From the Investment Team

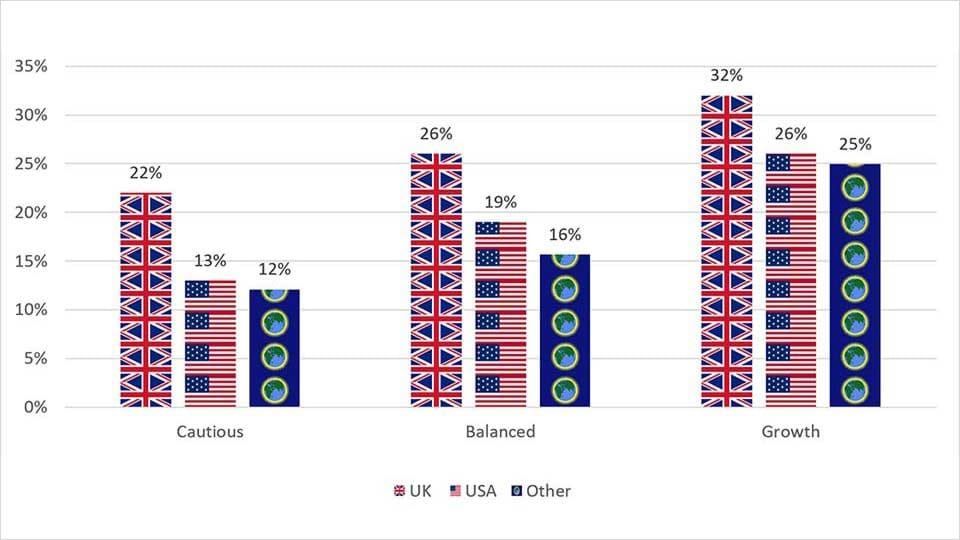

Brexit uncertainty has created opportunity in the UK market. The current price to earnings (P/E) ratio of the FTSE 100 is 13.03. In comparison the S&P 500, which represents the largest 500 US companies, has a P/E of 24.32. We believe UK equities are undervalued and have been increasing our exposure through the purchase of call options and good quality, cash generative stocks such as ITV and Vodafone. With the strong equity market today our call option values have increased. Our current equity exposures are:

Chart 1: Courtiers Multi-Asset Equity Exposures as at 29/10/2018

Source: Courtiers.

In the first Monday Budget since 1962 Philip Hammond provided figures to show the health of the UK economy. There are 3 million more people in employment then in 2010 and the unemployment rate at 4.13% is one of the lowest in history. Wages are growing (3.1%) while the Office for Budget Responsibility have forecasted growth to improve to 1.6% next year, 1.4% in 2020, 1.4% in 2021, 1.5% in 2022 and 1.6% in 2023. They have also forecast inflation to average 2% next year.

Meanwhile debt peaked in 2016/17 at 85.2% of Gross Domestic Product but this is predicted to fall in every year to 74.1% in 2023-24. Finally, the Chancellor expects borrowing to be £11.6bn lower than forecast in the Spring Statement and this is predicted to continue to fall to a low of £19.8bn in 2023-24.

This data reinforces our view the UK economy looks to be in good shape and the relative value of UK equities means we are happy with our current exposures.

Markets haven’t reacted with the FTSE 100 up +1.25% on the day and the S&P 500 currently up 0.63%. The pound fell slightly by -0.19% during the speech and is currently trading at $1.2802.*

From the Private & Corporate Client Teams

The personal allowance will increase to £12,500 and the higher rate threshold will increase to £50,000, with effect from April 2019 – one year earlier than expected. This will be a welcome tax break for most people.

Stamp duty relief will be extended for first-time buyers of shared ownership properties worth up to £500k. Unusually, the tax break will be backdated and so will apply to any properties bought in this way since the last budget. Some first-time buyers are in for a reasonable windfall.

In addition, there was the usual range of small giveaways on popular items – duty is being frozen on fuel, beer, cider, spirits, and short-haul flights, although the planned duty increases for wine and tobacco will go ahead as planned.

The minimum qualifying period for entrepreneurs’ relief has been extended from 12 months to two years, potentially saving the government from forking out for the percentage of those that fold within the first 2 years. Phillip Hammond’s reason for retaining the relief was to encourage entrepreneurial activity in an age of technology, wanting the United Kingdom to become a leading player in the global technology sector.

Good news for education: schools will receive an immediate payment this year of £400m, representing £10k per primary school and £50k per secondary school, to help buy the ‘little extras’.

Motorists will also be happy with a new £420m fund to repair potholes in Britain’s roads – we may see shares in the AA dip though!

Given that mental health issues are one of the biggest challenges facing businesses in the UK, the government’s announcement of increased NHS spending on mental health services should be welcomed.

We are also pleased to see additional tax measures which will attempt to limit the amount of new plastic manufactured and imported into the country, although some will be disappointed that the measures did not go further.

Clearly Brexit is looming large over next year, and spreadsheet Phil reserved the right to change his mind.

As with all budgets, the detail follows after the main speech so there is likely to be more to come.