Yesterday we saw the worst one-day fall in global equity markets since 1987.

Fears of ongoing economic distress, combined with global travel restrictions and cancellations of social and sporting events have pushed the VIX index (measuring volatility) to levels not seen since 2008.

Our options strategy has been defensive and our low levels of equity exposure have helped during the last few days.

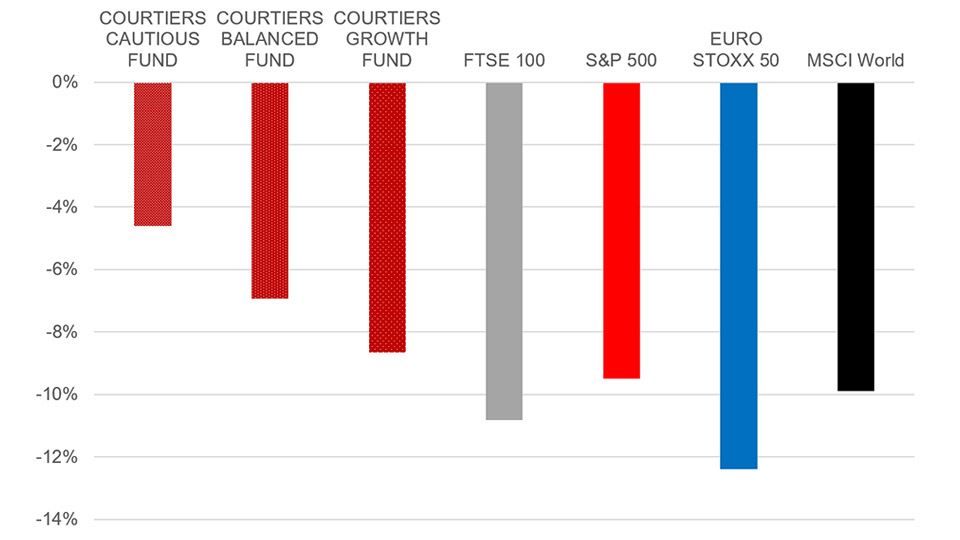

The Courtiers multi-asset funds have not fallen as much as the markets. The following chart shows the maximum drawdown in a single day over the last year from the Courtiers multi-asset funds compared to some major global indices. In simple terms, it shows the largest one-day loss experienced over the last year.

It is no coincidence that for the Courtiers multi-asset funds, and for the indices quoted, the maximum drawdown occurred yesterday. We are pleased that Courtiers multi-asset funds continued to be more defensive than global equity markets.

Max One-Day Drawdown 11/03/19-12/03/20

Source: Bloomberg & Courtiers. Based on total return. Past performance is not a reliable indicator of future returns.

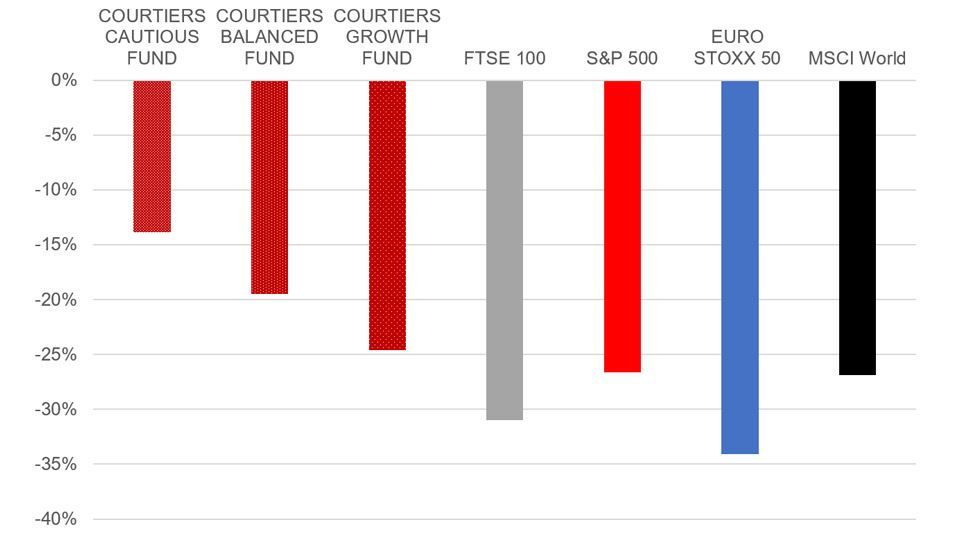

We have also looked at the peak-to-trough falls during the last year, otherwise known as the maximum drawdown during the last 12 months. This uses the peak price and the lowest price following that.

Max Drawdown 11/03/19-12/03/20

Source: Bloomberg & Courtiers. Based on total return. Past performance is not a reliable indicator of future returns.

Again, the lowest prices (the troughs) were experienced yesterday. The peak prices for the Courtiers multi-asset funds during the last 12 months were actually not that long ago, in late January. The scale of the equity market falls is evident with European equities falling almost 35% from their peak on 19th February. In contrast, Courtiers Total Return Cautious Risk Fund has a maximum drawdown peak-to-trough of 14%.

Today markets are rallying, though early gains have been tempered this afternoon. We expect market volatility to continue but there are opportunities and we remain cautiously positioned whilst looking to take advantage of some of the attractive (cheap) valuations.