The average life expectancy of people born in the UK almost doubled in the 170 years between 1840-2011 and the trend continues. While a longer life is good, it’s important to consider the implications for people’s finances, particularly pensions and pensions planning.

UK’s pensions landscape

With annuities and final salary pensions (both of which pay a guaranteed income) declining in recent years, the 2015 Pension Reforms and the rise of defined contribution (DC) schemes, have dramatically changed the UK’s pension landscape. To take just one example, a report by the Work and Pensions Committee found that since the introduction of the 2015 Pension Freedoms, some 1.7 million people have withdrawn over £45 billion flexibly from their pensions. Another remarkable figure is the drop in the number of pensions used to buy an annuity, from 90% of pension plans regulated by the FCA before the Pension Freedoms to just 10% in 2019-20.

Greater longevity risk

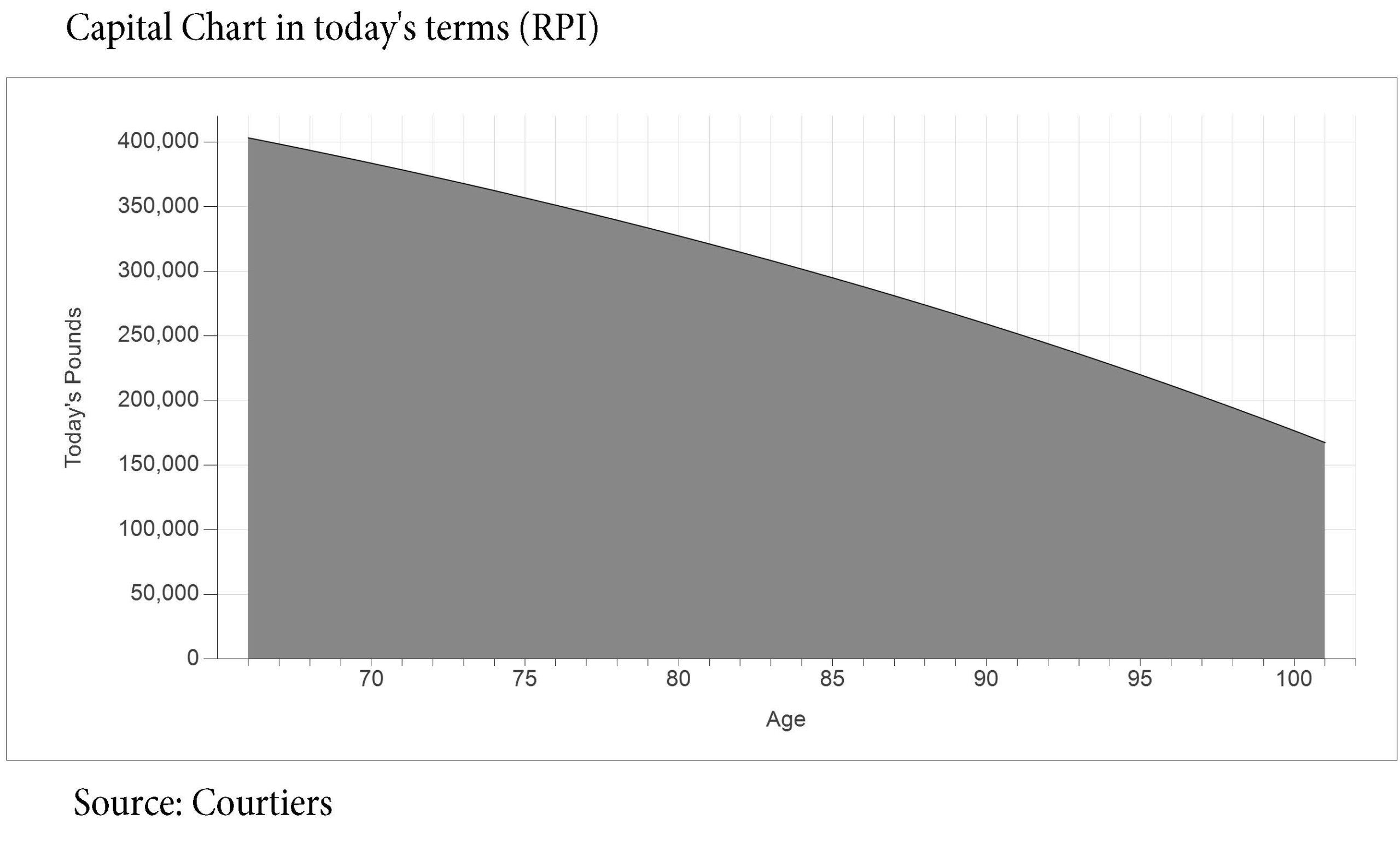

While many have welcomed the freedoms, there is another side to this. A combination of a radically altered pensions landscape and people living longer than in previous generations has resulted in a higher level of what’s called longevity risk. In short, with pensions needing to last longer than before, there’s a greater chance people will have less to live on in their later years and less wealth to pass on. As the graph below illustrates, living five years longer can make a massive difference.

Age at death Remaining pension pot

80 (2036/37) £327,373

85 (2041/42) £294,921

90 (2046/47) £259,193

95 (2051/52) £219,859

The graph and figures above, assume a 65-year old with an initial defined contribution pension pot of £400,000, who withdraws 3% of their pension savings in equal monthly instalments. It assumes pension pot growth averaging 5% a year and prices as measured by the Retail Price Index rising by 3% a year.

Complexity and uncertainty

A report by the Work & Pension Committee summed up the situation when it said; “Standard Life Aberdeen, an investment company, told us that 66% of those who will retire in 2021 may have insufficient savings to sustain their planned retirement income.” The report also highlighted the challenge faced when planning for retirement. “Uncertainty about the length of remaining life can make it difficult to plan how to draw down retirement assets and not run out of money. For example, a 65-year-old male in 2021 can expect to live an additional 20 years of life, but there is considerable uncertainty around this: one in ten are not expected to survive more than another seven years, while one in ten can expect to live for another 31 years.”

To confuse matters further, more and more compelling evidence has emerged that expectations surrounding life expectancy can vary greatly depending on a number of factors, for example by location: in Blackpool it’s around seven years lower than in Kensington and Chelsea.

It is clear that with people’s pensions needing to last longer, the implications of this higher level of longevity risk requires careful consideration.

As the Work & Pensions Committee states in its report “making pension decisions is complicated”. It’s not the purpose of this article to go into detailed retirement planning. This is best done with a Financial Adviser. However, faced with the prospect of having to make pensions last longer than previous generations, there are a number of strategies that people may wish to explore further:

- Save more to increase the size of your pension pot

- Reduce the withdrawal rate i.e. the amount you take out of pension savings each year

- Delay taking your pension

- Reduce expected standards of living in later life

Conclusion

Planning for your retirement is important, not just for financial security, but also because pensions are often essential if people are to achieve their wider financial and life objectives.

Pensions planning should not be seen in isolation, but as part of a broad view of financial circumstances and objectives through life. Your Courtiers Adviser can help you put your pension planning into this wider context. They can also explore your ambitions, for example, by making use of detailed cash flow modelling to project various scenarios into the future, including how long a pension might need to last. It is important that pension reviews are carried out regularly to take into account changing objectives and financial circumstances, especially changes in financial outgoings and income.

Further reading