You may have noticed in your new Personal Finance Portal (PFP), that there is the option to have open banking. While still a new concept; with over nine million business and consumers in the UK using open banking, if you’ve paid for online services (like shopping) or budgeted using a savings app, you might already be in that number (no, it’s not a Courtiers invention).

The Financial Conduct Authority (FCA) oversees finance apps and services, just like UK financial service firms and markets. This means that, under FCA regulations, companies have to follow strict standards and stringent rules to make sure your data remains secure.

Using open banking as part of your investment portfolio could be beneficial to you, helping you understand your full financial planning needs.

You’re in control

If you don’t read any further, the biggest thing for you to know about open banking is that you are completely in control. You opt in to connect open banking, rather than needing to opt out, meaning you get to decide who has limited access to your financial information, and if you grant permission, then change your mind, you can withdraw your permissions and unlink your accounts at any time.

Linking an account will not give us access to those finances or the account itself. We will only be able to see the name of the account (clearly labelled as open banking) and the current value. We will not be able to see individual transactions, but this transaction information will be available for you, the client, to see.

Open banking provides enough information for a clearer top-down view so we can guide you on any patterns or potential savings you may not be aware of in your spending history. What information you share with us is your choice – what matters most is that you’re comfortable. It’s also worth noting that you will need you to renew your permission every 90 days to confirm your consent to share information via open banking.

What is open banking?

Put simply, open banking offers you a secure, minimal way to move, manage and enhance your view of your money. Through open banking, you share basic financial data with us so that we can give you a better, personalised service or recommendations. Rather than you having to personally gather all your financial information ahead of a financial review, your adviser can see it in your PFP.

How open banking works

Your account provider shares your data with us, with your permission, using a technology called an ‘application programming interface’ (API). APIs are used across many different companies, from Meta to Google Maps. They allow two service providers to talk to one another and pass information between them, providing more seamless experiences for people using their services.

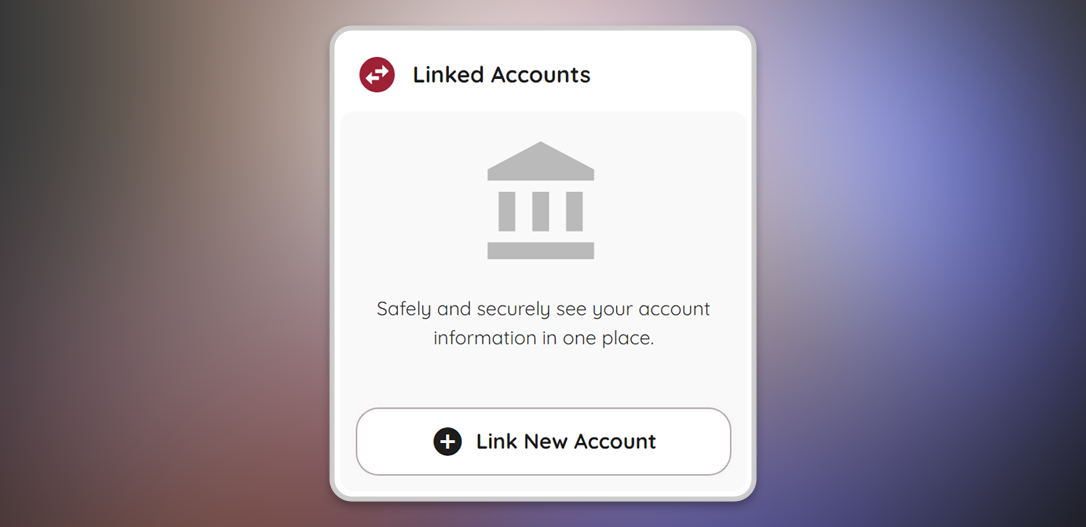

In your PFP, the open banking service is provided in ‘Linked Accounts’. With your authorisation, any open banking linked accounts will update daily, displaying account information in categories to help you understand more about your spending (or saving).

If you find that one of your transactions is incorrectly categorised, you can change it. You can also change multiple transactions at once through the ‘All Transactions’ screen.

Similarly, you may find categories you don’t need to use, (e.g. bills). Rather than leaving these empty, putting £0 here will ensure they present your banking information correctly.

If you have any questions following the setup of a linked account, send a secure message and help will be on hand.

How do I set up linked accounts with open banking?

Once you know you need to choose to opt in to open banking, linking one of your accounts is simple:

- On your dashboard under Linked Account, click “Link New Account”

- Find your provider in the list and follow the steps to link your account, choosing what information you share.

Additional to the above, there are other convenient ways to link accounts in your PFP. For more information, have a look around your PFP, speak to your adviser or see the complete PFP User Guide.

As mentioned, you will need to update your consent for us to access your information every 90 days. If you don’t confirm consent after 90 days, your PFP account will be automatically unlinked from your banking provider. You will need to do this for each provider.

Can I link all my accounts?

Right now, the UK’s nine largest banks and building societies are required to make your data available through open banking, and the number of account providers offering open banking is growing.

If your account is a payment account, you can link it with open banking. This can be an account you access online or through your mobile phone, including personal and business current accounts, credit cards and online e-money accounts.

Open banking is yet to support joint accounts. If you link a joint account, and you have configured your personal finance portal to view your partner’s plan, your joint account will be duplicated (there will be two of them on your plans). This is because joint accounts are treated as personal accounts on the portal.

Checking your provider

Making sure you are comfortable sharing your information with us, or any business offering open banking, is important. You should check provider details before giving them permission to see your account information, and if you’re unsure about anything or something feels wrong, don’t share your data and ask us for advice.

Open banking with Courtiers is facilitated by the authorised provider Intelliflo Ltd. You can check the open banking directory to see all companies enrolled and authorised to provide secure open banking-enabled services. You can also find case studies and insights into the use of open banking there.

Checking your provider

Now we’ve covered the basics of open banking, we hope you understand more about how it works, and how it can be beneficial as part of your PFP and your overall financial planning strategy by allowing you and your adviser to review all your financial information together in one place.

If you have any questions, please contact your adviser directly or use the contact form.

Not yet registered your Personal Finance Portal account? It’s easy to get started on the Login/Register page