“What’s the difference between a taxidermist and a tax collector? A taxidermist only takes your skin”

Mark Twain, Author (1835-1910)

Would you like to know how your heirs could pay less Inheritance Tax (IHT) when you pass on your hard earned estate, while you still have access to that capital whilst you’re alive? Often these two prove to be mutually exclusive but by using a Loan Trust you can achieve both.

While some trusts (particularly offshore trusts) have received much negative press of late, trust planning is an entirely legitimate method of mitigating your IHT liability and can actually be a fairly simple concept.

Who could benefit from a Loan Trust?

Firstly, you’ll need to have an IHT problem. That would mean having assets that total £325,000 (£650,000 for a married couple or civil partners) or a reasonable expectation that your assets will grow above that value*.

You’ll also need for some of those assets to be liquid (cash deposits or in an investment vehicle other than a pension) and surplus to your requirements for day-to-day living. Although they are currently surplus, you’ll be in a position where you’ll want to retain some access to them just in case you might need it in the future.

What is a Loan Trust?

A Loan Trust is a vehicle designed to control how your assets are passed to your beneficiaries. The trustees act on your behalf and in accordance with your declared wishes. You can choose to be one of the trustees and you would usually set the trust up on a Discretionary basis, meaning you, or the trustees, can change the beneficiaries whilst the trust is in place.

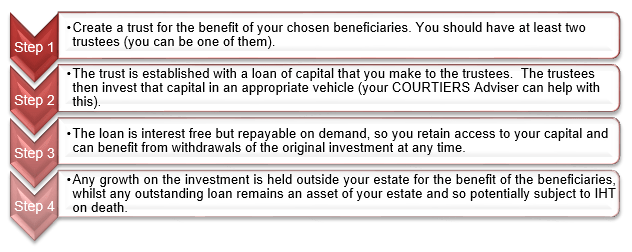

The diagram below shows how a Loan Trust works:

|

Advantages of a Discretionary Loan Trust |

Disdvantages of a Discretionary Loan Trust |

|

|

Summary

IHT can be a very complicated topic with seemingly endless options available. Some of these options are complex and some are structured to push the boundaries of acceptable conduct (in the eyes of the taxman).

Loan Trusts are neither. They offer an excellent half way house for IHT mitigation. If you’re not comfortable with giving away access to some of your capital, Loan Trusts offer a way to retain that access but capping the future liability to IHT on that sum.

If you’d like to discuss your specific circumstances or want to investigate other options, then please contact your Courtiers Adviser who will help you analyse your current situation, financial objectives and priorities and make recommendations to enable you to achieve them.