Pensions allow us to save for our future selves. With good planning we can retire with a comfortable income, free from the pressures of work and with an abundance of time to complete that bucket list.

Putting money into your pension is good. A positive action, no doubt.

Debt allows our present selves to obtain items that we may be unable to purchase outright. A debt could be large and planned for in the form of a mortgage to purchase your first property, or the result of sudden financial hardship in the form of a loan to meet immediate living expenses, or a million other reasons. However debt arises, interest means you will pay back more than you borrowed.

Paying off debt is good. A positive action, no doubt.

But which one should take priority?

If you were to find yourself with an additional £100 per month of spare income, where would you direct this money?

Mortgage

£250,000 repayment mortgage

Increasing your mortgage payments by £100 per month means the mortgage is paid 2 years and 8 months faster, saving £5,652 in interest:

£250,000 interest only mortgage

Your spare £100 per month could be used to save for the outstanding balance payment due on your interest-only mortgage in 25 years’ time, by paying it into a savings or investment account:

By investing the money into a Stocks & Shares ISA with an average risk fund choice delivering 4.5% growth rate per year, you would have a pot worth £49,100 in 25 years that could pay off some of the outstanding mortgage balance. Unless you have other means of covering the remaining outstanding balance at this point the property would need to be sold to pay off the outstanding debt.

With the Stocks & Shares ISA gaining £19,100 from investment growth alone, we now have to question the efficiency of paying down the repayment mortgage:

Increasing mortgage repayments by £100 per month for 25 years = £5,652 interest saved

Investing in ISA with 4.5% growth rate per year over 25 years = £19,100 growth

Result? Saving £100 per month into the Stocks & Shares ISA would leave you £13,448 better off, assuming your mortgage interest rate stayed the same and you got the steady 4.5% annual growth in your ISA. Of course, neither of these things are guaranteed. However, this example serves to demonstrate that paying down debt, whilst generally appealing, is not always the right approach when the interest rate on your debt is lower than the growth you can achieve elsewhere.

Pension

If you were to increase your monthly pension contributions by £100 per month over 25 years, it would have the following impact:

So far, this option gives you the greatest gain on your spare income of £100 per month, with growth of £23,800. This is due to the assumed investment growth and the additional tax relief you receive on your pension contributions from the government. This option does mean that the money will not be accessible until age 55 under current rules and once withdrawn, three quarters of it is likely to be liable to income tax.

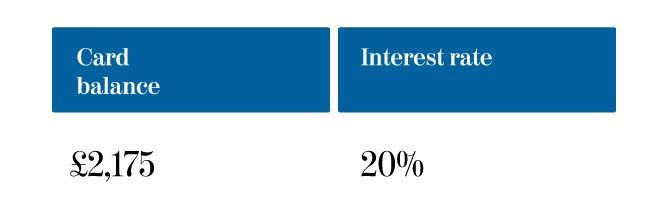

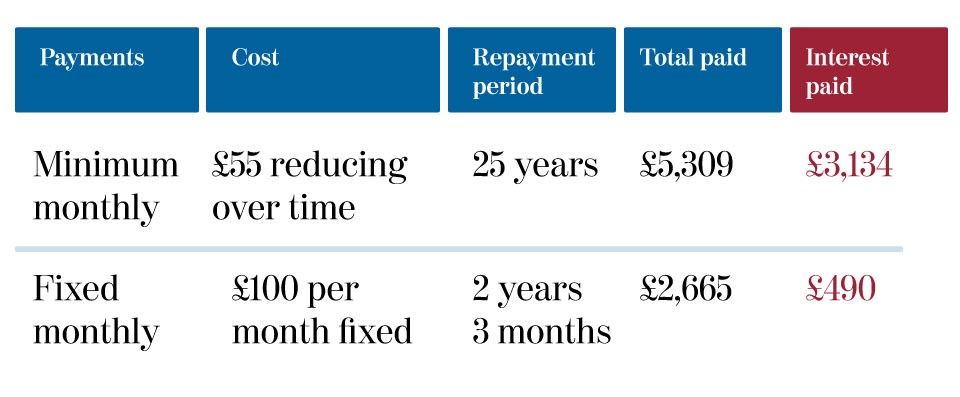

Credit Card

Let’s look at the effect £100 per month can have on paying off the above credit card debt versus making the monthly minimum payments:

By diverting this spare income to paying down your credit card balance with an interest rate of 20%, the debt is paid off 22 years and 9 months earlier and you pay 22% more than the amount of money loaned versus 144%!

With the pension gaining 4.5% per year and this credit card costing 20% per year you are highly likely to be better off paying off your credit card with the additional £100 per month.

This doesn’t just go for credit cards. Any debt where the interest rate is higher than the growth rate you are likely to receive on the alternative investment needs investigation. It’s important to consider all factors that come into play within this decision, so be sure to gain all relevant information and get financial guidance or advice where appropriate.

It is understandable to be unsure where best to place your hard-earned money. The government has been actively promoting the importance of pension savings in recent years but on the flip side, it has been drummed into us to prioritise paying off debt over and above everything else. There is no one-size fits all when it comes to financial planning and you have to take into account your particular set of financial and personal circumstances, in order to arrive at the best course of action for you…and your future self.