Global equity markets were deeply unsettled by the sweeping trade tariffs unveiled by President Donald Trump on ‘Liberation Day’. In the first week of April, the MSCI World index, which tracks global equities, tumbled nearly 10% as investors feared that the newly imposed tariffs would result in a global recession.

The VIX index, which measures the implied volatility of the US equity market, reached its highest level since the Covid crash in 2020. However, the mood brightened a week later when Trump decided to delay most of the tariffs for 90 days. As a result, the S&P 500 index, which tracks US stocks, saw its biggest one-day gain since 2008.

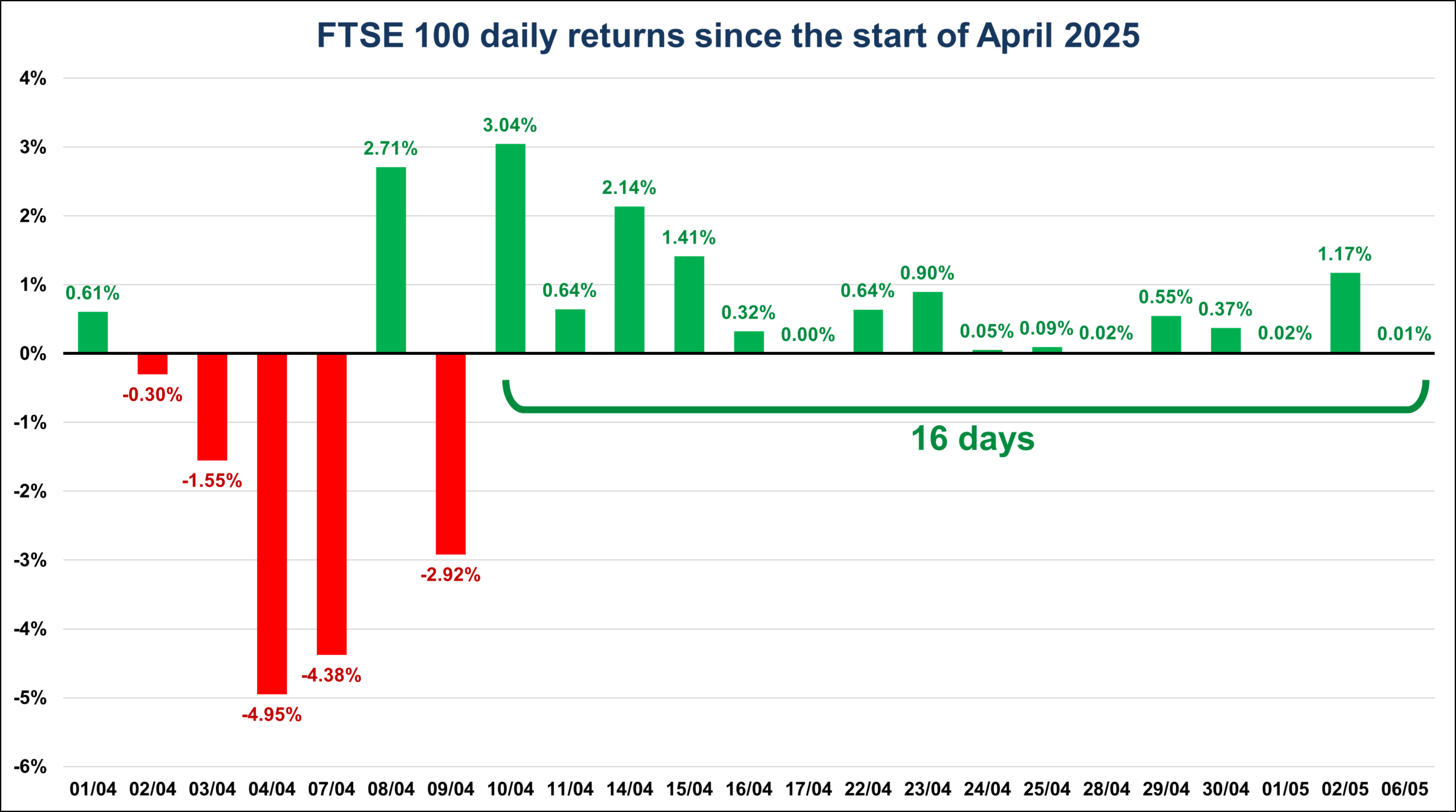

Although uncertainty remains – particularly in China where the trade war has been especially rife – the easing off from Trump has calmed investors to the extent that the FTSE 100 has just achieved a record winning streak. The return on the index has been positive every day since 10th April, resulting in a record streak of 16 consecutive green days.

Source: Bloomsberg and Courtiers. Chart shows daily price returns in GBP from 31/03/2025 to 06/05/2025. Past performance is not a guide to future returns.

Full round-up of April market performance

In the UK, the FTSE 100 index declined -0.66% while medium and smaller companies, measured by the FTSE 250 ex IT index and the FTSE Small Cap ex IT index respectively, gained 3.67% and 1.92%. In the US, the S&P 500 USD index fell 0.68% while in Europe the Eurostoxx 50 EUR index dropped 1.07%. Japanese stocks measured by the Topix JPY index rose 0.33%.

Emerging markets returns were mixed, with the MSCI Emerging Markets index returning -0.15% in local currency terms. Latin American equities, measured by the MSCI Latin America local currency index, surged 5.14% and Indian stocks measured by the Nifty 50 INR index climbed 3.46% but Chinese stocks measured by the MSCI China CNY index slumped 4.51%.

In the fixed income market, UK government bonds, measured by the FTSE Gilts All Stocks index, gained 1.70% with long-dated (over 15 years to maturity) gilts rising 1.80%. Sterling denominated corporate bonds, measured by the Markit iBoxx Sterling Corporates index, gathered 1.35%. In the high yield market, the ICE Bank of America Sterling High Yield index picked up 0.56%.

In the commodities market, the S&P GSCI USD index, which consists of a basket of commodities including oil, metals and agricultural items, shrank 8.43%. Brent crude oil futures tumbled 18.56% during the month. In the precious metals markets, the S&P GSCI Gold and Silver indices returned 5.73% and -5.70% in USD respectively, while in the agricultural markets corn and wheat futures returned 2.19% and -4.47% in USD respectively.

In currency markets, it was a mixed month for the pound as it appreciated 3.18% versus the US dollar and relinquished 1.50% against the euro and 1.57% versus the Japanese yen.