“Regret is unnecessary. Think before you act.”

William Shockley (1910 – 1989)

Some of the biggest cyber-attacks in history have taken place recently and in the Autumn Statement, the Government announced a ban on pension cold calls. These events remind us that today, many fraudsters are trying to trick us into sharing personal details in all manner of ways. Cyber Crime has become a fact of life, and it’s important to be aware of the risks that exist.

Take Five to stop fraud is a National Campaign actively promoting five simple ways to help prevent fraud;

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email, text or phone call is genuine

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic and make a decision you’ll regret

Our Advice

Following these basic steps can help prevent the majority of attempted fraud but recently, there have been instances where customers receive what appear to be legitimate messages from their banks. Scare tactics are a common way to prompt the individual into action with statements such as ‘your account will be closed if action is not taken’ or ‘to avoid further losses’. A common scam at present is where a text message is sent purporting to be from the customer’s bank asking the customer to call the number at the end of the message. This number dials directly to the fraudster which is then redirected to your bank. The fraudsters then listen in on your call to your bank and gather information when you go through the security procedure.

When contacting your bank or building society only ever call the number from a legitimate statement or on the back of your card. If you haven’t signed up to receive information via text message and you suddenly receive one; usually asking for you to update information or stating that there has been unusual activity, call your bank (from a number you are certain is legitimate).

Not only are these frauds increasingly complex, they have also been assigned a variety of unusual names. The text message scam mentioned above is known as ‘smishing’ and there are more:

Vishing

Criminals persuade victims over the phone to share personal details or transfer money. The fraudster claims to be from your bank, stating your account has been compromised and you must move money into a new account. The criminals then provide you with the new bank details with which to transfer the money into. This is just one way they might pressure you into acting in haste. Do not be fooled.

In the event of receiving a call of this nature, tell the caller you will call back and hang up. Wait at least ten minutes (as the line may not be closed until the fraudster hangs up at their end) or ideally, if possible use a different line to call the number on the back of your bank card and report the call.

Phishing

An email falsely claims to be from a legitimate company such as a bank or other popular service provider in an attempt to get the user to pass on private information for use in identity theft. A Phishing email will typically try to direct the recipient to a website where they are asked to enter personal information such as passwords, credit card details, social security or bank account numbers. While the websites may look authentic, they are not.

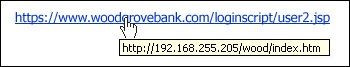

If in doubt, hover your mouse over the link address and you can see if it is genuine, but do not click. The example below shows a link which will appear. In this case is not the same as the link written in the email, therefore it should be treated as highly suspicious.

Image source: Microsoft

If in doubt…simply delete the email and move on. If you wish to query the email with the official service provider, go via your website browser to their official website and follow the contact procedures there.

The most important thing to remember is that however genuine any form of written or verbal communication might appear, by taking a closer look at what it is asking, the type of wording used and any link addresses, it can be easier to detect what might be a fake request.

If you are unsure, ask us and we can have a look for you. If you contact your bank or building society directly, only ever use details from documentation you are certain is legitimate or use the details included on the back of your bank card. Remember, if you haven’t signed up to receive information via text message and suddenly receive one, ignore it or call your bank, again, using a number you are certain is from a legitimate source.

Fraudsters targeting people via phone calls, text messages, email, online and in other ways has become a fact of life.

Take Five to stop fraud campaign provides useful information, advice and resources on each of these areas and it is worth taking a good look.

It is always wise to keep an open mind and think twice when it comes managing your finances and transacting online or via mobile, especially when other parties are involved and especially during times when spending is higher than usual. By heeding the warning signs, thinking twice and letting common sense prevail, we can all beat fraudsters.

If you are ever uncertain about any form communication you’ve received relating to your finances and would like our advice then please, pick up the phone and speak to your Courtiers Adviser. We are here to help.