“I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle”

(Sir Winston S. Churchill 1874 – 1965)

The rate of tax relief that can be claimed and amount of Stamp Duty payable on Buy-to-Let properties is changing and has caused much anger.

The Chancellor announced significant changes to Buy-to-Let Tax Relief in his summer Budget speech. He announced further changes to Stamp Duty in the following autumn budget. In summary the changes are:

1. The wear and tear allowance will be replaced by a new system from April 2016.

Under the present system, you are able to automatically deduct 10% of the rental income for wear and tear.

From April 2016, a landlord will only be allowed to deduct actual costs incurred on replacing furnishings in the tax year.

2. The tax relief on financial costs incurred will be restricted to the basic rate of tax only (20%). This will be phased in from April 2017 over 4 years.

Currently a landlord can deduct the mortgage costs from the rent received and pay tax on the difference.

Under the new system, tax will be applied to the rent received less a tax credit at the basic rate.

The phasing will be staged as follows:

– 2017/18 – the deduction from property income will be restricted to full tax relief of 75% of finance costs with the remaining 25% available at the basic rate.

– 2018/19 – 50% of finance costs available for full tax relief and the remaining 50% available at the basic rate.

– 2019/20 – 25% of finance costs available for full tax relief and the remaining 75% available at the basic rate.

– 2020/21 – all financing costs incurred by a landlord will be given as basic rate tax relief.

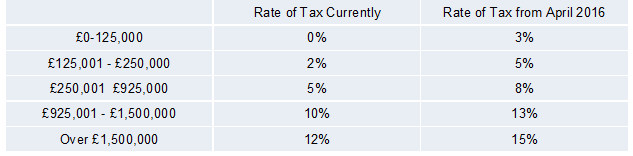

3. An extra 3% stamp duty will be added on purchases of buy-to-let and second homes starting from April 2016.

From 1st April 2016, the following Stamp Duty will now apply for Buy to let and second homes:

What does this mean for you?

Mortgage Interest Tax Relief

Example: Mr Smith is a higher rate tax payer and has annual rental income of £20,000. The interest on the mortgage is £12,000 per annum.

Current System:

Mr Smith is able to deduct the mortgage interest costs from the rental income and tax is due on the difference or profit.

£20,000 less £12,000 = £8,000 profit.

Tax is payable at 40% on the £8,000.

Meaning a tax bill of £3,200. This leaves a profit of £4,800.

New System:

Mr Smith pays tax on the full rental income less a tax credit of 20% on the mortgage interest.

40% tax due on £20,000 = £8,000. Less a tax credit of £2,400 (20% of £12,000).

Total tax due is £8,000 less £2,400 = £5,600.

The net result is a tax increase of £2,400 or 75%.

Leaving a net profit of £2,400. Mr Smith is worse off by £2,400. A drop in income by 50%.

Stamp Duty

Example: A buy to let property costing £300,000 would currently incur Stamp Duty of £5,000.

From 1st April 2016 this will increase to £14,000.

An additional £9,000 of Stamp duty will be payable.

Conclusion

Now might be the time to consider alternative investments such as a collective portfolio.

The cost of a buy-to-let property will be greater given the increase in stamp duty. As a result the rental yield will fall based on a higher initial investment.

You will no longer be able to automatically deduct 10% of the rental income for wear and tear. Instead you can only deduct actual costs incurred in that tax year. This will reduce your income further.

The Tax treatment depends on individual circumstances and is subject to change.