The Brexit deadline of 31st October has come and gone, and yet the UK has still not left the European Union. A further extension to 31st January 2020 has been granted by the EU, and in the meantime MPs have voted in favour of a general election, which will take place next month.

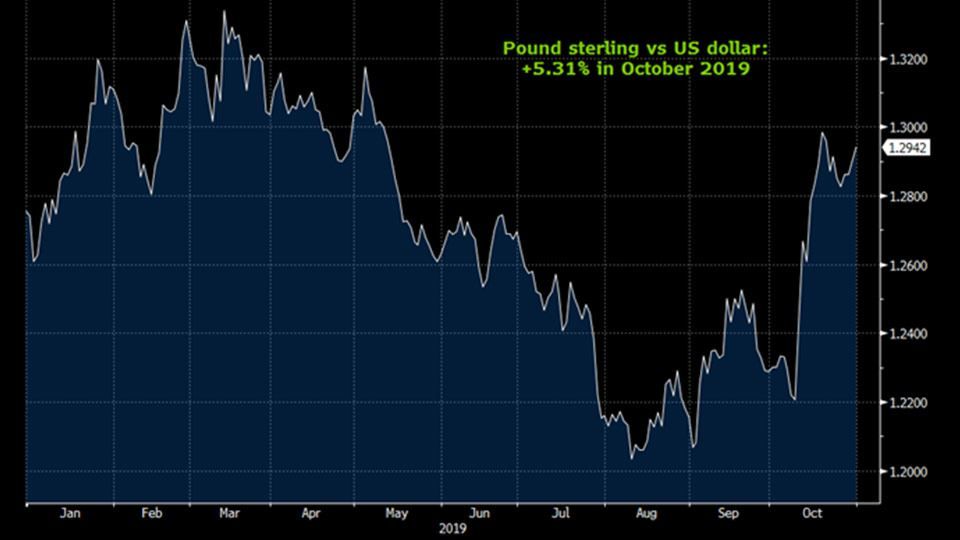

Amidst the political turbulence, it was a strong month for the pound, which leapt whenever there was renewed optimism for a Brexit deal being reached. It reached a five month high against the US dollar, as shown in the below chart, and posted its best month-on-month gain versus the dollar since May 2009.

In the US, the Federal Reserve has cut its benchmark interest rate for the third time this year, bringing it down to 1.5 – 1.75%. These quick-fire rate cuts are the result of the US economy slowing amid trade tensions and weaker global growth. The benchmark rate in the UK has been static at 0.75% since last August, while UK inflation measured by the Consumer Prices Index (CPI) currently sits at 1.7%, the lowest level since 2016.

A full round-up of October market performance

In the UK, the FTSE 100 index declined -1.87%, while medium and smaller companies, measured by the FTSE 250 ex IT index and the FTSE Small Cap ex IT index, picked up +0.98% and +0.53% respectively. In the US, the S&P 500 index gained +2.17%, while in Europe the Eurostoxx 50 index climbed +1.10%. Japanese stocks measured by the Topix index surged +4.99%.

Emerging market returns were also positive, as the MSCI Emerging Markets index put on +3.01%. Chinese equities measured by the MSCI China index rose +3.91% while Latin American equities, measured by the MSCI Latin America index, increased +1.43%. Indian stocks measured by the IISL Nifty 50 PR index lifted +3.51%.

In the fixed income market, UK government bonds, measured by the FTSE Gilts All Stocks index, slipped -1.82% and long dated (over 15 years to maturity) gilts lost -3.08%. European corporate bonds, measured by the Markit iBoxx Euro Corporates index, dropped -0.18% while sterling denominated corporate bonds, measured by the Markit iBoxx Sterling Corporates index, conceded -0.17%. In the high yield market, the Bank of America Merrill Lynch Euro High Yield index and the Bank of America Merrill Lynch Sterling High Yield index captured -0.01% and +0.70% respectively.

Commodities had a mostly positive month. The S&P GSCI index, which consists of a basket of commodities including oil, metals and agricultural items, returned +1.24%. The price of a crude oil futures contract crept up +0.37%. In the agricultural markets corn and wheat picked up +0.52% and +2.62% respectively. The precious metals also saw gains as the S&P GSCI Gold and Silver indices rose +2.99% and +6.44% respectively.

In the currency markets, the pound rallied against most major currencies, including the US dollar (+5.31%), the euro (+2.92%) and the yen (+5.28%).