Pictured: Colin Cottell and James Timpson

James Timpson reflects on 10 years at Courtiers

A lot’s happened in the world since James Timpson, Fund Manager of the Courtiers Multi-Asset Funds, joined Courtiers in 2013. You could say ‘there’s never been a dull moment’. That year saw the infamous bond taper tantrum when US bond yields surged. Three years later in 2016, the UK voted to leave the EU. In early 2020, the pandemic broke and last year Russia invaded Ukraine. Each of these events sent seismic shock waves through the world’s financial markets.

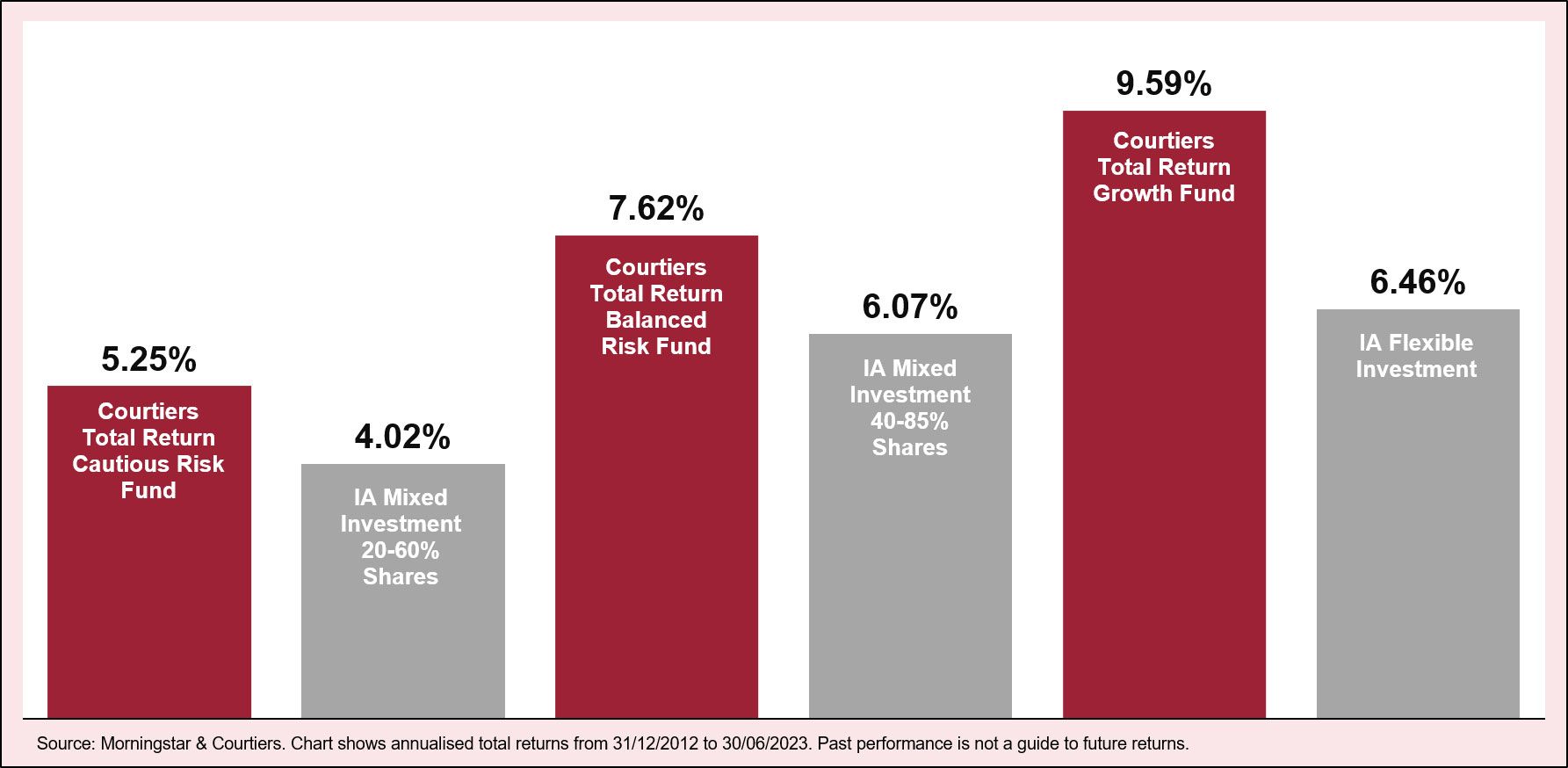

Despite these periodic shocks to the financial markets, the Courtiers Multi-Asset Funds have outperformed their peer groups over the last five and ten years.

While James himself is far too modest to claim any personal credit for the long-term performance of the Courtiers Funds, it’s fair to say that as his career’s developed, he’s played an increasingly important role.

After an internship at an insurance company, James joined Courtiers as a Trainee Analyst. After passing his CFA exams first time, he became an Investment Analyst. Further promotions followed to Senior Analyst and then Deputy Fund Manager in 2021. Earlier this year, he became Fund Manager of the Courtiers Multi-Asset Funds.

When James first walked through the front door at Courtiers’ office in Henley-on-Thames, Courtiers ran just three funds, with combined assets under management (AUM) of around £250m. Today the company runs seven funds totalling around £1 billion. The Investment Team has grown and now includes three full-time Analysts and a Product Specialist. Courtiers itself has tripled its employee numbers, from 40 then to 120 today, and opened five further offices across England.

Roles and responsibilities

Since he first joined Courtiers, James’ own role and responsibilities have also evolved. These days, rather than analysing stocks himself most of the individual stock analysis is carried out by other members of the Investment Team. Once an investment has been given the green light, he explains how it’s down to him how much to commit to a particular investment, taking into account how this affects the overall risk of the fund. Conducting stress tests to gauge the impact of events on the Courtiers Funds, say another credit crisis, is also a key responsibility. “Essentially, I have to ensure that the overall risk of each fund remains within its specified mandate whenever we buy or sell an investment,” he explains. James also oversees the execution of trades within the funds, liaising with brokers specialising in numerous different asset classes.

James is very conscious that the money he’s investing is clients’ money. Clients have very specific risk mandates, determining which of the Courtiers Funds their money is invested in. “It forces you to make sure that the funds strictly adhere to their clearly defined risk parameters,” he explains, “as clients have been promised that their portfolio will never exceed the level of risk that they are comfortable with.”

Team ethos

While it’s clear that James has specific responsibilities, it’s also apparent that he’s very much part of the Investment Team, and that he’s fully onboard with the team ethos. “It’s a fairly flat structure, which means that anyone in the team can research and propose an investment idea,” he says. Investment proposals are generally discussed in the Investment Team’s weekly asset allocation meetings.

The team ethos is best illustrated by its ‘golden ticket’ policy, which allows anyone in the Team to veto an investment. Where no one chooses to use their ‘golden ticket’, this emphasises that the decision to make a particular investment “is entirely the Team’s responsibility” and not any one individual’s.

The Team puts a lot of work into analysing stocks. “It can take two or three days to analyse a brand new stock for the funds,” James says, “and each stock has initially been chosen because it ranks highly in our value-based quantitative stock selection model, so it’s very rare that the ‘golden ticket’ policy is invoked.”

Communication is key

James believes that communicating with clients is an important aspect of his job, especially during periods of market stress. He recalls how even during the darkest days of the pandemic, the Market Commentaries continued to go out to clients as normal. This even included a couple of videos produced remotely when everyone was working from home. “I think having such a high level of communication with clients at times like the pandemic is one of the things that Courtiers does really well.”

James is well known to many Courtiers clients for his presentations on the financial markets at the Courtiers Annual Client Seminars, held in December each year. James says he always looks forward to meeting the people whose money the Investment Team is looking after. A former contestant on ‘Countdown’, James always likes to inject a little audience interaction and humour into proceedings. “I think it’s important to make the presentation accessible and engaging, particularly as financial markets can be quite a dry topic for many people, and humour is a good way of doing that.”

James says the strong long-term performance of the Courtiers Funds is due to a number of factors. “Diversification across a broad range of assets and markets”, as well as the use of options which can help to maximise returns when markets are rising and minimise losses when markets are falling. “We have a strong belief in fundamentals, which means we’re always looking for the markets which offer the best value.”

A watershed moment

Although the long-term performance of the Courtiers Funds has been impressive, James admits it’s not always been plain sailing. Having missed the global financial crisis in 2008 and the US debt downgrade in 2011, James says that the crash that accompanied the pandemic as it broke in early 2020 was his first real market crisis. “Seeing markets plummet 10% in a day multiple times a week was really alarming,” he says. However, the funds held up reasonably well as a proportion of their equity exposure was through call options. “The call options’ losses were limited to the amount we paid for them, so they eventually stopped losing money even when the market kept falling,” James explains.

The market crash also highlighted the importance of maintaining strong levels of liquidity in the funds. “We were getting big margin calls on our futures positions,” James explains, “and having plenty of cash held in liquidity funds ensured that we were able to meet those without any problems.”

Having been through this baptism of fire in 2020, James says he now sees the pandemic period as something of “a watershed moment”. Before 2020, he says, when markets were down 2% for the day he would think ‘Wow, something must have really shaken markets’. Post-pandemic, and with market volatility having remained so elevated since the crash, he says he feels better equipped to deal with day-to-day market movements.

Crises and opportunities

Over the years, James says experience has taught him to accept that short-term movements in the markets, like the 3-4% fall when Russia invaded Ukraine in 2022, are an inevitability over which you have absolutely no control. “Sentiment towards a stock or a market can change from day to day, which is why short-term movements are a lot less meaningful than long-term trends.

“Markets have a strong tendency to recover from crises. We saw that with the pandemic and it’s happened several times over the last few decades.”

Indeed, crises like the crash of early 2020 also bring opportunities. In addition to “forensically looking at our existing holdings to make sure they could withstand any further volatility,” James says the Investment Team saw opportunities for new investments. New River, a real estate investment trust, which saw its value plummet as retail parks emptied of shoppers during the lockdown, is a case in point. Along with the Courtiers Funds generally, it recovered strongly in the subsequent market rally as the vaccines were unveiled.

Looking ahead, although James says he expects volatility to remain a feature of markets for the foreseeable future, he’s determined that it won’t deflect him from his goals. “The ultimate goal is to deliver strong returns over the long term so that our clients can achieve their long-term objectives. If we do that, then I can sleep at night knowing that I’ve done my job quite well.”

As the chart below illustrates, since the start of 2013 all three of the Courtiers Multi-Asset Funds have outperformed their peer group. Over the same period all three funds are in the top quartile for annualised returns. Past performance is of course, not a guide to future returns. In recognition of the consistent long-term performance of the Multi-Asset Funds, since 2016 the Investment Team has picked up a total of 15 industry awards.