In short, they’ve done, “actually pretty well”, explains Gary, adding they’ve taken some losses in current markets but “they’re not big,” certainly not in the ranks of the big growth funds that have been “absolutely hammered”.

The Team puts performance down to good diversification, plus the fact Courtiers isn’t directly invested in Russian equities and with very little in emerging markets generally.

While Gary’s careful not to be too upbeat, conscious from his own view that “you’ve still lost a bit of money for clients during this crisis”, he feels the funds and strategies currently in place have done “extremely well”.

As clients know, long-term investing will highly likely see ups and downs along the way and Gary makes clear this is the cost for long-term outperformance. As long as capital is set aside for emergencies and immediate capital expenditure, something Courtiers Advisers make sure is the case with clients, you “sit it out and get on with things”, which Gary points out is “effectively what [the Investment Team’s] doing.”

Changes in strategic direction?

Asked how ongoing tensions might be affecting investment strategy, Gary compares opportunities that might have existed “before this broke out”. Examples include PJSC Rosneft Oil Company, and PJSC Gazprom Energy. “Technically, we could have, if we wanted to, have bought [them]…and I guess today we definitely wouldn’t be buying those stocks.”

The Investment Team would also be “very, very careful” of companies like Evraz PLC, a steel manufacturing and mining company, its largest investor being Roman Abramovich. While today’s news includes sanctions placed on Abramovich by the UK Government, the Evraz website is currently inaccessible in the UK.

Having been around “for as long as mankind’s been on the planet,” Gary makes clear that wars bring more uncertainty than anything else. When a conflict comes around as we’re witnessing today, there will come with it a lot of unknowns, so it’s important to be very careful with liquidity. To be cautious and confident, the Team needs to look at whether anything they might want to buy has got any risks that might “come to the fore” as a result of this crisis.

It’s equally important to look for opportunities that uncertainty can create. Uncertainty sees the market “tend to operate indiscriminately, so good stocks get punished as well as bad ones” and in doing so, it’s important to respect what the world’s trying to do to squeeze Russia as a result of its recent actions – and “be mindful of not violating any of the spirit of the sanctions as well as the letter of them.”

Will we see what we saw before?

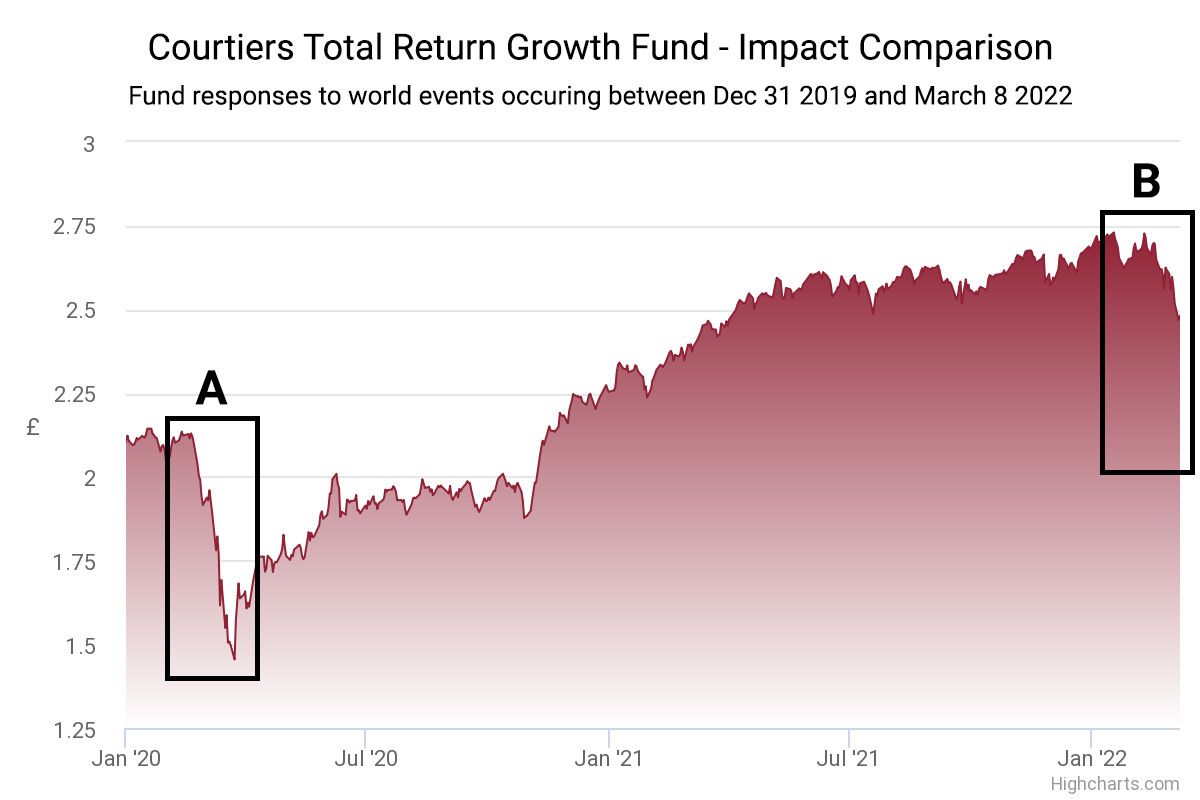

Comparing the impact on markets following news of a global pandemic to the dip seen during the period following Putin’s invasion of Ukraine, the Total Return Growth Fund shown below, designed to accommodate above average risk and the most volatile of the three Courtiers Multi-Asset Funds, saw fund prices dip from above £2.10 to below £1.50 and above £2.60 to below £2.50 respectively. The windows in which these events occur are highlighted below:

Source: https://www.courtiers.co.uk/fund-information/courtiers-total-return-growth-fund/

Asked whether we might see a drop in markets as acute as that caused by the pandemic, Gary explained that the portfolios comprise assets of good value. “You want stocks that are under-priced with a margin of safety, and that means you can stick out the ups and downs and work your way back again.”

The Courtiers Total Return Fund lost ground in the Summer of 2020 and climbed back, at which point it “shoots the lights out of virtually all time periods over the last ten years.”

The Investment Team works to ensure they’ve got assets that even if punished by short-term market sentiment can represent good long-term investment. “That’s very much what you’ve got to do in this situation at the moment,” Gary says.

Wars are periods of enormous uncertainty. Very often, in conflict, markets start to discount the end and pick up strongly. “In terms of the effects on asset prices, the worst is a financial crisis which will tend to depress for a longer period, which you saw happen in 2007-8. Wars do have a negative effect, but they tend to affect bonds more than they affect equities.” Gary goes on to explain Courtiers has very little bond risk for reasons he emphasises often.

Gary closes his insight by saying Courtiers won’t pick up “the pain from the interest rate hikes,” which he’s been forecasting for quite a while.