If you have a defined benefit pension scheme from a current or ex-employer, the security of your pension could be at risk if the employer faced financial difficulty.

If this ever happened, the Pension Protection Fund (PPF) would step in to see if it can rescue your pension savings.

Why would employer insolvency affect your defined benefit pension?

A defined benefit scheme involves your employer building a pot of money big enough to pay you and all other members of the scheme a sum in retirement, based on individual earnings. It’s the employer’s responsibility to ensure the pot is big enough to provide all the retirement income and lump sum commitments made to members of the scheme. If the pot proves to be insufficient and the sponsoring employer becomes insolvent, the PPF steps in.

After an assessment period (the PPF aim to complete this within 2 years), the PPF will transfer the scheme to its ownership if the scheme is deemed unable to secure benefits at least equal to the pensions that the PPF can pay

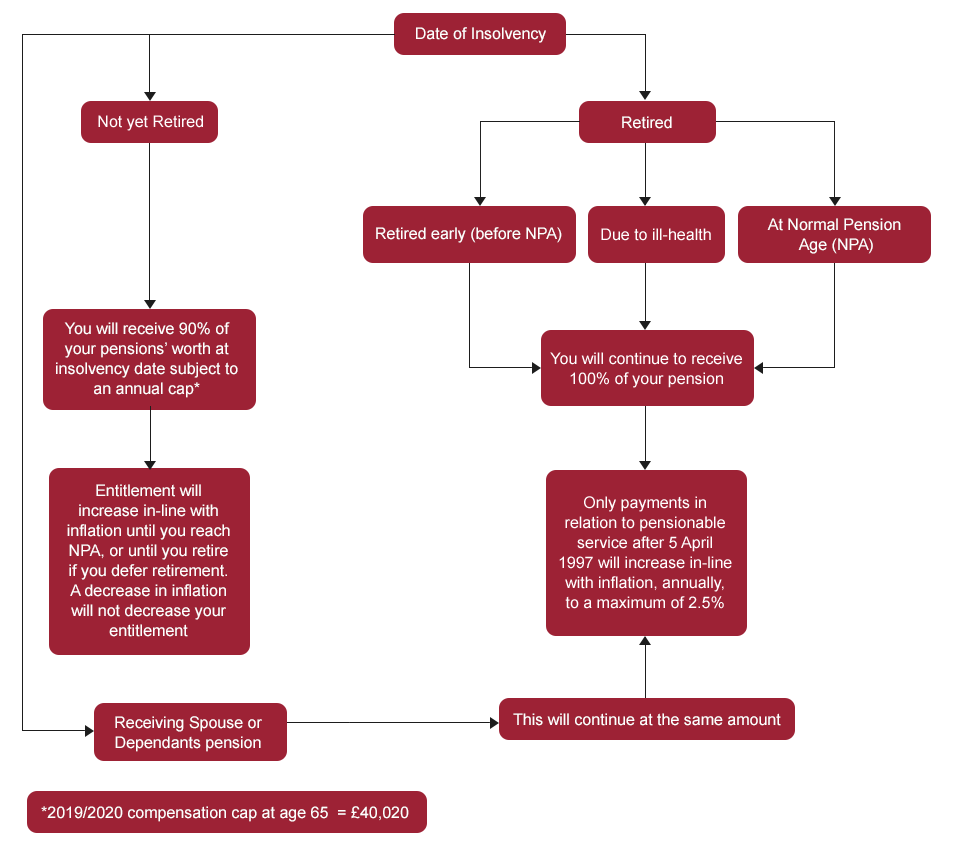

What level of pension might you receive if it was rescued by the PPF?

The below chart shows the level of your pension you’d be entitled to based on specific circumstances:

Keep the family safe

In the event of your death, the PPF would continue to support your family with your pension. Payments can be made by the PPF, to any children under the age of 18 or 23 if in qualifying education or have a qualifying disability. The level of benefits received depends on whether any payments are also being made to a spouse and how many children are eligible for compensation.

As with any pension scheme, be sure to complete a death benefit nomination form. This will ensure that a partner who you are not married to / in a civil partnership with, but live with as if you were, will receive any survivor pension that would have been paid under the original scheme.

If your current or ex-employer suffers financial woes, the PPF throws out a lifeline to save you suffering too. Though some members may lose 10% of their pension income or be subject to a cap, you’re still guaranteed an income for life and security for your loved ones. That should save you a few sleepless nights.

To find out more about the PPF, visit their website at https://www.ppf.co.uk/