Transferring out of a Defined Benefit (DB) pension into a Defined Contribution (DC) scheme at any time is a complex decision and one that should never be taken lightly. That’s why before doing so, anyone with more than £30,000 in DB pension savings is required to obtain advice from a regulated financial adviser, while some pension schemes insist on this even when savings fall below this threshold. “It will always be the job of the adviser to ascertain whether this is in the best interests of the client,” says Kapil Divecha, Chartered Financial Planner at Courtiers.

Plummeting transfer values

While the bar for advising a client to proceed with a DB transfer was already high, the aftermath of the ill-fated Truss government’s economic policies have only muddied the waters and raised the bar further.

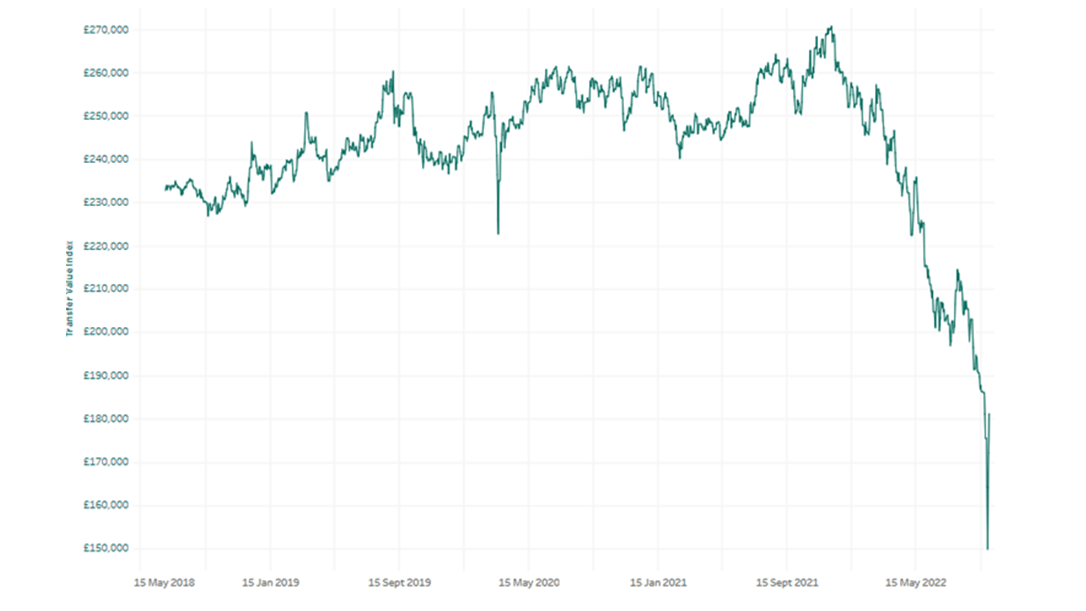

Figures from pension consultancy XPS Group show that at the end of September the average lump sum cash payment a person received in exchange for giving up their DB pension benefits, (known as a cash equivalent transfer value, or CETV) fell to an unprecedented low of £181,000. As Chart 1 below illustrates, transfer values, as represented by XPS Group’s Transfer Value Index, have been dropping like a stone all year. This last figure represents an 8% fall in just one month and a decline of almost a third throughout 2022. Receiving a significantly lower sum than you would have just a few months ago, is clearly not good news. In short, it means that a CETV recipient is worse off than they would have been had they accepted the lump sum available just over a month ago and transferred their DB pension.

CETVs

A CETV is the expected cash amount needed to buy the final salary scheme benefits on the day that the CETV calculation is made. It represents the current expected cost to the scheme of providing pension benefits for a specific individual based on their estimated lifetime once they have reached the scheme’s normal retirement age. It also takes into account any entitlement to DB lump sum payments, and dependants’ benefits. CETVs are determined by the trustees after seeking advice from the actuaries. CETV quotes are pension scheme and person specific. You won’t know what it is until you ask for a quote. Once calculated the lump sum may then be transferred to a Defined Contribution (DC) plan. “In some cases, pension schemes may increase the CETV to encourage members to leave the scheme,” adds Kapil.

An inverse relationship

For an explanation of why CETVs have fallen since the start of the year, it’s important to understand the relationship between CETVs and the government’s borrowing rate – the interest rate it pays investors who lend it money by buying government bonds. This is known as the gilt rate.

The gilt rate is the biggest driver of transfer values. DB schemes buy gilts and use the interest they receive to pay for future pensions. So, when gilt yields rise, schemes can expect better investment returns. As a result, they don’t have to put aside so much now to meet future pension outflows. This in turn means that the current cost of providing pension benefits declines, leading to a corresponding fall in CETV values for individual scheme members.

For more than a decade, massive bond buying (called quantitative easing) by the Bank of England meant that gilt yields remained at low levels and consequently transfer values were high.

Chart 1 – XPS Transfer Value Index

Source: XPS Group

As Chart 1 above illustrates, in recent months the situation has changed dramatically as the Bank of England’s attempts to bear down on inflation by raising interest rates forced gilt rates higher.

The so-called mini-Budget in September, when the markets took fright that the government’s economic plans were unsustainable, led to further volatility. Initially falling after the Bank of England intervened to calm the markets, at one stage 20 and 30-year yields spiked to their highest level since 2002, both exceeding 5.1%. Rishi Sunak’s arrival at No 10 Downing Street has calmed markets with 20-year yields falling below 4% and the yield on 30 year gilts more than 1 percentage point lower than their post mini-Budget September high. However, despite the recent decline in gilt rates, they remain well above the levels seen in recent years.

Turbulent times

The pensions industry is facing turbulent times. In late September, the Bank of England was forced to intervene to restore market stability after some pension funds were forced to sell gilts. This caused gilt prices to fall, which in turn meant pension funds were forced to sell more gilts – a phenomenon described as a ‘doom loop’.

While this immediate problem appears to have been addressed, it is too early to say whether the new Prime Minister can continue to reassure the markets and maintain current gilt rates, or even reduce them further. “Now that we have a new Prime Minister, who was an ex-Chancellor, we’ve seen volatility around the gilt yields decrease. After the uncertainty that we saw following the mini-Budget, Rishi Sunak is likely to be cautious and avoid making too many changes,” says Kapil.

DB pension schemes in rude health

On the bright side, holding bonds that pay a higher rate of interest than just a few weeks ago should strengthen the financial position of DB pension schemes. In early October, accountancy firm PwC said that largely as a result of recent increases in long-term interest rates, which reduces the current cost of meeting future obligations to members, most of the UK’s 5,000-plus corporate DB pension schemes are in rude health. As this article explains, however, this comes at the cost of lower transfer values.

Conclusion

Lower transfer values and continuing volatility in the gilt market with its knock-on effects on pension funds are clearly not ideal conditions to transfer out of a DB scheme. That’s not to say that transferring out of a DB scheme should automatically be dismissed out of hand and individuals may have good reasons for going ahead. These could include the flexibility of a Defined (DC) pension and the ability to pass on all of a DC pension – the rules of some DB schemes mean that a surviving spouse may only be entitled to a certain portion of that received by their partner.

On a practical note, it can take several months for a DB pension transfer to be completed, so especially in these volatile times, the CETV you are offered could be markedly different from the one that you would be given if the calculation was carried out today. Once you have received a CETV, it is guaranteed for three months.

The final word comes from Kapil. “When considering a DB pension transfer, we would always start with the premise that it won’t be in the best interests to transfer, however there may be individual reasons why it might be suitable. We would look holistically at each person’s situation taking into account all relevant financial information, to prove if and why a transfer would be suitable for the client.”