Courtiers clients contact their Advisers on all matter of things. This includes when they have concerns about the legitimacy of organisations that contact them, says Paul Kemsley, Senior Private Client Adviser.

Paul explains, “We’ve had a number of instances in which clients have told us they’ve been contacted by people purporting to be from certain organisations, when it turned out that they weren’t who they said they were.”

Paul adds that Courtiers also receives emails that appear to be from legitimate organisations, but which, as a result of Courtiers’ robust internal controls get picked up and identified as scams.

Last month, HMRC, one of the organisations used by fraudsters as cover to steal personal information and ultimately money from the public, issued a warning to the 2.1 million people receiving tax credits. It informed them that they could be susceptible to criminals, who imitate government messages to make them look authentic. This was just the latest of the many scams that HMRC identifies on a regular basis.

Between May 2021 and April 2022, HMRC says it responded to nearly 277,000 referrals of suspicious contacts made to members of the public. Of these more than 115,000 offered bogus tax rebates. April 2022 also saw more than 5,000 phone scams, compared to just 425 in April 2020. HMRC says it reported 6,250 malicious websites requesting they be taken down.

In another scam, people are contacted through an automated phone call, which informs them that HMRC is filing a lawsuit against them and to press 1 to speak to a caseworker to make payment.

Action Fraud warned of hundreds of cases, where people were told they owe HMRC taxes and they must make payment via iTunes Vouchers. These were attractive to fraudsters because they were easily redeemed and sold on.

Fraudsters have also been taking advantage of the pandemic. The Metropolitan Police warned of a false message designed to steal people’s bank account details that said; ‘As part of the NHS promise to battle the COV-19 virus, HMRC has issued a payment of £258 as a goodwill payment’.

Fraudsters contact people in a variety of ways, particularly through telephone calls, texting or emailing, as well as via social media.

The intention is often to get people to reveal details of their bank account, credit cards or to obtain other personal information

Typical HMRC scams

| Phone calls threatening arrest if people don’t pay fictitious tax owed immediately.

Some calls come from a ‘spoofed number’ that is made to look like a genuine HMRC number. Emails or texts offering spurious tax rebates or bogus Covid-19 grants. Criminals claiming that a direct debit has failed. Using false websites or adverts to persuade people to pay for government services that should be free, including charging for calls to HMRC helplines. |

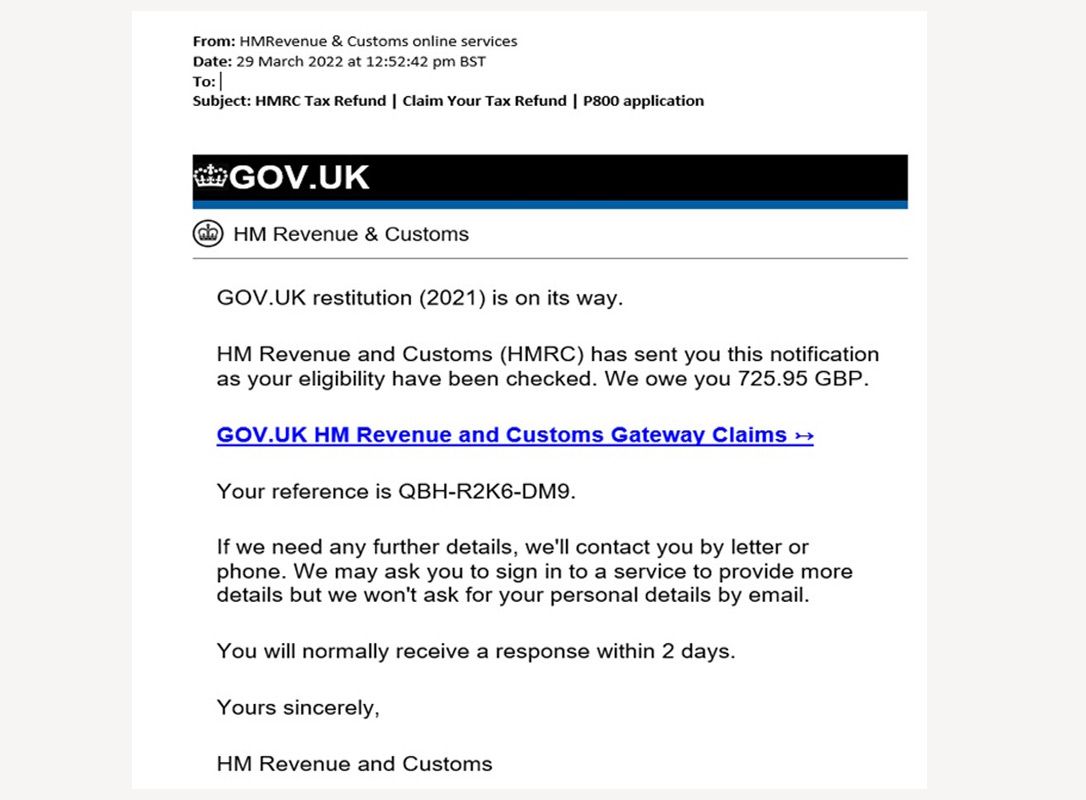

Example of a phishing email

Source: HMRC

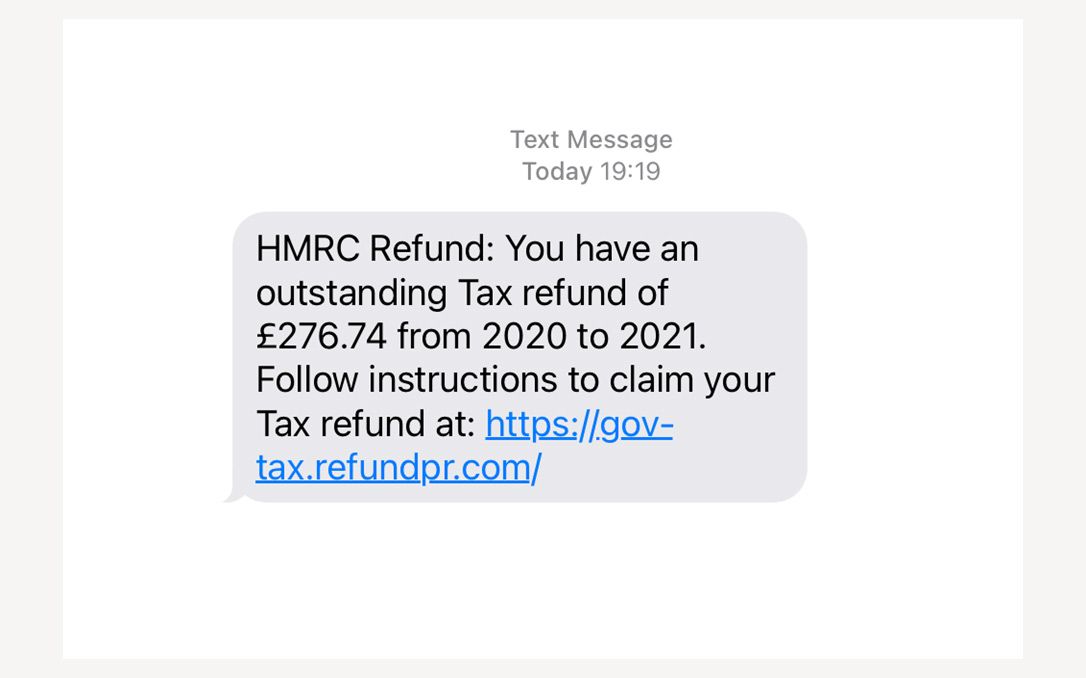

Example of a bogus tax refund

Source: HMRC

It pays to be vigilant

Although fraudsters can be convincing, they often exhibit tell-tale signs that reveal that they are not who they seem. HMRC suggests when contacted, people should run through a checklist that will help them identify potential scammers and keep their personal information and finances safe.

So, what sort of things should set the alarm bells ringing?

- You feel rushed or pressurised into making a quick decision.

- The person or the communication is threatening or unexpected.

- You are told to transfer money.

- You are offered a tax rebate or grant.

- You are asked for your bank account or credit card details.

- The email, message or website is badly written and contains spelling mistakes and grammatical errors.

What should you do if you are suspicious?

- If you have any suspicions that someone or some communication may not be from HMRC disregard it immediately.

- Report any suspicious emails, telephone calls or letters to HMRC.

- Contact your Adviser.

- Do not open attachments or click any links in an email or text message, as this may direct you to a fictitious website.

- Take particular care to protect your HMRC login details. These should never be shared with anyone else. Should someone else use your login details, you might have to pay back any fraudulent tax refund claim made on their behalf.

- Remember that you will never get an email, text message or message from messaging apps such as WhatsApp, or a telephone call from HMRC, which tells you about a tax rebate or financial penalty, or asks about your personal or payment information.

HMRC will also never ask you to click on a link or submit your bank details online. If you are genuinely owed a tax rebate, you will be asked to log on to your online tax account.

To ensure you receive only genuine information, use the free HMRC app or the official HMRC website. Official government websites should always have ‘.gov.uk’ at the end of their address.

Search on GOV.UK to find official HMRC phone numbers.

Contact Action Fraud, either online or by calling 0300 123 2040.