America has a lot going for it, but Trump’s stance on the economics of trade deficits have us thinking about our investment strategy. For the past few years Courtiers has been reducing US large-cap exposure, instead choosing shares in lower priced American companies and businesses outside of the US. By staying broadly diversified, our concentration on shorter-dated government bonds should help us navigate through Trump’s second presidency.

8:22 pm 13th April 2025 – Post ‘Liberation Day’ Update

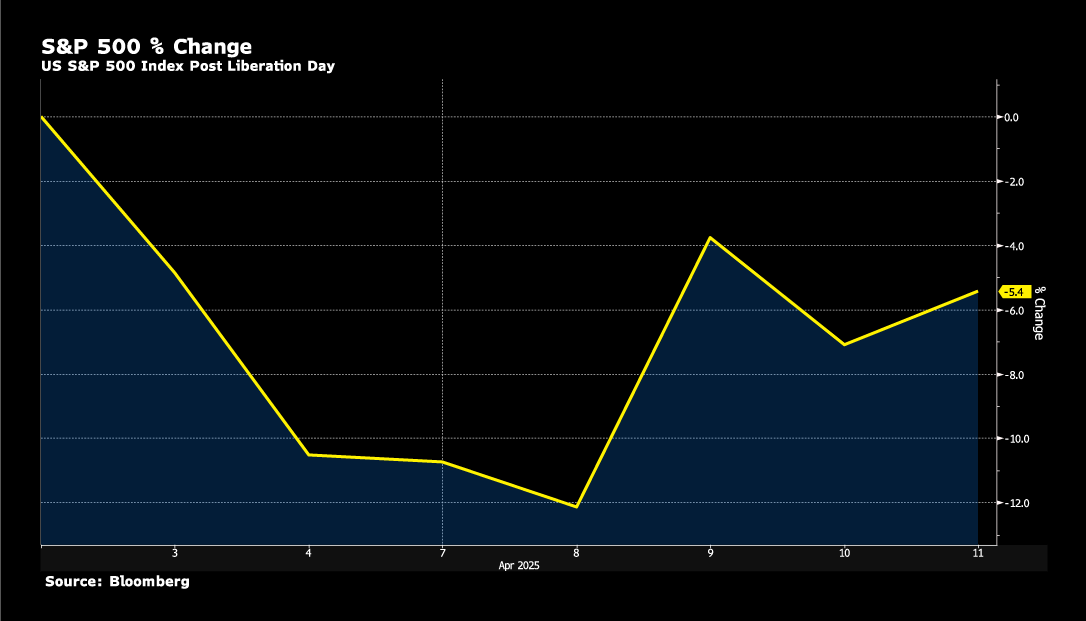

It’s 11 days post the ‘Liberation Day’ revelations, but it feels much longer. Markets spooked at the eyewatering tariffs announcement, which was way beyond their wildest expectations, and equity prices tumbled in the aftermath. But then we had the 90-day reprieve announcement (I said this President can spin on a dime) followed by one of the biggest one-day stock market bounces in history. I warned that we faced a bumpy road ahead, but the journey for many investors since 2nd April has been even more nerve-wracking than a ride on the infamous New Jersey ‘Kingda Ka’ rollercoaster, reputedly the scariest in the world.

Many ascribe Trump’s volte-face to the collapse in the S&P 500 (an index of the value of shares in the biggest 500 companies in America), which fell over 10% on Liberation Day, but recovered with the announcement of the 90-day stay of execution:

Changes to share values tend to impact the economy through a ‘wealth effect’, which simply means consumers tend to spend more when they feel better-off, and less when they feel worse-off. However, it’s really only the affluent who are impacted by the wealth effect, and it needs to be pretty dire to stop them spending.

The bond market, on the other hand, is a different animal as it determines the level of interest borrowers pay on their mortgages, loans and credit card balances. When these rise, consumers dial down their spending almost immediately. As a seasoned property developer, Donald Trump will be very mindful of the detrimental impact rising interest rates can have on building and investment projects, which in turn can cause recession. This is why James Carville, a leading strategist in Bill Clinton’s 1992 presidential campaign, said “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope… but now I would like to come back as the bond market. You can intimidate everybody”.

It was the UK bond market collapsing following Liz Truss and Kwasi Kwarteng’s 23rd September 2022 budget, that sent long-term UK interest rates soaring (and ended their political careers). Although not as dramatic, a couple of days after ‘Liberation Day’, US bonds began to react adversely to the tariffs, which started pushing up American interest rates. This would not have gone unnoticed by Donald Trump.

The Federal Reserve and its Chairman, Jerome Powell, are likely to come under increasing pressure from the President and his economic team to cut interest rates. But as tariffs can have an inflationary impact, at least initially, reducing short-term US borrowing costs may be limited.

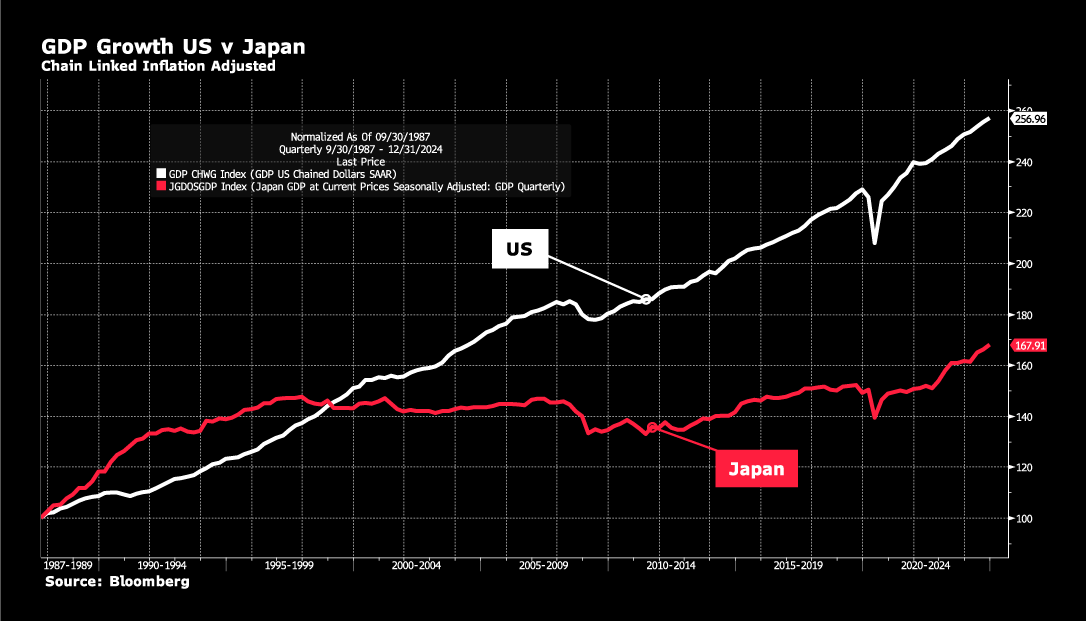

Despite the recent set-back, nobody should underestimate Donald Trump’s loathing of trade deficits, which he sees as ripping off Americans. In his 1987 book “The Art of the Deal” Trump wrote “…for decades they [the Japanese] have become wealthier in large measure by screwing the United States with a self-serving trade policy that our political leaders have never been able to fully understand or counter”. President Trump thinks he has a better understanding of the economics of trade deficits than his predecessors (he doesn’t!) and he will spend the rest of his presidency trying to eradicate them. He may succeed, at least in part, but if he does then it will be worse for both US families, who will pay more for a vast range of goods, and the American economy. The US has outpaced the major developed economies of the world post the global financial crisis because of, not despite, its trade deficit. Since 1987, when Trump made his comments about dodgy Japanese trade policy, America’s economic growth has eclipsed Japan’s:

For his entire business life Donald Trump has been an anti-trade-deficit idealogue and no economist or adviser is likely to change his views. But rising long-term interest rates can do irrevocable damage to a presidency, which is why even the 47th President will have to take heed of the bond market. I expect this US administration will continue to seek ways to punish trading partners that sell more to the US than they buy from it, in which case both equities and bonds are likely to experience a series of ups and downs. Buckle up everyone!

How is Liberation Day impacting our investment strategy?

America has a lot going for it: world-beating technology; vast natural resources; a flexible labour-market; a driven entrepreneurial class; and a huge land mass (even without Greenland) to name but a few. Investors write off the USA at their peril. But contrary to the period in the aftermath of the Global Financial Crisis when many thought US dominance had come to an end and that better investment opportunities existed elsewhere (Courtiers never thought that, by the way), recent opinion has favoured American business to such an extent that US share prices are very expensive.

Courtiers has been reducing its US large-cap exposure for the past few years in favour of owning shares in lower-priced American companies and businesses outside of the US. There are lots of opportunities, especially in the UK, Europe and Asia. This means we remain broadly diversified (our favourite word) and because we also believe that the three-decade long-bond bull market has ended, we are also concentrating on shorter-dated government bonds, which are much less sensitive to ‘Trumpian interest rate risk’ (i.e. we are also short duration).

Hopefully, this will mean we can navigate the second Trump presidency reasonably unscathed, but I hope he doesn’t get a third!