“You and I are gonna live forever”

Noel Gallagher, Oasis

Whilst we know that, for the foreseeable future at least, nobody is going to live forever, the increasing rate at which the population is living longer is a serious concern for employers with Defined Benefit (DB) pension schemes. As scheme deficits continue to rise, if any member of a DB scheme outlives their life expectancy by just one year, it could feel like forever to those responsible for meeting ongoing pension commitments. How can employers tackle this?

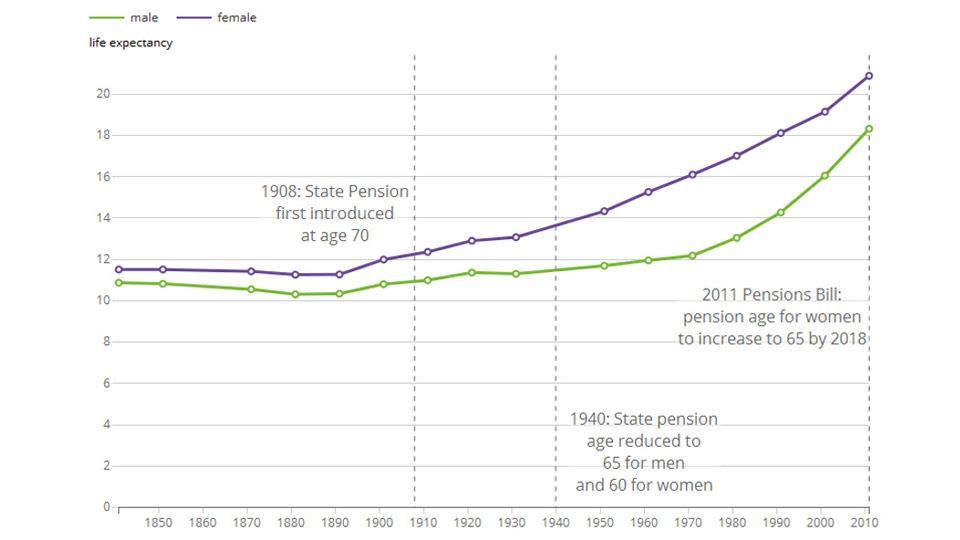

DB pension schemes face the risk that the investment performance of their fund will not be enough to meet their promise to pay employees a monthly pension based on their earnings history, length of service and age. This is then compounded by longevity. Today’s pensioners are living longer than their historic counterparts and this continues to be an upward trend, meaning payments may need to be made for longer than originally anticipated.

Life expectancy at older ages continues to increase meaning our pensions need to last longer.

Life expectancy at age 65, England and Wales, 1841 – 2011

Source: ONS (click for interactive version)

This goes some way to explaining how 4,095 of 5,020 DB schemes were in deficit at the end of July 2016 (Source: The Pension Protection Fund, 2016). There is good news in all this though. The risks to companies operating DB pension schemes can be managed and a strategy to do this must form an integral part of a business’ risk management policy.

Remove, Reduce or Retain?

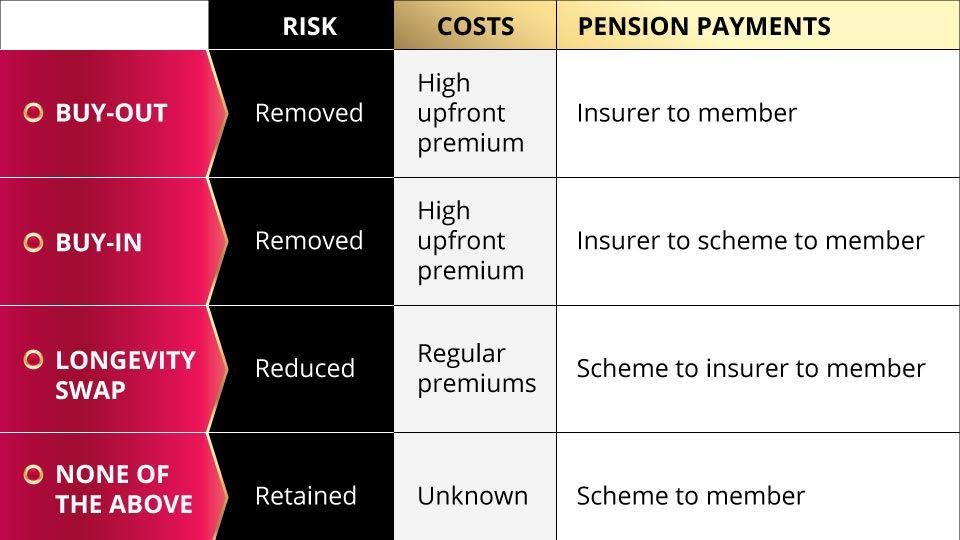

While some risk, such as investment risk, rewards the risk-taker with the potential of good returns, no such reward exists for DB scheme longevity. Longevity is an unrewarded risk that a business can choose to remove, reduce or retain in the following ways…

Buy-outs and Buy-ins

These are bulk annuity options. The insurer receives an upfront premium to take on the liabilities of the scheme and pays the retirement income of the scheme’s members.

Buy-Out

The insurer pays the agreed benefits to members directly. The scheme liabilities pass from the trustees to the insurer in respect of the assets covered under the buy-out policy.

Buy-In

The insurance policy effectively becomes a scheme asset. The insurer pays the agreed policy benefits to the scheme trustees who then pay the members.

Buy-outs normally pave the way for a scheme wind-up whilst buy-ins lend themselves better to situations where the trustees only want to transfer risk on a portion of the scheme assets.

A buy-out or buy-in is good because it transfers longevity risk plus investment and inflation risk to the insurer. It does however usually mean paying a very high initial premium to an insurer, for assuming all responsibility. Due to high upfront costs these options could be cost prohibitive for smaller businesses.

Longevity Swaps

A longevity swap covers specified pension liabilities for a pre-agreed term. The trustees normally pay the insurer a fixed premium for the entire swap term.

In exchange the insurer meets the pension liabilities until the end of the swap term or until the death of the member(s) if that occurs sooner.

A longevity swap can be a compromise that allows the risk to be managed at a comfortable, financially predictable level for a business, but it is not eliminated. If members die earlier than anticipated, then the swap will not have been advantageous to the business in terms of the profit and loss account, but this is the price for reducing the possible long term cost.

None of the Above

High upfront costs and/or the potential that an employer could pay more in premiums than the actual cost of covering members’ pensions themselves, may leave them hoping that there are more options to consider…and there are. They could choose to retain the longevity risk but take financial planning and investment strategy advice to soften any longevity blows. If a scheme is skewed by one or two long serving high earners and it is purely these members that the employer feels they cannot assume risk for, there is potential for just these named lives to be covered by a longevity swap while the business retains risk for the rest of the scheme.

With ever increasing life expectancy, the issue of longevity risk is not going to subside any time soon. Combined with low interest rates, the threat of under-funding is real and there is no one-size-fits-all solution.

As part of a broader range of pension scheme, auto-enrolment and employee benefit services, Courtiers can help businesses to identify and plot the best course of action depending on the size and nature of their DB schemes and future strategies and objectives.