Jake Reynolds took to the stage at the 2025 Client Seminar to talk equities and their history, and focused in on the client questions you’ve been putting to Courtiers advisers (and the Investment Team) over the year.

With the valuations and the tech bubble in the US, is there going to be a correction, or a crash?

While Gary Reynolds goes into more detail about the US in his part of the Client Seminars, Jake kicked off with the global data that reflects this question.

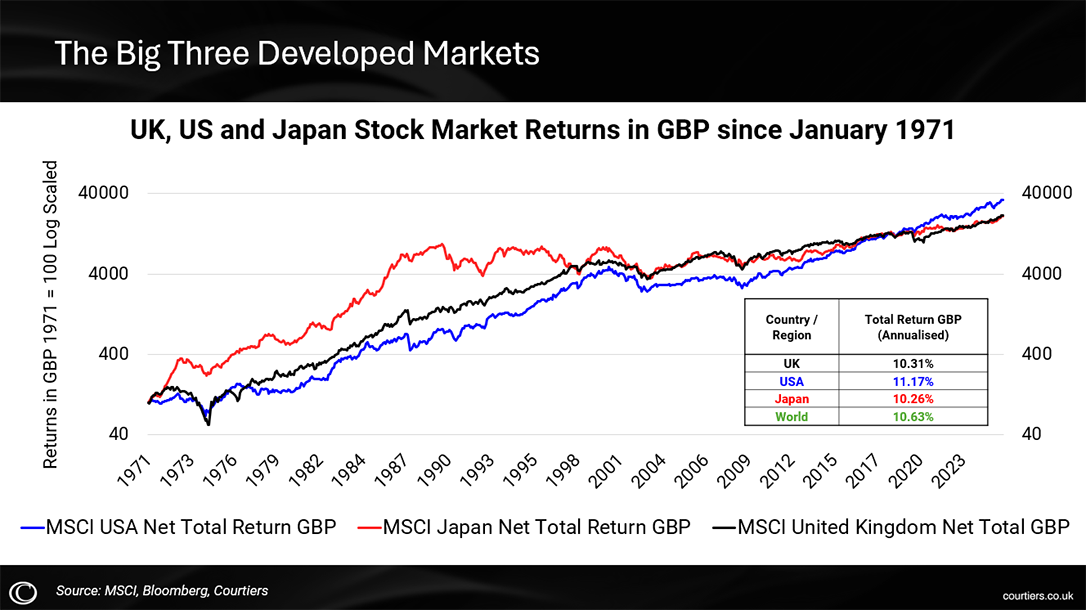

Looking at the almost 55 years of daily returns across the top three largest markets in the world, the USA, Japan and UK, all the markets offer an annualised return of over 10%.

“A 10% return doubles your money in seven years, quadruples your money in 14 years and octuples your money every 21 years. That return in equity markets is vastly superior to any other asset class out there.” – Jake Reynolds, Asset Management Director

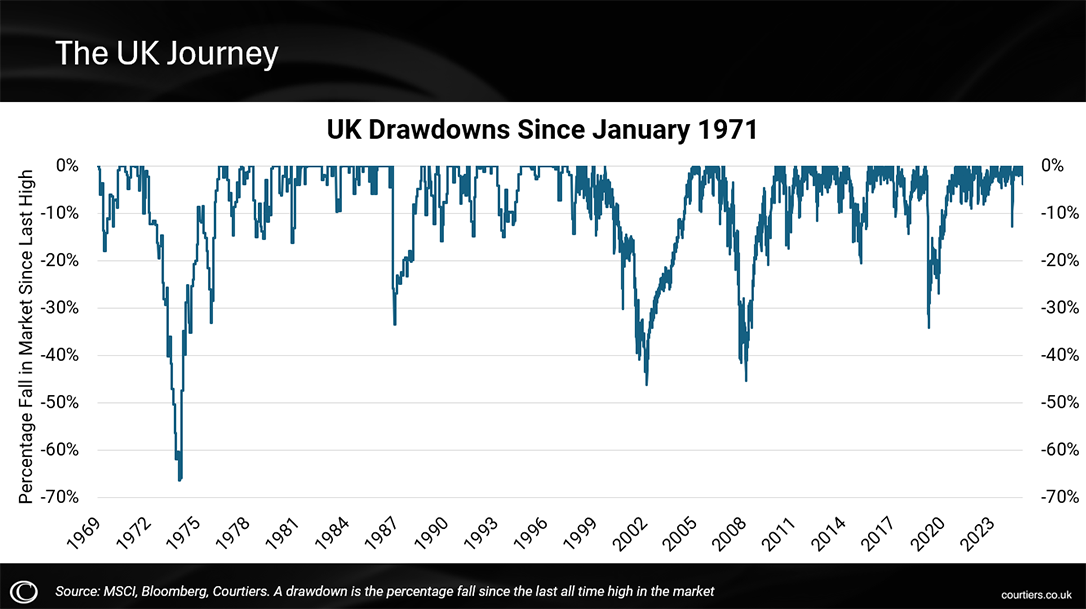

However, to make these annualised returns, you have to factor in putting up with this:

This is UK Drawdowns since 1971, showing the percentage fall since the last all-time high in the market. The journey is anything but linear, and only eight times in a calendar year across the last 55 years has the return landed between 8-12% (less than 15% of the time you get close to the 10% return), however the market can be quite predictable.

Peter Lynch was right when he stated that the market falls at least 10% about once every two years: since 1994, the UK Stock Market has fallen by 10% 15 times. There have also been four bear markets, which Peter Lynch also predicted.

So why bother investing internationally?

We are 17% ahead of the FTSE 100 (The most-visible equity market) with the Courtiers Total Return Growth Fund. This is partly due to the UK stocks we are holding in the fund, and because we don’t just rely on UK stocks to get growth: we diversify.

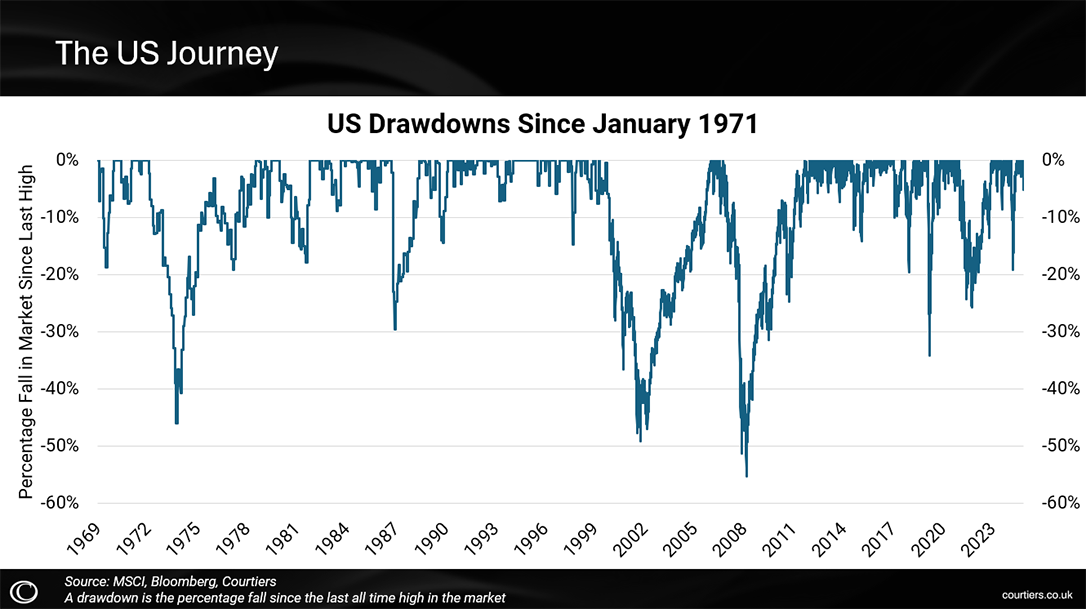

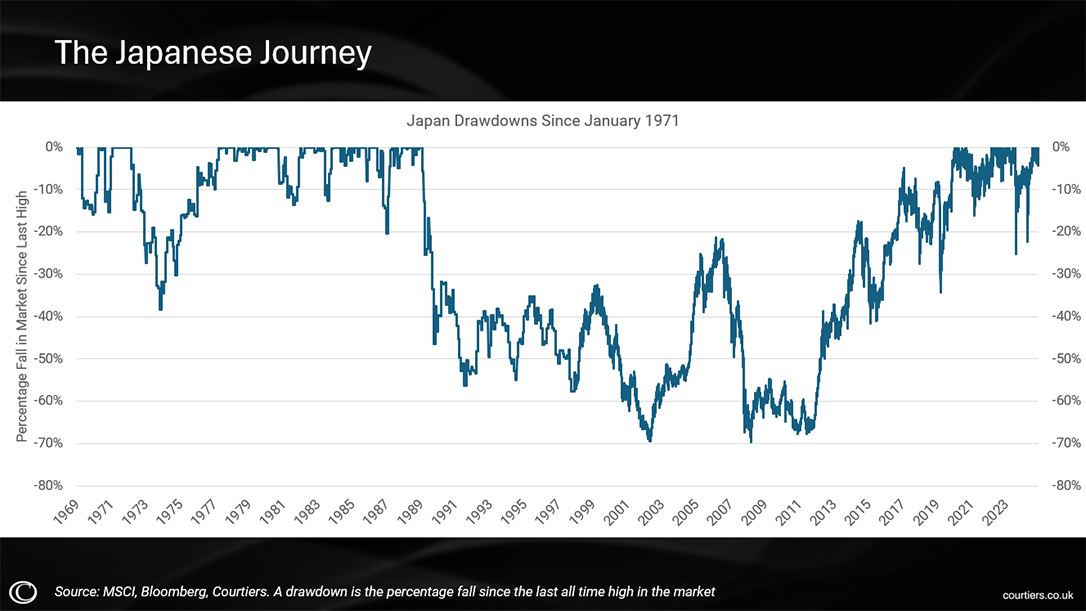

Each market has periods of volatility, with the UK having a low in the 1970s, the US getting hit harder by the dot com burst of the 2000s and the 2008 recession, and Japan took 30 years to make its money back in the 2000s.

Why not diversify across all countries with a Globally Diversified Tracker?

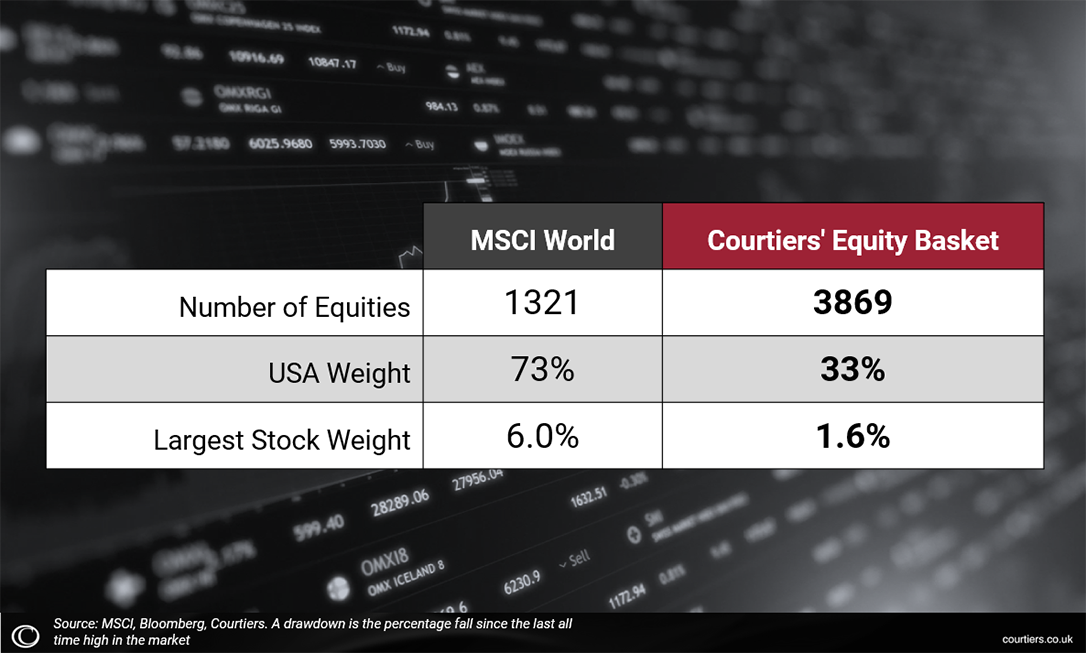

Trackers like the gold-standard MSCI World have become incredibly concentrated, with a 73% weight in US stocks, and an 6% weight in Nvidia, while Courtiers remains and actively spreads its holdings. We try not to allocate too much into one stock, as you never know what is going to happen.

What have we put into our diversified basket this year?

It was the FTSE 100’s 40th birthday last year, and only 25 of the original stocks still remain, hence the need to diversify. We’ve picked up one of the original stocks: Associated British Foods PLC. Associated British Foods PLC owns many brands that can be found in 9 out of 10 UK households, as well as seeding a well-known fashion brand – Primark. We’re always looking at the valuation of stocks, rather than the stories, and Associated British Foods PLC has a good score with the cheapest valuation we’ve seen since 1997.

We also are still seeing value in Unipol Groupo, who we picked up last year, as well as other stocks outside of the US. We have tweaked our valuation model, changing it to value stocks across the world rather than in their own region which highlights discrepancies. This is why we’ve now bought into the oldest bank in the world: Monte Dei Paschi Di Siena paying three-times the dividend that Citizens Financial Group offered.

Other investments include LatAm Airlines and Lenovo. The latter we bought in 2022, sold in 2024, but when it came back to the price we paid in 2022 when the US tariffs hit, we rebought it knowing the stock well, and in a month, it was up 20%. This shows how, if you can keep your head through the bumps, it can really enhance your returns.

Read more Client Seminar articles

James Timpson talks Positive Returns for Courtiers Funds in 2025.

Gary Reynolds covers The Invisible Black Hole and How our Growth fund outperformed the Mag 7 in 2025.

If you have any questions or would like to know when we will run the Client Seminars again, contact your Courtiers Financial Adviser or get in touch through the Contact Us page.