The UK’s inflation rate reached 5.1% in November, driven by surging prices of a range of everyday goods and services, including fuel, electricity and gas, and second-hand cars. The Bank of England predicts inflation to reach “about 6% by Spring 2022”, while Jari Stehn, Chief European Economist at Goldman Sachs, says he sees it surging to “almost 7%” in April fuelled by a big rise in the energy cap as energy companies are allowed to pass on more of rising wholesale costs to their customers.

After a decade in which it was seen by many as yesterday’s problem, inflation, as measured by the Consumer Prices Index, has returned to the top of the country’s economic agenda, leading to warnings of a cost of living crunch. But what might this mean for investors and for people’s personal finances?

Rising inflation means that unless offset by higher income, people are worse off in real terms. A 4% rise in income sounds impressive but if inflation is 6% the person is actually 2% worse off.

The case for equities

For savers and investors, the effects of higher inflation need a corresponding rise in returns from those savings, or assets just to stay still.

While putting your money into a bank account or building society account is attractive in terms of being able to access it easily, savings rates offered by banks and building societies show no signs of getting anywhere near current or expected levels of inflation. In short, savers are even worse off in real terms than they have been in recent years.

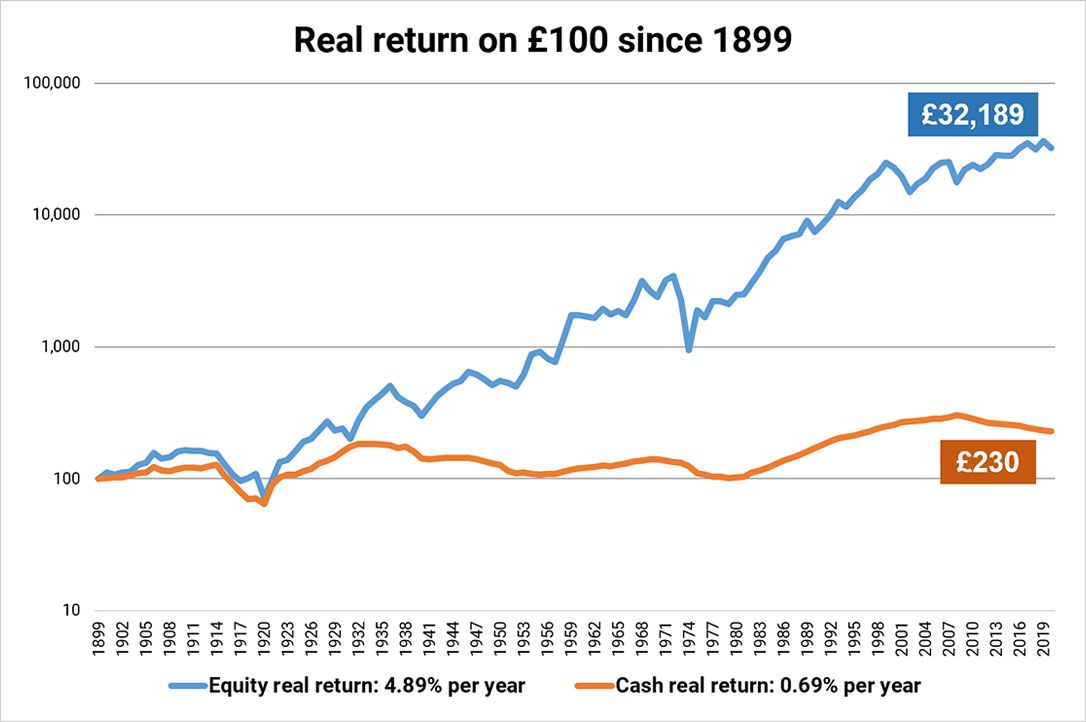

In contrast, as the graph below illustrates, over the longer term returns from investing in global equities have proved to be significantly higher than putting money into a savings or bank account in protecting wealth from the ravages of inflation.

Source: Courtiers/Barclays. Graph illustrating real returns of Cash Vs Global equities since 1899 taking into inflation into account. Please note that past performance is no guarantee of future returns.

Source: Courtiers/Barclays. Graph illustrating real returns of Cash Vs Global equities since 1899 taking into inflation into account. Please note that past performance is no guarantee of future returns.

It should be noted, of course, that not all investments in equities are equally risky. Courtiers offers a range of funds to meet the needs of people with different attitudes to risk. These range from those who are cautious (Total Return Cautious Risk Fund) to those who are prepared to take a higher level of risk in return for potentially higher rewards (Total Return Growth, UK Equity Income and Global ex-UK Funds.)

Bonds

In a high inflation environment, investing in government bonds is likely to prove particularly risky. This is not only because any government action to try to curb inflation by raising interest rates is likely to reduce bonds prices, (there is an inverse relationship between the interest rates and bond prices) but also because inflation reduces the real value of government bonds on maturity. The longer the duration of a bond – some take 30 or even 55 years before they mature – the greater the erosion of its value in real terms. Furthermore, the low yield on government bonds means that returns are significantly below the rate of inflation.

Courtiers’ investment strategy recognises the interest rate risk by investing in short duration bonds in its Multi-Asset funds and in its Investment Grade Bond Fund – as these are less sensitive to interest rate rises.

Rising incomes and fiscal drag

Raising your income above inflation is an obvious way for people to maintain or increase their standard of living. However, while in theory an 8% rise in a person’s income when inflation is running at 6% means they are better off, this depends on their tax position. If a rise in income takes a person into a higher tax bracket, then they could end up worse off in real terms. This problem’s been made worse by the government’s decisions to freeze tax allowances and income tax thresholds, most until April 2026. Known as fiscal drag, this has the effect of pushing people into higher rate tax brackets as their income rises. Rising pension contributions that often go with higher salaries also risk taking people above the £1,073,100 Lifetime Allowance for pension contributions, which has also been frozen.

Withdrawal symptoms

To compensate what is effectively a cut in their standard of living, some people may wish to withdraw more of their savings or assets. However, this must be balanced against the need not to run down those savings or assets too much. Withdrawing capital from your pension or stocks and shares ISA when stock markets are falling can be especially detrimental. This is one reason why Financial Advisers recommend that people keep a significant cash buffer.

Drawing on their expertise in cashflow modelling, Courtiers Advisers are able to guide clients on how much they can safely draw on, while continuing to meet financial goals and objectives.

Conclusion

After a decade during which it received little or no attention, inflation has returned to the UK with a vengeance. However, by taking the appropriate actions and supported by appropriate advice, this need not prove an impediment to people meeting their financial goals.