With the race on to reduce carbon emissions, the drive to find new ways to move away from our reliance on fossil fuels – particularly coal, oil and gas is accelerating.

As the world looks ahead to a future based more and more on renewables, solar and wind power have emerged as two of the frontrunners in the UK.

Courtiers Analyst, Nyasha Jonhera, says the growth of both solar and wind has been driven by the development of cheaper and better technologies. “In 2000 the average wind turbine generated enough power for 600 homes. By 2020, this had quadrupled so that they generated enough power for around 2,500 homes,” she says.

“The bigger, the better” says energy.gov

Since 1990, wind turbines have grown in width and height. Where in 2000 a turbine was around 58m (190ft) tall, by 2020 they’d reached 90 metres (295ft) and with larger blades to boot. By 2035, the Office of Energy Efficiency and Renewable Energy (EERE) expects turbines to reach around 150m in height…almost 500 feet.

Nyasha says, “It’s a similar story for solar, where the efficiency of solar panels has risen from about 12% efficient ten years ago to 19% today, with 27% promised in 2023. This nearly doubles the amount of energy a solar panel can extract from the sun.”

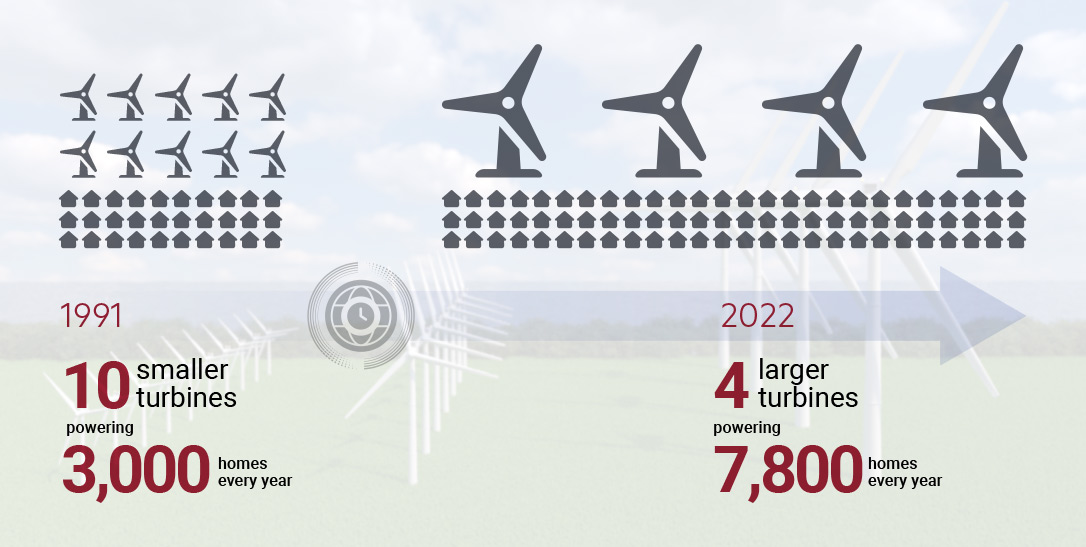

Courtiers Head of Asset Management, Jacob Reynolds, can vouch for how better technology is driving the development of renewables. He recently visited a wind farm in Delabole Cornwall, the UK’s first commercial onshore wind farm established in 1991 and it’s seen greater energy output through more efficient technology since.

Now owned by Bluefield Solar Income Fund, a London-based investment company which specialises in renewable energy, initially there were 10 wind turbines on the Delabole wind farm, enough for 3,000 homes. These were then replaced by four bigger and more efficient wind turbines, capable of producing enough energy for 7,800 homes.

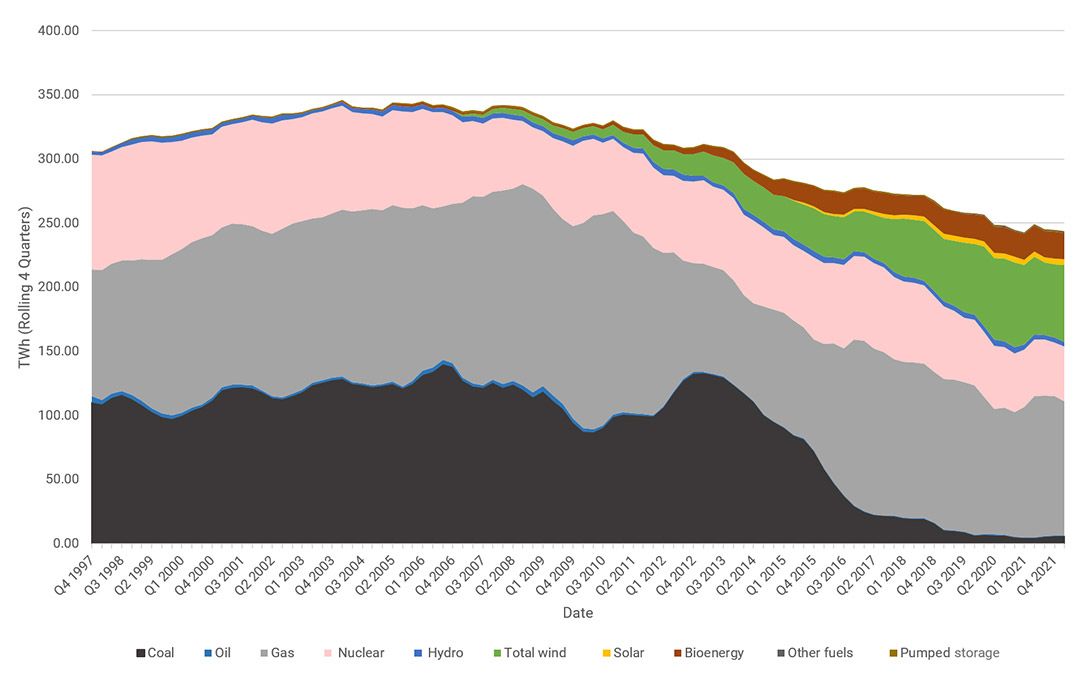

With helpful government policies and financial support, Bluefield is one of a growing number of companies that recognises the opportunities in the sector and as money’s poured in, the UK’s energy mix has shifted dramatically. In the 1990s, the proportion of renewable energy was about 2%. This has now grown to around 25% in 2022, having hit a peak of 42% in 2021.

Electricity production and availability from the public supply system

Quarterly data (TWh), April 1997 to April 2021

Source: BEIS

With more than 70 countries having signed up to net-zero emissions by 2050, including the UK, global management consulting firm McKinsey has modelled different scenarios, Nyasha explains. These vary from the most optimistic – achieving net zero by 2050 with carbon emissions falling by 50% by 2030 – to the most pessimistic, which is based on current policies and technology, that would see the target missed by about 90%.

“While questions remain about how long it will take to wean the world off fossil fuels in favour of renewables the direction of travel is clear,” says Nyasha.

It’s one reason why she says Courtiers recently decided to invest in Bluefield Solar Income Fund, which it now holds in all three of its multi-asset funds, adding it to its three existing infrastructure holdings: BBGI Global Infrastructure, Victory Hill, and INPP. “The investment benefits are clear. A progressive dividend strategy, income visibility, inflation protection and a strong development pipeline.”

Then there are the diversification benefits that come from infrastructure. During recent market turbulence the performance of the combined infrastructure funds “has held up well against both equities and bonds.”

With traditional investment strategies based on equities and bonds going through a difficult period, infrastructure assets are proving their worth, with the path towards net zero offering some fresh additional opportunities.