It was a very volatile week last week, Monday 5th August, 2024.

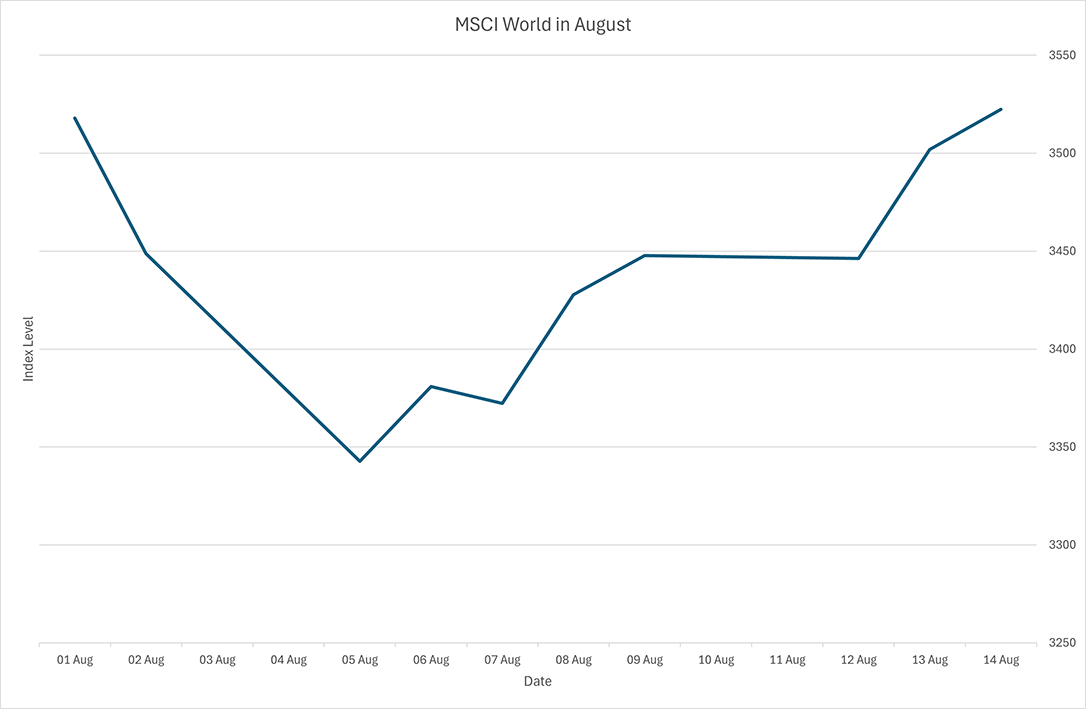

It was 599 days since the MSCI World, an index of equities across the developed world, dropped over 2% in a day. This level was breached sixteen times in 2022 alone. This remarkably steady period for equity investors broke on Monday 5th August, when the MSCI World dropped 3.04%.

Japan was the hardest hit, down 6% on Friday 2nd August and 12% on Monday 5th August; the largest one-day fall in 37 years.

The large falls across the globe on Monday were followed by large rises the rest of the week. The US stock market saw the biggest one-day rise since November 2022 on Thursday 8th August, while Japan saw the biggest one-day rise since 2008. Global stock markets are now close to recovering all their losses since the first drop.

Source: Courtiers and MSCI, 2024

The US stock market move on Monday was the largest fall since September 2022. This is due to worries that the Federal Reserve (FED) may have left interest rates too high for too long and sent the economy into recession.

These fears were based on one measure called the “Sahm Rule”. However, very little data corroborates this recession theory. Even the inventor of the rule, Claudia Sahm, remains very outspoken that this indication of recession is wrong. Her rule was not intended to be a recession predictor but as an indicator of when the Fed should loosen monetary policy to support a slowing economy. The “Sahm Rule” triggers when the rolling 3-month percentage unemployment figure rises 0.5% above its previous low.

Whether this is an indicator of when to loosen policy or the FED using the press to warm the market for them cutting rates, the prediction is that they will cut rates by 0.5%.

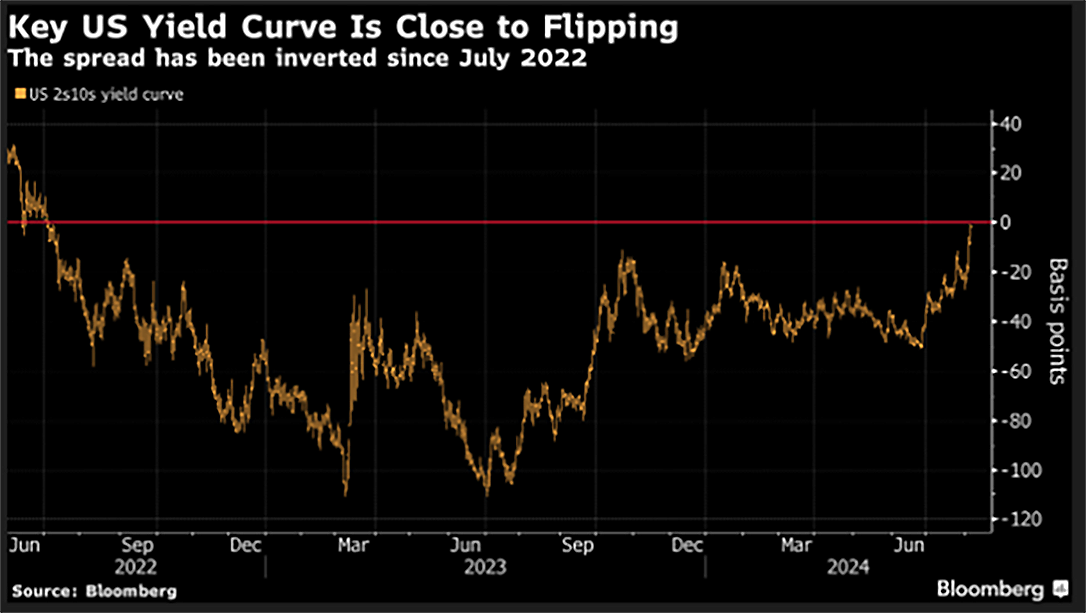

Another favourite recession indicator, the inverted yield curve, is very close to being normal suggesting that investors are less concerned about the next couple of years than the “Sahm Rule” indicates.

Source: Bloomberg, 2024

The yield curve first inverted in 2022, leading economists to predict a 100% chance of a recession in 2023. A point James Timpson made last December by quoting the words of Ezra Solomon, “The only function of economic forecasting is to make astrology look respectable”.

Equities are not a one-way bet and volatility is the price we pay for better returns than cash. The best course of action is to ride it out and focus on returns for the long run. As the adage goes, bull markets climb a wall of worry, showing resilience in the face of economic news and pushing securities higher.