It’s funny; most of the time we get frustrated when our leaders fail to deliver on promises they made during their election campaigns, but the anxiety regarding Donald Trump is that he is actually doing what he said he would do.

Judging by the market’s reaction to the ‘Liberation Day’ announcements, Wall Street assumed that he was bluffing when he promised retaliatory tariffs on countries he considered to be ripping off Americans. In just a few days, investors seem to have ditched their hope and put on sackcloth and ashes in mourning for the death of globalisation. Such pessimism is likely as misplaced as the unbridled optimism that preceded it.

Donald Trump loves a deal. He has spent his entire life dealing. Mostly in real estate and, it has to be said, he has been very successful, notwithstanding that he had a good start as son of a multimillionaire property developer. In his 1987 book “The Art of the Deal” he opens with the following:

“I don’t do it for the money. I’ve got enough, much more than I’ll ever need. I do it to do it. Deals are my art form. Other people paint beautifully on canvas or write wonderful poetry. I like making deals, preferably big deals. That’s how I get my kicks.”

Trump is also a patriot. In response to a change in federal tax that would benefit him personally he wrote “…I still believe the law will be a disaster for the country, since it eliminates the incentives to invest and build – particularly in secondary locations, where no building will occur unless there are incentives.” So, the 47th president of the United States is a deal-making loyalist, which is fine, except that Trump’s idea of a deal is where there is a clear winner, and he sees any trade deficit as a win for the exporter and a loss for America.

Economists don’t view transactions as creating winners and losers. For example, say I want a new bike, and you have one, which you sell to me for £500. For Trump, one or other party got the better of the deal, but for the economist, we are both better off because I preferred a bike to £500 and you preferred the £500 to a bike. It’s a win-win. That’s how world trade takes place – as an extension of the specialisation that Adam Smith extolled in his pin factory example i.e. if workers specialise in doing one thing rather than many, production rockets and we are all better off.

There is no doubt that many countries around the world have taken advantage of America. China ripped-off US intellectual property and Europe took advantage of America’s willingness to foot the bill for defending its Eastern borders, then had the cheek to levy high tariffs on US imports, especially cars, because Germany wanted to defend its domestic markets for Mercedes, Volkswagen and BMW. So, when this American President cries “foul” he can back it up with cause, tapping into the sympathy of Americans generally, and especially those that lost manufacturing jobs to ‘unfair’ foreign competition. But, despite this supposedly uneven playing field, the US has thrived whilst Europe has struggled, which proves the theories of all the previous free traders like Adam Smith, David Ricardo, Winston Churchill, and Patrick Minford, that it is the country that levies the tariff that suffers because it shields their domestic economy from foreign competition and rips off their consumers. It is America’s willingness to trade despite unfair tariffs that has made it great and enabled it to direct its resources to new, world-beating industries.

If Trump really does follow through with his punitive, high tariffs, America will suffer, but global economic hegemony will rest with the US for decades to come because it has huge natural resources (it is now a net-exporter of energy), substantial land mass (even without annexing Canada and Greenland), a robust democracy and a ‘can-do’ approach to commerce. Even if the American economy suffers in the short term, it will take the hit from a position of strength with unemployment at just 4.1%, well below its long-term 5.7% average.

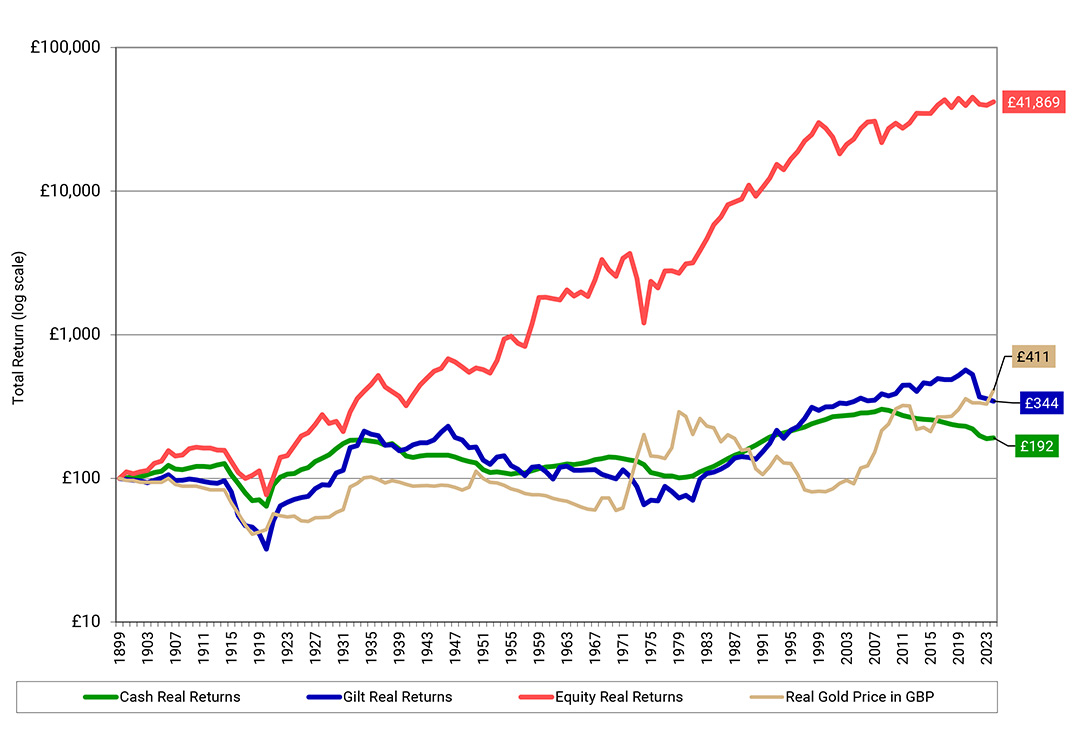

Michael O’Sullivan, one of Courtiers Asset Management Limited’s Independent Non-Executive Directors, issues a weekly commentary called “The Levelling”. In the latest issue he looks at political risk and tracks back equity markets to the late 1800s. Michael points out that in 1900 nearly 50% of stocks were railway companies and the UK made up 25% of equity markets. Today, the UK accounts for just 3% of world stock market value, but despite losing its hegemony, an investment in UK shares in 1900 yielded breathtaking profits, turning the purchasing power of £100 invested at the start of the period to £41,869 by the end of 2024 (see below). Not bad for a ‘failing’ economy.

Real Returns

It’s been a rough few days for share prices and it will likely be another rough one today as we all try to fathom whether this US president really is a dealmaking genius or a self-aggrandising propagandist. I suspect it’s something in-between. I also suspect that there will be many twists and turns as this saga unfolds, especially because Donald Trump has an acute sense of the mood of the people, which will change quickly if his MAGA support base start losing jobs as other countries decline to buy US exports.

It will take a while for all the possibilities to be absorbed and assessed by investors worldwide. In the interim its likely going to be a rollercoaster ride of ups and downs. The best thing we can do is fasten our seat belts, stay diversified and keep calm; exactly what we have done during each and every market sell-off over the last 43 years since Courtiers was founded.