Since Rachel Reeves announced in the Autumn Budget 2024 that Inheritance Tax (IHT), Agricultural Property Relief (APR) and Business Property Relief (BPR) will change from April 2026, many small and family businesses, including family farms, may be forced to close or sell off major parts of their land or business to cover costs. But there are ways you and your Courtiers Financial Adviser could mitigate the impact of these changes.

What Rachel did:

Rachel Reeves announced that from April 2026, Inheritance tax (IHT) reliefs available to farms and family businesses will be reduced. The first £1 million of agricultural and business property will continue to have 100% relief. After that, relief drops to 50%. This is effectively a 20% charge on businesses and agricultural property values in excess of £1 million.

The Chancellor explained that these changes are expected to only hit 2,000 estates between 2026 to 2027, including 500 farm estates, and that this change would generate £500 million annually by 2027.

However, the Country Land and Business Association (CLA) have calculated that, overall, 70,000 farms are likely to be affected. This is based on figures from the Department for Environment, Food & Rural Affairs (Defra) showing that there are 30,000 farms in the UK with over 50 hectares of land and 40,000 with over 100 hectares.

The difference comes from the fact that the CLA is looking at the impact on farms over a generation, while the government is looking at a single year. The CLA claims that, if the average value of land is £9,250 per acre as per Knight Frank’s Farmland Index of March 2024, every farm over 50 hectares has land worth more than £1 million, which is where APR and BPR are nominally capped. Even with nil-rate bands and residence nil-rate bands taking this allowance up to £1.5 million (for some couples this could be £3 million) farms over 50 hectares are likely to be worth over £2 million when including the farmhouse, equipment, machinery and other assets. Consequently, farms with 100 hectares will be worth over £2 million.

“It is important to note that the disparity comes about as we are looking at the impact on farms over a generation, whereas the government’s figure is only looking at a single year. We are not claiming that 70,000 farms will shut down or must pay the tax a year.” – Country Land and Business Association.

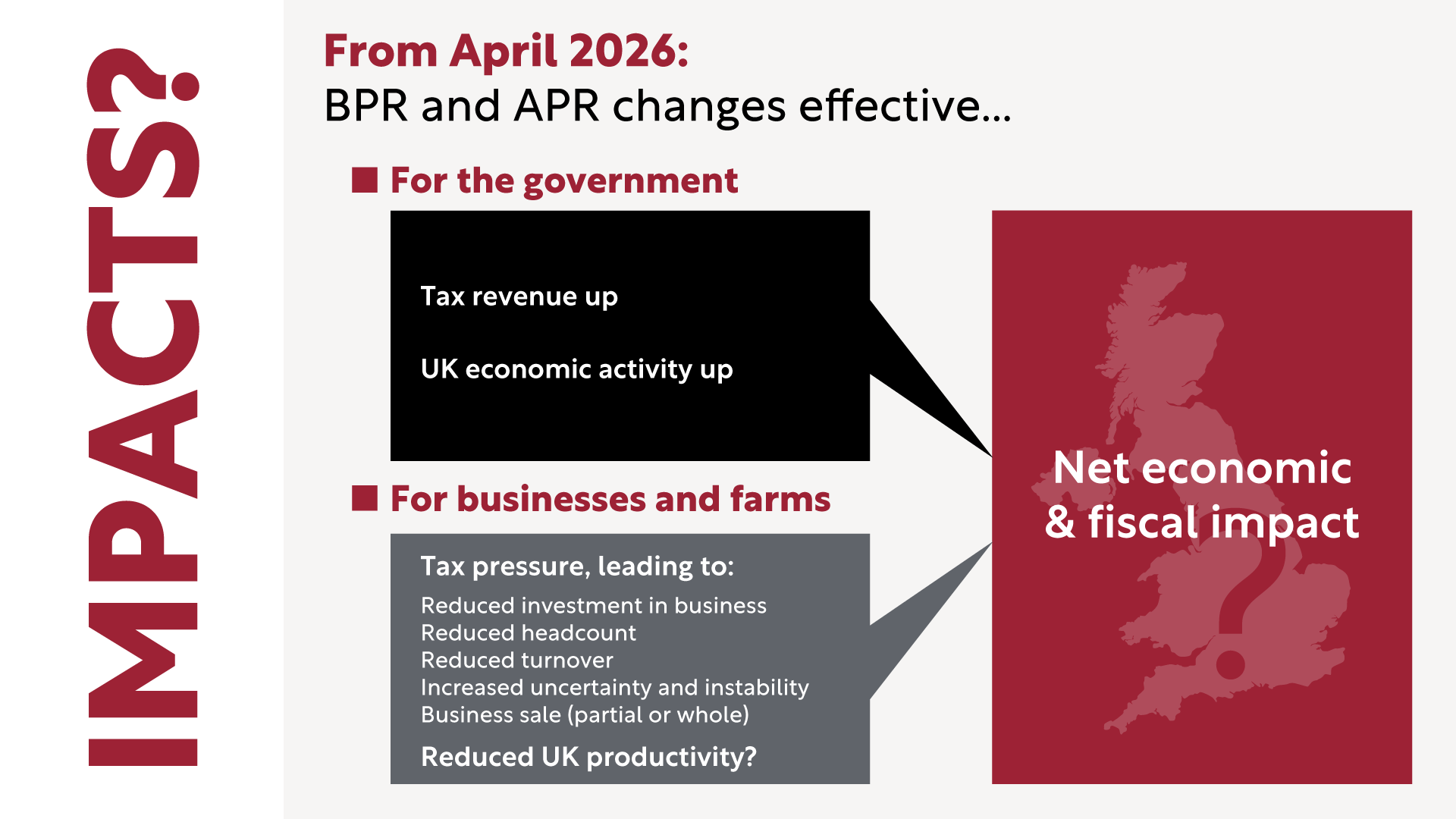

Effects on the Economy:

For those who can’t see it as viable to pass their farms down, they may be forced to sell their land to cover the inheritance bill. With over four in ten farmers stating they will have to sell at least half their farm business and 39% needing to sell off farmland, this could fuel another worrying farming trend: tycoons and ‘lifestyle’ farmers.

These potential buyers threaten UK farming, as tycoons and lifestyle farmers may not contribute to traditional UK farming output. In the last 12 months, private and institutional investors, along with lifestyle farmers, account for more than half (53%) of agricultural land purchases in England, with only 47% of acquisitions coming from traditional farmers.

The problem when looking at farms in relation to IHT is that IHT measures assets on their market value, which can be significantly greater than the value of the farm and land as an agricultural unit. This is especially true when the land’s ‘hope value’ (additional worth attributed to the land based on its future use) is linked to development opportunities. This can significantly increase the value of the land to a level that outperforms any future profits generated from farming.

The Exchequer expects that this tax change will raise £1.8 billion in tax revenue by 2030, but Family Business UK (FBUK) and CBI Economics estimate it will lead to a net fiscal loss of £1.9 billion. Similarly, The Office for Budget Responsibility (OBR) predicts that the government’s changes could speed up active tax planning across families, which could result in £200 – 300 million in lost tax revenue each year.

To mitigate the impact of BPR and APR, many businesses are accelerating decisions like gifting assets, pausing investments or restructuring before April 2026. FBUK states this reduced activity will lead to a loss in gross value added (GVA) of £14.8 billion over the next five years. £6.5 billion of this is associated with family business activity, and the remainder feeds into the economy and supply chain.

Jamie Shepperd, Chief Executive Officer at Courtiers and owner of Moorlands Farm, has this to say:

“To secure long-term growth in the UK, we must foster an environment that encourages entrepreneurship and supports business expansion. This is how we generate wealth, create jobs, and ultimately increase tax revenues. However, raising taxes on individuals and businesses can have the opposite effect – dampening ambition, slowing economic activity, and reducing overall tax receipts. Unfortunately, this is the pattern we’re currently witnessing in the UK: stagnating growth, rising unemployment, and declining fiscal returns.

Anne-Marie and I are fortunate to live at Moorlands Farm, where we pursue our passion for breeding national hunt racehorses, hopefully to see them run in our colours. Through this, we maintain close ties with the local farming community. There is growing concern among farmers about the proposed changes to Agricultural Property Relief, the reduction in subsidies, and the rising costs of production. For many, farming is more than a livelihood – it’s a way of life, often passed down through generations. These changes threaten not only the viability of family farms but also the broader rural economy.

The consequences could be far-reaching: higher food prices, reduced domestic food security, and increased reliance on imports, which carry a greater environmental footprint.

The key message is raising taxes does not automatically lead to higher tax revenues. Sustainable growth comes from empowering people to invest, innovate, and build.”

What can you do?

One of the key things to do now is think about your legacy and how to pass on your estate in a way that will benefit your family.

If you own the business in its entirely and it’s above the BPR and APR rates, you could have an IHT liability. However, if you jointly own the business with others in your family, passing it on could be less problematic.

Passing shares straight to your descendants, rather than your spouse, can also reduce or eliminate any IHT claim when your partner also passes away. It may also make sense to transfer some of the business ownership to your children while you are alive, as if you survive for another seven years, the gift will be IHT-free under potentially exempt transfer rules.

You should check your legal position and talk to your Financial Adviser before enacting any of these arrangements, as every situation is different, and this may not be the correct option for your circumstances.

If these arrangements are not suitable, another possibility is a life insurance policy covering tax bill fund payments on your death. It’s also possible to take dividends from the business or take funds from asset sales, although this will potentially incur further tax charges.

The good news is that family business IHT costs don’t have to be settled immediately. Tax authorities recognise that these assets are illiquid, so allow families to pay IHT in instalments. This can avert having to sell assets quickly and causing a crisis.

Thinking of your own legacy planning?

If you are affected by the IHT, BPR and APR changes coming into force from April 2026 and are keen to ensure your family are looked after in the future, your Courtiers Financial Adviser can help you plan your legacy.