In recent weeks we’ve seen iron ore (the key component for steel) and palladium (used by car manufacturers to limit harmful emissions) hit record highs.

Meanwhile copper traded above $10,000 for the first time since 2011, as Courtiers Analyst James Timpson mentioned in his last Market Update.

The price of crude oil surged, with light crude oil (which virtually doubled in the past year) consistently trading above $60 a barrel since April. Goldman Sachs recently said it expects prices of Brent Crude oil to hit $80 a barrel.

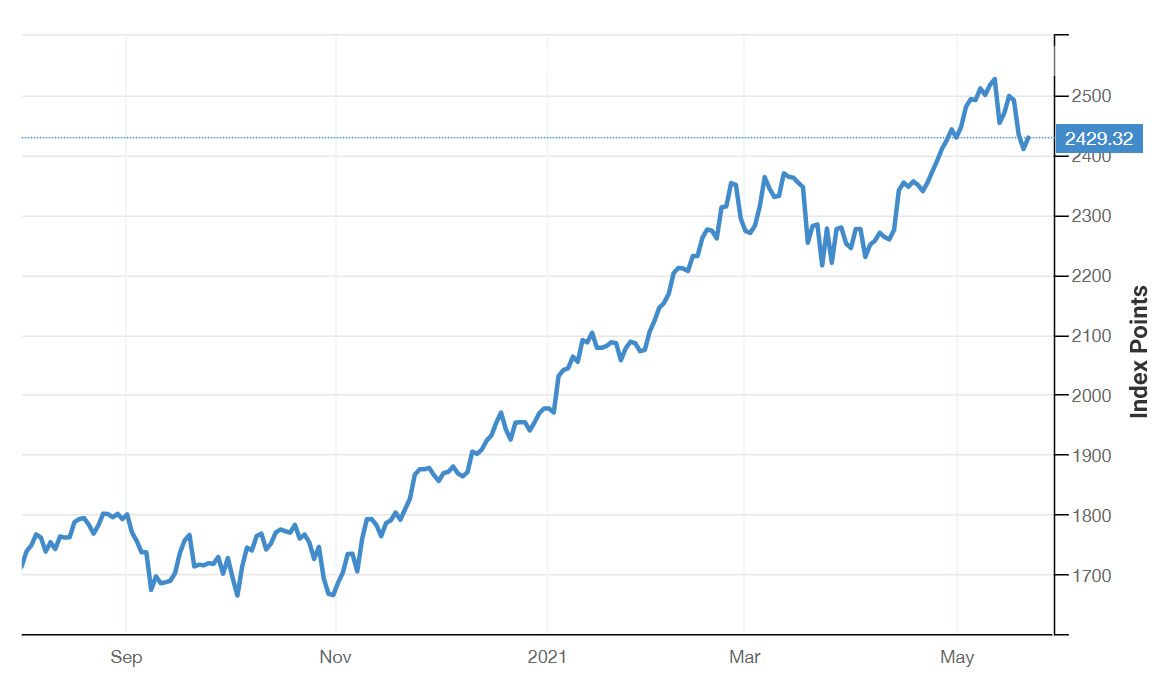

With prices of many of the world’s vital commodities at such elevated levels, as shown in the graph below, expectations have risen among some that as countries continue to reawaken from the pandemic, we could be on the verge of a commodities supercycle…a prolonged period during which the price of commodities and raw materials grow above their long-term trend.

The S&P GSCI® Index* – May 21 2020 to May 21 2021

* The S&P GSCI® is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The index consists of 24 commodities from all commodity sectors – energy products, industrial metals, agricultural products, livestock products and precious metals but its exposure to energy sector is much higher than other commodity price indices.

Source: Trading Economics

Observing this trend, I asked Caroline Shaw, Head of Asset Management at Courtiers whether she expected commodities prices to continue to surge, and whether the Courtiers Funds were positioned for clients to take advantage of developments in the sector:

Q: There has been some speculation that the world is on the verge of a commodities supercycle. What is your view?

Caroline: “We aren’t convinced that there is a supercycle in commodities, though it’s true that commodity prices have broadly rallied strongly recently. The pandemic has caused supply restrictions and demand voids that have affected commodity prices and we expect price volatility as these anomalies unwind. As demand adjusts to the likely higher spending than a year ago, when most of Europe, Australasia and North America was locked down, the result could well be a normalisation of commodity prices to pre-Covid levels which, for many commodities, will be lower than today’s highs.”

That spending will be on infrastructure (building transportation, housing and digital infrastructure for example) but will also be in opening new mines and investing in capital projects for commodities where demand is high, thus resulting in downward pressure on price as supply improves.”

How has Courtiers responded to what’s been going in the commodities sector during the pandemic?

“We spotted some good opportunities in the summer last year and bought exposure to Anglo American, BHP and Rio Tinto when all three companies hadn’t quite recovered from the stress in the economy due to the pandemic and the slowing of raw commodity demand across the world. Those positions have helped the Courtiers multi-asset funds deliver strong returns over the last year, as the global demand for raw materials has soared with expectations of continued infrastructure spending. Prior to the market crash in February / March 2020, we owned a small position in Kumba Iron Ore. Whilst its price fell with the wider market, it’s recovered strongly and has benefited from the recent iron ore price increases. We also considered exposure to metals and took some exposure to copper in early November 2020 via copper futures. These have risen 54% since then, as demand for copper has improved and supply has been constrained by mine specific issues, particularly in South America.”

Do you see further opportunities in the commodities sector?

“We foresee further supply side issues within the copper market in the shorter term and, with continued demand for copper for use in the construction industry and in equipment (for electric vehicles for examples), we expect the price to remain strong.”

Q: The commodities sector is well known for being cyclical, so what warning signals will you be looking out for that might indicate that it is time to trim your position vis-à-vis commodities, or even sell out completely?

A: “The commodities exposure via direct equities is not pure commodities exposure, but commodity price increases are generally helpful. The businesses we own were added to our portfolios as we saw good value there. We’ll continue to monitor those positions, selling out when the value characteristics are diminished. We reviewed our copper exposure recently, following the rapid rise in price, and concluded that there may be more short-term supply constraints, which will be a tailwind for the copper price, provided demand remains robust. We keep those factors under constant review.”