Cash continues to play an important role in helping to meet certain financial needs and objectives, but how valuable can it be in preparing family for the future?

Key takeaway: Cash savings have an important role to play over the short-term, but for long-term returns, cash can be risky.

Considering asset classes away from cash deposits is a good idea as part of a long-term family wealth strategy.

Ups

Cash savings in deposit accounts are an excellent source of liquidity for:

- Planned short term spending

- Emergencies

- Acting as a risk reducer to an overall investment portfolio.

Downs

While cash is considered a “safe asset class”, it still carries its own risks, especially over longer periods:

- If your bank or building society went bust, the Financial Services Compensation Scheme (FSCS) limit would protect cash deposits of up to £85,000 per person, per bank/building society. Any savings held over and above this amount would be at risk of loss.

- A combination of low interest rates and the impact of inflation can affect the real purchasing power of your money over time (the longer the timespan, the potentially greater the impact).

Inflation – key when saving/ investing for the future

When a wealth strategy is long term, e.g: 20+ years, inflation is important to consider. Long term financial goals can comprise significant life events such as funding university, weddings or helping family onto the housing ladder and these can all be costly. It’s important to explore all options.

Millstones to milestones – price increases over 30 years

Comparing some costs over the last three decades paints a picture. Today, for a young couple to be living comfortably together:

- in their own home

- with milk in the fridge

- bread in the cupboard

- each working hard to secure Master’s degrees within four years

- head over heels in love and excited to be married in six months’ time…

…it’ll cost far more than it did a generation ago. Some may remember student fees in 1988 were at zero. These are now almost £10,000 per year and according to the Independent, the average cost of a wedding has increased by 12.5% in the last year alone:

Considering future inflation, we can’t predict the future but we can project it. By analysing inflation over time (either historic or projected), we’re able to factor potential future inflation into wealth strategies and project a more realistic view of future investment performance over time. This proves insightful and valuable when clients are considering ways to invest for the benefit of the family’s future.

Hedging the cost of inflation with NS&I

Certain NS&I savings products may provide some hedge against inflation over time, but as we currently have, during a sustained period of such low interest rates, they’re still unlikely to deliver the type of returns necessary to fund major life events. A recent article from Caroline Shaw, our Head of Fund & Asset Management, touches on dismal cash returns during a decade of market performance since Lehman Brothers collapsed.

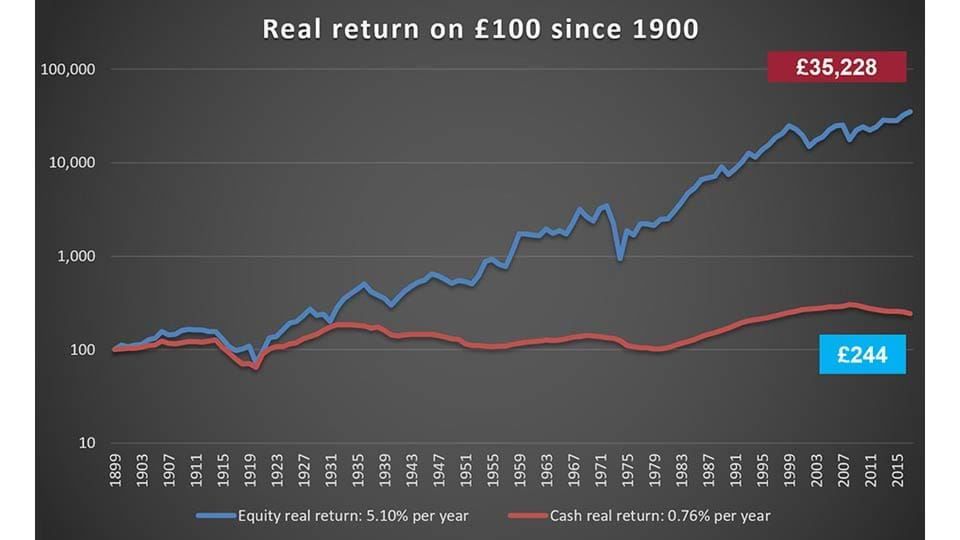

While holding some monies in cash for emergencies and short term planned spending (0 to 5 years) is a good idea, the below charts show us it’s not the best way to hedge against inflation over time.

Cash vs Global equities: real returns on £100 since 1900 taking into account inflation

Source: Courtiers & Barclays. The annual returns are total returns (i.e. they include income). Real returns are adjusted for inflation. Past performance is not a reliable indicator of future returns.

…and below we see the same data over 30 years (more equivalent to a typical generational family wealth strategy):

Cash vs Global equities: real returns on £100 over 30 years taking into account inflation

Source: Courtiers & Barclays. The annual returns are total returns (i.e. they include income). Real returns are adjusted for inflation. Past performance is not a reliable indicator of future returns.

Time spent is beyond return – use it wisely

As is clear, in real terms cash is simply not an effective way to build up a significant pot for important, costly, long term objectives.

To help meet important future goals, the ability and willingness to accept greater levels of risk with part of your savings is likely to reap greater potential rewards over the longer-term, despite short-term fluctuations in the markets. It’s therefore important to explore options with open ears and an open mind if you are to make an informed decision with greater confidence in maximised returns.

There will always be market wobbles, ups and downs and many long-term investors know this. This is why identifying opportunity and managing risk, while seemingly polar opposites, are equally vital in managing investments effectively.

For any questions regarding Courtiers wealth management, please speak directly with your adviser or contact us.