On one hand, it’s brilliant that so many young people are getting into investing, but on the other, when they don’t know how to invest in a tax-efficient way, they might be missing out on savings.

According to the Oliver Wyman Forum survey, almost half of the Gen Z clients surveyed (i.e.: those born between 1996 and 2012) invest in the stock market. They are also 45% more likely to start investing by age 21 than Millennials, and two to four times more likely than Gen X and Baby Boomers, with a Blackrock survey suggesting the cohort saves a hefty 14% of their incomes.

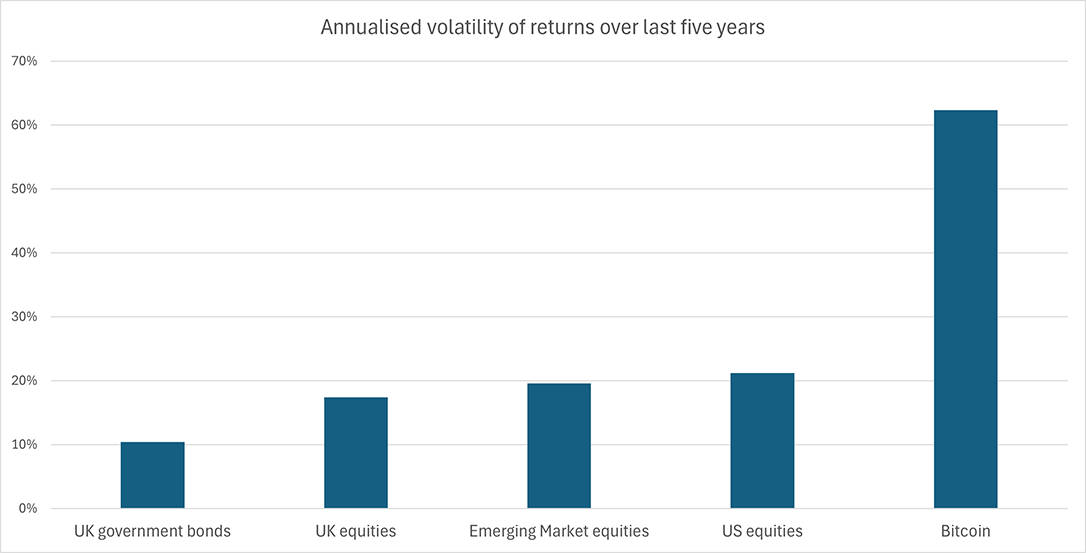

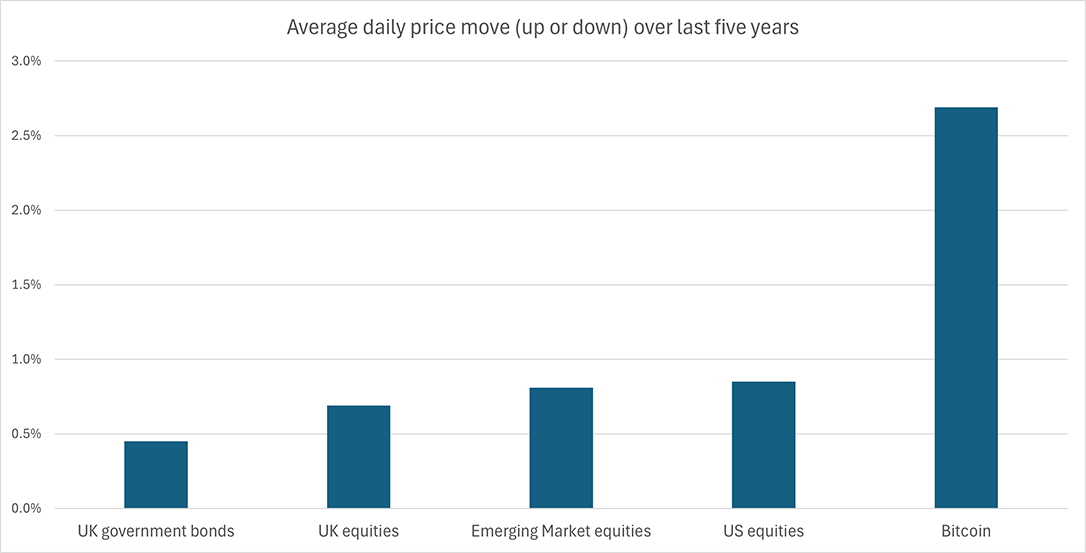

With a sizeable risk appetite – and the time required to run such risks – many Gen Z investors look to cryptocurrency, but most of them are investing towards their retirement income already (69% worry about outliving their retirement savings) or in individual stocks (37%, although this rises to 55% for Millennials – those born between 1981 to 1996).

A lot of crypto falls outside of authorisation and regulation by the FCA – with the FCA themselves saying those invested should be prepared to “Lose all their money”. Additionally, Gen Z (and Millennial) investors could potentially be setting themselves up for a hefty capital gains tax (CGT) tax bill on such assets when they withdraw them. Especially with the recent budget increasing CGT to 18% (low rate) and 24% (high rate).

More than 16,000 people under 35 paid CGT last year, accounting for £338 million between 2022-23. This could be because young people seem to veer towards popular online trading accounts, like Trading 212 or Chip, which download as apps on your phone. Market research company Kantar’s TGI Data on challenger banks also found that those who use them are 23% more likely to have a desire to invest.

There are several vehicles that allow individuals to invest money tax free up to certain maximum limits each year. ISAs allow individuals to invest money, tax-free, up to a certain maximum limit each year. This offers a way to save or invest and pay no personal tax on the income and/or profits received. There are four types of ISA: Stocks and shares, Cash, Innovative Finance (IF-ISA) and Lifetime Isa (LISA), all with their own stipulations.

And, while a Gen Z client wouldn’t see the benefits for a long time, a SIPP (Self-Invested Personal Pension) can offer a range of benefits that could suit Gen Z needs. Individuals should consult a financial adviser to discuss the best course of action for their personal circumstances.

Making the most of your money and ensuring you get the best out of your financial decisions, whatever your age, is as important to us as it is to you. For any further information on pensions, ISAs or SIPPs, you can contact our Financial Advisers, who would be happy to sit down and discuss your options.