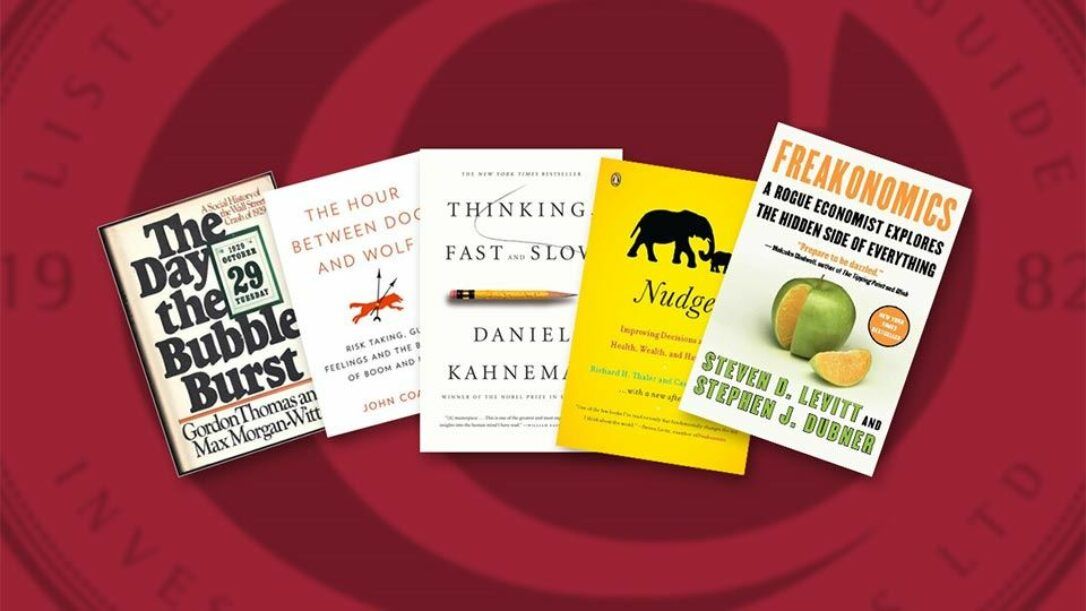

In honour of World Book Day, here are five of my favourite books (finance related of course!) which I’d recommend to any investors interested in financial markets and behavioural finance.

1. The Day the Bubble Burst

(Gordon Thomas and Max Morgan-Witts) – describes the social impact of the 1929 Wall Street Crash. Fascinating to see the inequality of data and the lengths people went to then to get ahead of information (extra telephone lines, faster messengers, networks of contacts on the trading floors). Technology has moved on hugely. Social impacts still relevant today.

2. The Hour Between Dog and Wolf

(John Coates) – a neuroscientist’s analysis of what happens to your body when you trade. Concludes that women and older men are different risk takers to younger men (testosterone driven traders with short time horizons) and that the financial industry needs more long term strategic thinking (“where women excel” – his quote not mine!). It is no coincidence that Courtiers head trader is female and focused on risk adjusted, longer term returns.

3. Thinking Fast and Slow

(Daniel Kahneman) – THE book to help you understand how and why you make the choices you make. Describes two systems in our mind. The first is fast and emotional, the second is slow and more logical. Kahneman looks how the two systems work together. Well written and relevant in both professional and personal life.

4. Nudge

(Cass Sunstein and Richard Thaler) – a look at the application of behavioural economics and how choice can be designed. The section on how to nudge people towards appropriate retirement choices is topical and relevant. Auto-enrol employees into pensions and most don’t opt out. Hey presto! Pension savings!

5. Freakonomics

(Steven Levitt and Stephen Dubner) – the original book and a fun journey through statistics, economics and why you should question everything. An easy read (the easiest of the lot here) and highlights how data can be twisted and how incentives and rewards can result in unintended consequences. Scepticism is alive and well, and, thankfully, perfectly acceptable.