Pensions are essentially simple. The more you put in the more you’re likely to get out.

There is of course a catch; the annual allowance, which is the maximum that can be saved in a pension in a tax year before a tax charge is triggered. Currently, the annual allowance is £40,000, although this is less for high earners (those whose total threshold income is above £200,000 and total adjustable income is above £240,000 a year) where a tapered annual allowance applies.

Bearing in mind that a person may have more than one pension, the annual allowance applies to all their pension contributions combined, including tax relief, as well as the contributions of any employer or employers.

Where the annual allowance is exceeded, people won’t get tax relief on any contributions exceeding the limit in that tax year. They may also be faced with an annual allowance charge. This adds the amount by which the annual allowance is exceeded to a person’s taxable income, increasing their income tax liability.

Examples

One example of where the annual allowance could be exceeded is when a person or their employer makes a large pension contribution, taking their contributions above the £40,000 annual allowance. Another is where the person is a high earner and the amount saved is greater than the tapered annual allowance. An increase in accrued benefits from a final salary pension (DB) scheme i.e.: its capital value and tax-free cash entitlements (excluding death in service rights) could also result in the annual allowance being exceeded.

Carry forward – avoiding the overspill

Under what are called the carry forward rules, rather than incurring a tax charge a person may be able to boost their pension savings by more than their annual allowance and still receive tax relief. Carry forward achieves this by allowing people to carry forward unused allowances from the previous three tax years and to use them to boost their annual allowance for the current tax year. In effect, it allows people to catch up with pension contributions they might have missed, and to avoid any annual allowance charge that might have otherwise been due as a result of exceeding their annual allowance.

Conditions

- Although a person may have unused annual allowances from previous tax years, to use carry forward certain conditions must be met:

- You can only carry forward unused allowances once you have fully used up the current year’s allowance of £40,000.

- The amount that a person can personally contribute gross (i.e. with tax relief included) into a pension and receive tax relief in a particular tax year is restricted by their relevant UK earnings (see example below). In other words, their salary, or other forms of income that are chargeable to income tax, must be the same or higher than the total contributions in the tax year they are made.

- In addition to any unused allowance in the current tax year, you can only go back to the previous three tax years, starting with the earliest of those three years and working forwards.

- Once you have used up the unused allowance from a particular tax year, you cannot use it again.

- You must have been a member of a UK-registered pension (State Pension excluded) in each of the tax years from which you wish to carry forward unused allowance, though you don’t need to have paid any money in. It also applies to overseas schemes, where either you or your employer qualifies for UK tax relief.

- Once a person has triggered the MPAA (Money Purchase Annual Allowance) by flexibly accessing their pension they cannot carry forward unused allowances from previous tax years to defined contribution schemes. However, it may be possible to carry forward unused allowances for use in defined benefit schemes. If you think this might apply to you, it would be worthwhile speaking to a financial adviser.

Source: Courtiers

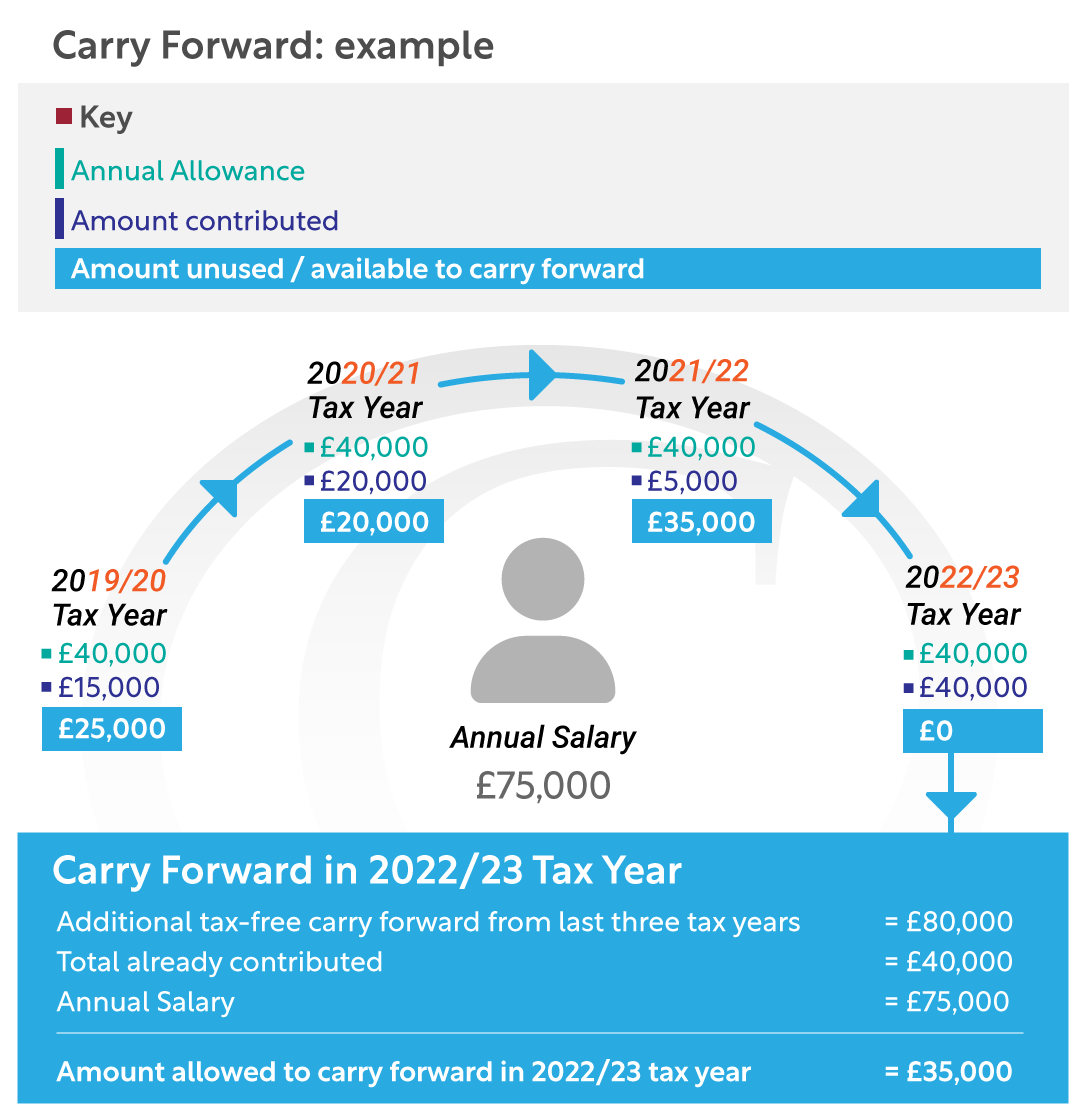

The maximum this individual can carry forward from the previous three tax years is £35,000, which is made up of £25,000 from 2019/20, and £10,000 from 2020/21. When combined with their full annual allowance of £40,000 for the current tax year this equals their current annual salary of £75,000.

The £10,000 still unused from 2020/21 and the £35,000 unused from 2021/22 could potentially be carried forward and used in the 2023/24 tax year.

Practicalities

To find out how much you have in unused allowances over the previous three tax years, refer to the pension statements you should have received from your pension providers. You should then be in a position to pay the contributions. There is no need to tell HMRC, however, it is a good idea to keep a record of the calculations. Working out unused allowances for final salary schemes can be more complicated than for money purchase or defined contribution schemes, so it may be helpful to speak to a financial adviser.