Comparing how long it takes for investors to get their money back is just one way to assess the relative value of companies.

As this Research Note written by Gary Reynolds, Courtiers CIO reveals, in the case of global car manufacturers Stellantis and Tesla that comparison is stark. If profits remain the same, it will take investors just over three years to get all their money back from the owner of global marques such as Maserati, Peugeot and Vauxhall, compared to 70 years from Tesla.

While there are several other ways to value companies, Gary explains why pretty much whatever value metric you use, a company like global car manufacturer Stellantis, which Courtiers holds in its Multi-Asset and Global (ex-UK Equity Income) Funds, will always be more attractive than those like Tesla.

Gary sees similarities between the current period and the dot.com bubble of the late 1990s when prices of technology stocks were chased ever higher, until the bubble inevitably burst. With the share price of ‘techy’ growth stocks like Tesla, Nvidia and Seagen (Seattle Genetics) at such elevated levels, Courtiers is happy to take the opportunity to pick up currently unloved stocks like Stellantis, he says.

Research Note from Gary Reynolds CIO – 30 June 2023

Investors’ rapacious appetite for technology companies in the late nineties drove up the price of any business with “dot.com” in its name. Some stocks became so popular that they sold at huge multiples of their profits and even companies that made no money whatsoever were chased skyward by markets.

“History may not repeat, but it does rhyme” as the saying goes, and 2023 is looking like dot.com bubble version 2. This time round even companies in established sectors, such as car manufacturers, can generate massive increases in their share price if they are seen as “techy”. Here’s an example:

Company A and B both make and sell cars. In its last financial year Company A had revenue of $179.59BN and generated $16.8BN of profit. Company B had lower gross revenues of $81.46BN and made a net profit of $12.56BN. Both companies generated free cash flow, but Company A’s free cash flow was $11.34BN compared to Company B’s free cash flow of $7.57BN.

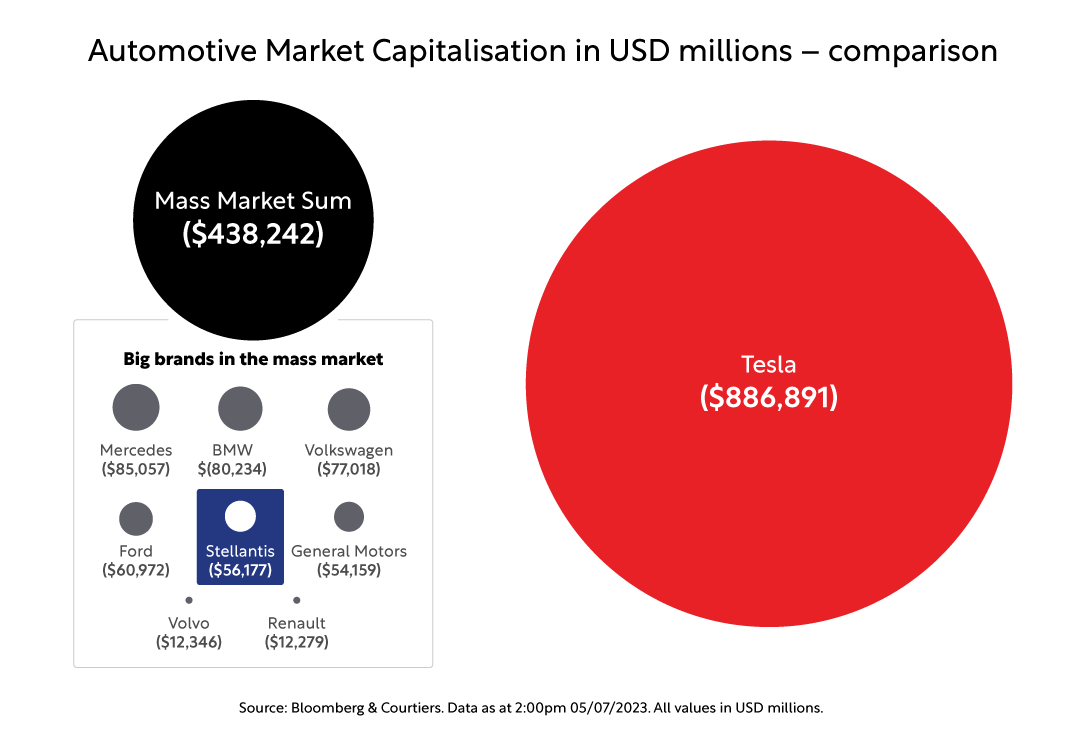

As Company A has higher revenue and profits and better cash flow you would expect Company A to be worth more than Company B. You’d be wrong! Company A is valued by the stock market at $55.6BN. Company B is valued a staggeringly 15 times higher at $835BN.

Company A is Stellantis, the owner of a number of global marques, including Maserati, Peugeot, Vauxhall, Jeep, Fiat, Dodge, Citroen, Chrysler and Alfa Romeo. Company B, as you’ve probably guessed, is Tesla.

The difference in what you get for your money is laid bare in the key ratios. Bloomberg estimates that Stellantis is trading at 3.38x earnings whilst Tesla trades at 76x. Regarding free cash flow, Stellantis trades at 4.45x whilst Tesla trades at a whopping 143x.

To put these ratios in context, if profits remained the same for the future, then investors get all their money back from Stellantis in just over 3 years whilst Tesla investors have to wait for 70 years. To get your money back in pure cash Stellantis investors will have to wait just over 4 years – Tesla investors over 140 years.

Tesla devotees will defend their positions by claiming that their chosen motor company is innovative, is building the cars of the future and is led by one of the world’s greatest entrepreneurs. Fair enough! But if you take the long-term average price earnings ratio at between 18 and 20, then Tesla needs to grow its current profits fourfold just to justify the price being paid for the business today. And what if hydrogen and/or synthetic fuel and/or some other technology that betters electric vehicles comes along? If that happens the price of Tesla stock will plunge. That’s a big risk.

Stellantis may not be as sexy as Tesla (although try telling that to an owner of a Maserati or Fiat 500) but it is well diversified and produces a range of vehicles, including electric and ICE (Internal Combustion Engine) cars. And investors in Stellantis don’t need to see a big improvement in profits to justify what they’ve paid for the business. In fact, if profits stay the same and the market decides that Stellantis is a normal company then its share price will appreciate sixfold to get its price earnings ratio up to 18 (the rough market average).

Tesla v Stellantis is an example of growth v value investing. Growth investors expect profits to rise rapidly to justify the high price they pay for shares today. Value investors don’t need prices to do much and, even if profits don’t rise, they can generally sit back and pick up dividends, reinvested earnings and cash handouts. Those returns from value investing come at considerably less risk.

We don’t chase the high returns from the likes of Tesla, Nvidia and Seagen (Seattle Genetics) for two reasons: firstly, it’s high risk and secondly, value investing produces better returns in the long run. There are periods when growth investing significantly outperforms value investing. These include the late 1990s and the first 6 months of 2023, but times like these tend to accentuate the difference in valuations and create considerable opportunities for value investors like us. So we are more than happy to pick up the unloved stocks that are generating cash, paying great dividends and reinvesting in their future and wait patiently for the market correction.

End research note