and corrupt and disgraced individuals, many of whom ended up behind bars.

As Gary pointed out, Bankman-Fried is unlikely to be the last case of its kind. “We have all this history, but we learn nothing from financial markets.”

Gary said the tulipmania bubble of 1637 when the price of a single tulip bulb hit the equivalent of £300,000 today was simply “potty”. But as he pointed out, at least you could plant the bulb unlike “those wretched bitcoins”.

The collapse of hedge fund Long Term Capital Management in 1998 was a salutary lesson of the dangers of being over leveraged and that in the real world, financial models don’t always work. While those who invested in Enron and trusted Bernie Madoff with their money were the victims of elaborate accounting tricks that hid the financial realities and turned out to be massive scams, with Madoff running what turned out to be a gigantic Ponzi scheme.

Gary said the recent fall from grace of Sam Bankman-Fried had only reinforced his dislike of crypto and digital assets and confirmed his stance that they aren’t suitable for the Courtiers Funds. Gary explained that he can’t see or model the risks, and for a whole load of reasons he just doesn’t understand this type of asset.

In the investment world he warned, there are many examples of things like crypto that appear extraordinarily tempting and people like Madoff who promise investors the earth, and such temptations should be resisted. Gary explained how strong compliance, external trustees, and regular auditing of the Courtiers Funds were in place to help the Investment Team avoid such risks and safeguard clients’ money.

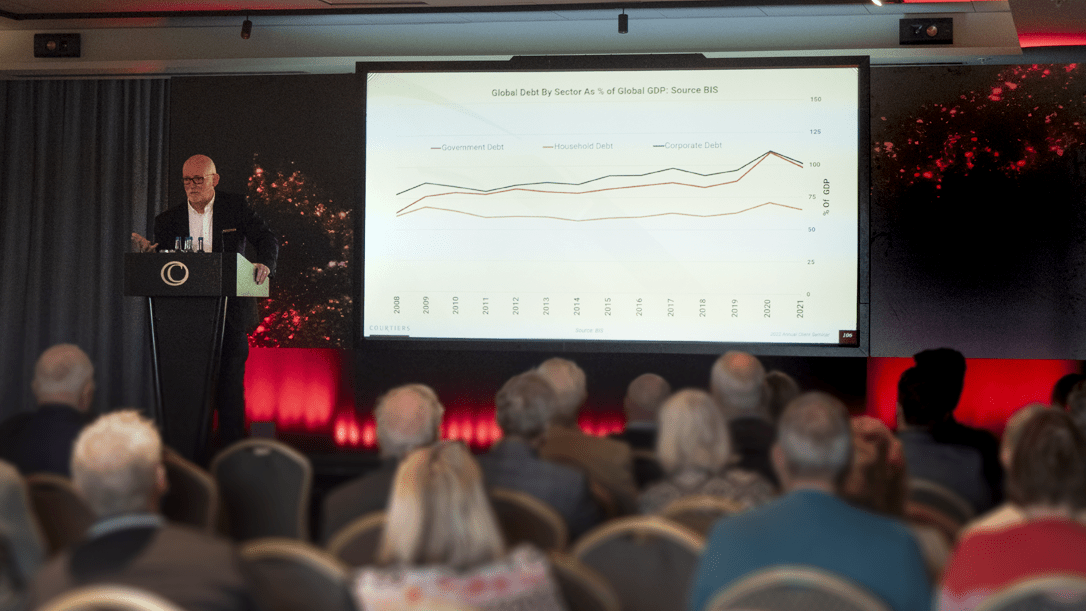

Turning from leverage used by companies, to leverage by governments and households, Gary said that despite the UK government spending more, he was “genuinely encouraged” that net debt is still only a fraction over its long-term average. Similarly, UK average household net wealth is the highest it’s ever been. Less positive has been the role played by the Bank of England. While its programme of quantitative easing (QE), buying government bonds from existing bondholders – was the sensible thing to do in in the wake of global financial crisis of 2008, the big rise in QE in 2020 when the economy was in lockdown hasn’t turned out so well. The subsequent unlocking of the economy unleashed a wave of spending leading to the current high level of inflation, as well as elevated interest rates that Gary said are likely to stick around current levels.

Gary finished his presentation by wishing clients and their families a very happy Christmas and “a low volatility and prosperous 2023”. Let’s hope he has more luck with his request for a calmer year than James did last year.