“Tomorrow belongs to those who can hear it coming.”

David Bowie

If we want control over our life in later years, we need to face retirement head-on and prepare for it.

Pensions, alongside ISAs, are still the most viable way for most of us to invest in later life and the sooner we start saving, the better. That’s a big ask when we have so many competing financial priorities, but when we give up work and the employment income tap stops running, we need to replace that income stream.

State Pension on the Back Foot

- The UK State Pension is funded on a ‘pay as you go’ basis (i.e. pensions are funded by those currently in work).

- Today there are four people of working age for every pensioner – by 2050 there will be just two1.

- 97% of UK pensioners receive the State Pension.

- The State Pension Age is currently due to rise to 67 by 2028 and the Government recently announced plans to extend that to 68 between 2037 and 2039. This is seven years earlier than the previous target of 2044 – 2046 and would broadly capture anyone born after man first set foot on the Moon.

As the Government’s pension pot comes under increasing pressure to accommodate more retirees in future, self-reliance is looking more important now than it has been for generations.

Saving. How Much is Enough?

Your retirement income is interwoven with your lifestyle and life expectancy.

Ideally we would all save enough to cover the future lifestyle we want, for as long as we need it. In reality, if our retirement income doesn’t stack up, we can only live the lifestyle we can afford.

- In 2015/16 the average (median) net income for single pensioners was £250 a week before housing costs (£466 for couples)2. That’s £13,000 a year for single pensioners (£24,232 for couples).

- In November 2016, 12.9 million people were receiving an average State Pension of £134.53 a week (£7,000 a year)

The average private pension income was £103 per pensioner (£5,356 per year).

How Long Will Savings Need to Last?

- Nearly 20% of current UK residents are expected to live until at least 100 years of age.

- The UK population over age 75 is expected to double over the next 30 years.3

While not all of us may reach 100, government statistics suggest that many of us will live for 25 – 30 years after we retire.

Inflation – Gradually Eroding the Value of Money

People rarely realise how much inflation eats into the value of their savings over time. It is important to remember that the price of most goods and services will increase year by year. To have a yearly pension in the future that has the same buying power as £10,000 today4, you would need:

- £12,615 in 10 years’ time

- £15,913 in 20 years’ time

- £20,074 in 30 years’ time – that’s a pension pot of about £500,000 drawing 4% per year

The Sooner we Start Saving, the Better

The key is to:

- Start saving early

- Save regularly

Saving early: Compound Growth

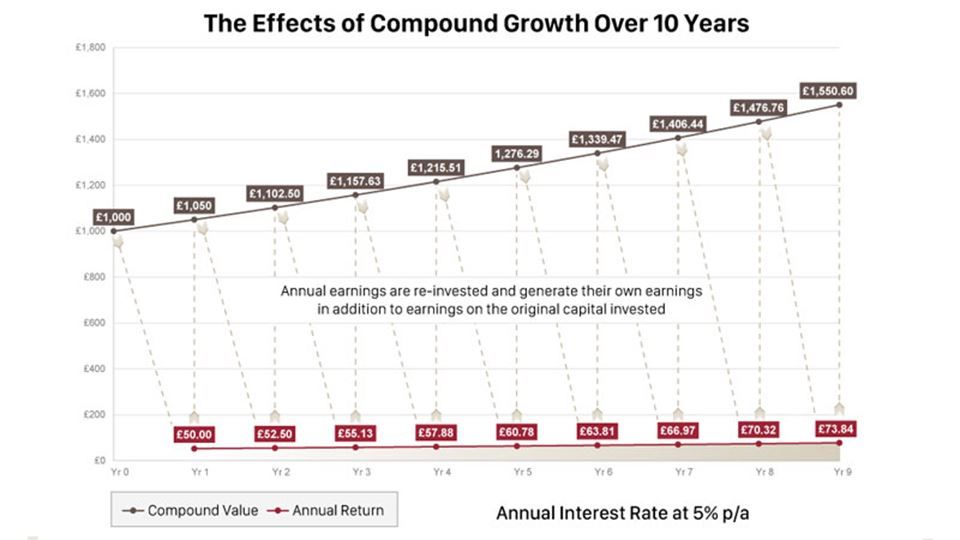

By saving early you will maximise the effect of compound investment growth. Broadly speaking this is interest on top of interest as shown below in an example based on a starting investment of £1,000:

Compound growth is a powerful feature that can help you reach your financial goals sooner than you might without it.

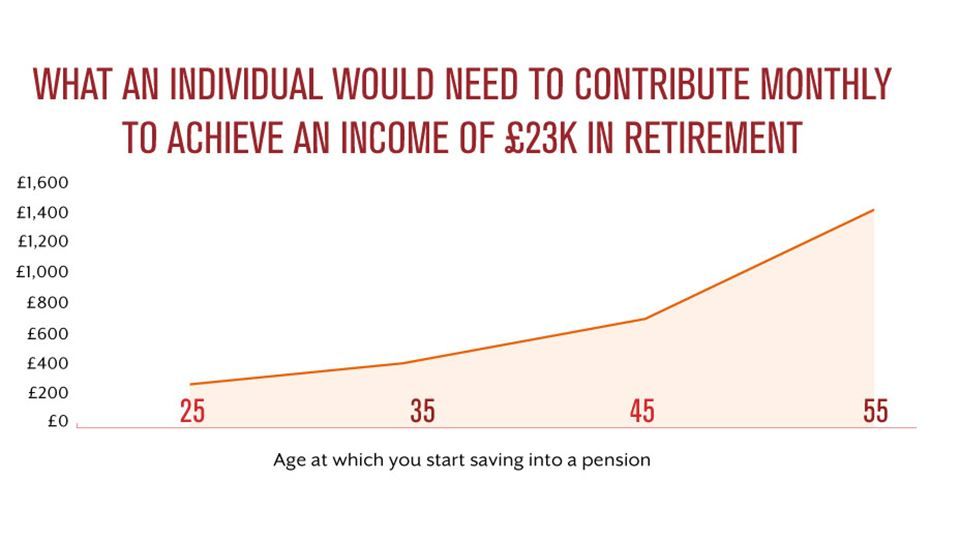

Therefore, the later you start saving, the more you’ll need to contribute each month to achieve the same goal as someone who started saving earlier. We can see this demonstrated in the chart below:

Source: Scottish Widows Retirement Report 2017: Adequate Savings Index. Chart calculated using the MAS Pension Calculator. Please bear in mind this is an example and that real life contributions, inflation rates and investment returns are unlikely to match exactly the assumptions used in this chart.

Save Regularly: Don’t try to beat the Market

Your pension contributions buy additional units in the funds held in your pension portfolio. You get more units for your pension contribution if stock market prices are low and less units if prices are high, although remember that higher unit prices will boost the overall value of your pension pot.

In an ideal world, we would all buy stocks when prices are low and sell when prices are high but predicting the highs and lows is extremely difficult.

Making regular monthly contributions can help reduce the risk associated with making annual or larger ad hoc contributions at an unfavourable time.

Getting Started & Setting Goals

- Successful financial planning is built around well-defined objectives.

- Set yourself a pension target so you’ve got something to focus on. The target might be based on a modest estimate of how much you need in retirement and for how long, or it might be wildly aspirational.

- If there’s no target, it’s difficult to engage with your pension, track how your plan is doing and gauge how far the pension is going to get you in retirement.

- The retirement goalposts are likely to move as we go through life, but we need to start saving somewhere.

- Setting up a plan is the first hurdle – Automatic Enrolment does this for you.

If you’ve opted out of your current employer’s workplace pension scheme, it could pay to think again. You are losing valuable employer contributions if you don’t ask to rejoin. - Remember…The annual charge for Automatic Enrolment default funds is capped at 0.75% of the fund value.

- Automatic Enrolment schemes also benefit from mandatory governance designed to ensure schemes are run in the best interests of members.

Building Wealth in a Tax Efficient Environment

Building your retirement fund through a pension has many benefits including:

- 25% tax-free Pension Commencement Lump Sum

- Upfront tax relief on contributions at the Basic Rate of Tax Relief

- Further tax relief for Higher Rate and Additional Rate tax payers via self-assessment or salary exchange

- Statutory employer contributions into Automatic Enrolment schemes

- Investments grow free of Income Tax and Capital Gains Tax within the pension fund

- Pass on pension funds tax-free if you die before age 75 – or at the beneficiary’s marginal rate of tax after age 75.

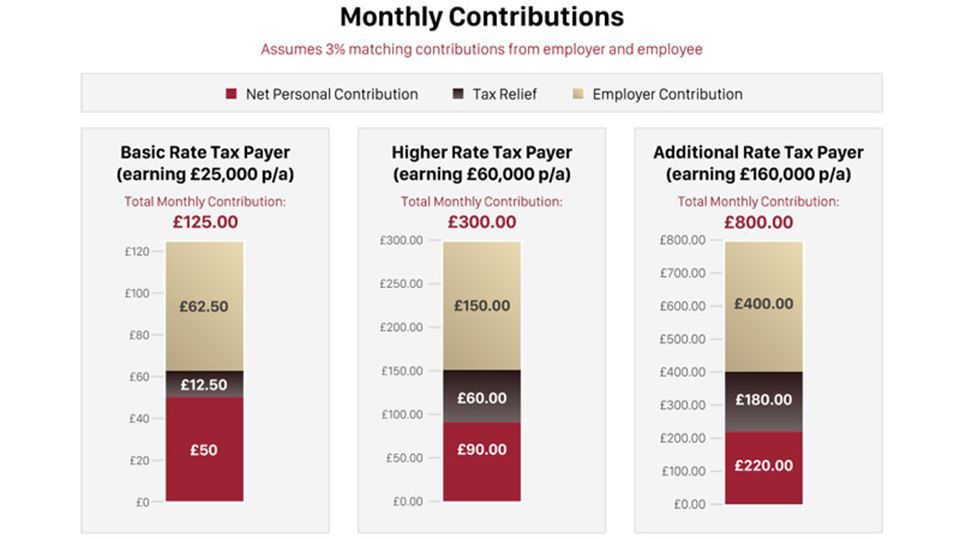

If you opt out of your current workplace pension scheme, you’re giving up the chance to receive a lot of money over time from employer contributions and tax relief as the example below clearly demonstrates. In simple terms, a basic rate tax payer gets £62.50 for every £50 they contribute each month, even before any employer contribution is added.

Think Carefully Before Withdrawing any of Your Pension

- Taking your entire pension pot in one go may have punitive tax consequences.

- 75% of the pension pot is normally treated as taxable income so a withdrawal can push you into a higher tax band.

- The original meaning of the word pension is ‘regular payment in consideration of past service’. Most people will need their pensions to provide a regular income stream throughout their retirement.

- If pension money is moved to an account with returns below the rate of inflation, the future value of that money will be eroded over time.

- It can be tempting to move the pot to another type of investment in the hope of ‘quick’ returns but make sure you properly understand the downside risk as well as the potential for gains.

- Liquidity and cash flow can be affected if pension money is moved into an asset such as property which must be maintained to preserve its value and can take a long time to sell when you need the cash. Tax treatment will also be different.

Helping you Decide

It’s wise to seek financial advice before making major decisions regarding your pension. If you are deterred by the potential cost of advice, free impartial guidance is available from

You may also be able to access free financial advice or guidance through your workplace pension scheme, so it’s worth asking your employer in the first instance.

Sources:

- The Pensions Regulator (June 2017)

- Pensioners’ Incomes series 2015/16, Table 2.1 DWP 2017

- Office of National Statistics 2015 National Projections for the UK, 2014-based

- Based on the Office of National Statistics average 2006 – 2016 CPI rate of 2.35% per year