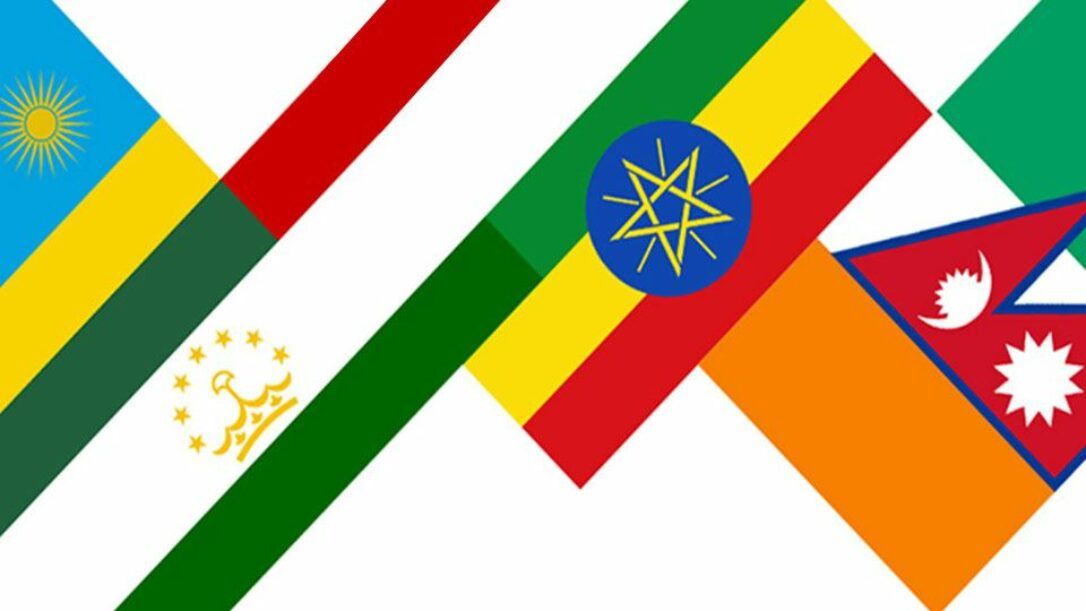

These five countries show the highest potential for growth in economic productivity.

- Rwanda: shows most potential for growth but its stock market comprises only seven companies and is open for only three hours a day. Trade volumes are very low – typically fewer than five equity trades per session.

- Tajikistan: home to the newly formed Central Asian Stock Exchange (CASE) which aims to build a platform for companies and investors to trade financial instruments, in line with international standards. However, the anticipated launch of the equities market has been delayed so there is currently no trading opportunity.

- Ethiopia: with a population of 87 million, it is the largest country in the world without a stock exchange, but it does have a commodity exchange trading mostly coffee and sesame seeds. There are plans to add other commodities, equities, government debt and metals as part of a five year plan.

- Nepal: there has been a stock exchange in Kathmandu since 1994 and there are 230 companies listed currently. Total floated (i.e. not privately held) market capitalisation of all listed companies is only £5.5 billion, about the same size as the Royal Mail. This is a small stock exchange with less than 6,000 trades a day, less than one hundredth of the number traded on the London Stock Exchange.

- Cote d’Ivoire: its economic capital, Abidjan, is home to the regional stock exchange that serves eight West African countries (Benin, Burkina Faso, Guinea Bissau, Mali, Niger, Senegal, Togo and Cote d’Ivoire). It began operations in 1998. Trading is, apparently, entirely electronic but its website is so unbelievably slow I am unable to find out how many companies are listed and what liquidity is like (check it out – www.brvm.org). It would be quicker to fly there!

The lack of market access and poor liquidity makes investing in these countries very difficult. Our analysis also has Kenya and Vietnam in the top 10. These have more developed stock markets and offer more easily accessible investment opportunities. We are not invested yet but are keeping an eye on the potential out there.

For more details on our analysis please see James Timpson’s research note ‘Developing Countries Review’ of 31st May 2016.