2017 was meant to be a difficult year for investors. Post-Brexit blues, the election of President Trump and the rise of populism in Europe were billed as the agents of a storm that would blast global markets. But the winds never came, and last year turned-out to be one of the calmest on record.

Contrast this to the start of 2018. The UK economy was doing better than expected. Macron proved that with the correct packaging, liberal-centrist pro-European policies can still win elections, while President Trump had managed to introduce much needed reforms to America’s corporate tax system. We entered this year with optimism, and rising corporate earnings.

As 2018 kicked-off, equity prices rocketed. Within four weeks, the US market was up nearly 8%. And then, as Dylan Thomas says, “… the weather turned”. Investors lost their nerve and by early February all of the gains of 2018 had been reversed into losses. This is normal market behaviour. Last year, with ultra-low volatility, was abnormal.

How did we do?

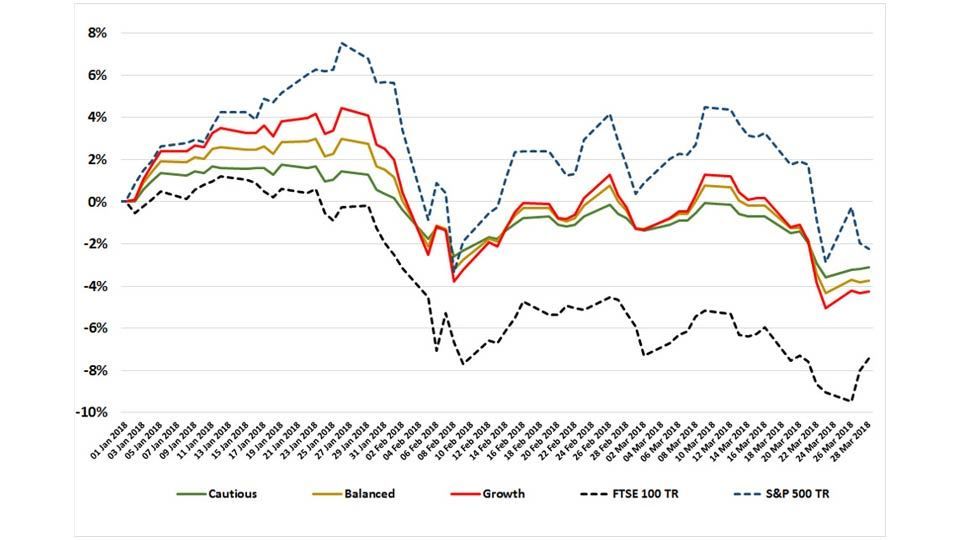

The following chart shows the percentage returns from our multi-asset funds from the start of the year to 28/03/2018.

Chart 1: Courtiers Multi Asset Funds & Indices – % Return 2018 YTD (as at 28/03/2018)

Source: Bloomberg/Courtiers

Our Growth fund was the big climber in January, although it didn’t boom by as much as the S&P 500. Cautious fund lagged our Growth and Balanced funds. That is what you would expect in a rising market. As at 28/03/2018, Cautious was down –3.11%, Balanced –3.75% and Growth –4.27%. Cautious out-performed as the market drifted off and that, again, is exactly what you would expect.

The FTSE 100 has had a really bad time losing -7.43% with some UK large caps getting a pasting. Thankfully, we have done a lot better than our domestic market.

What about volatility?

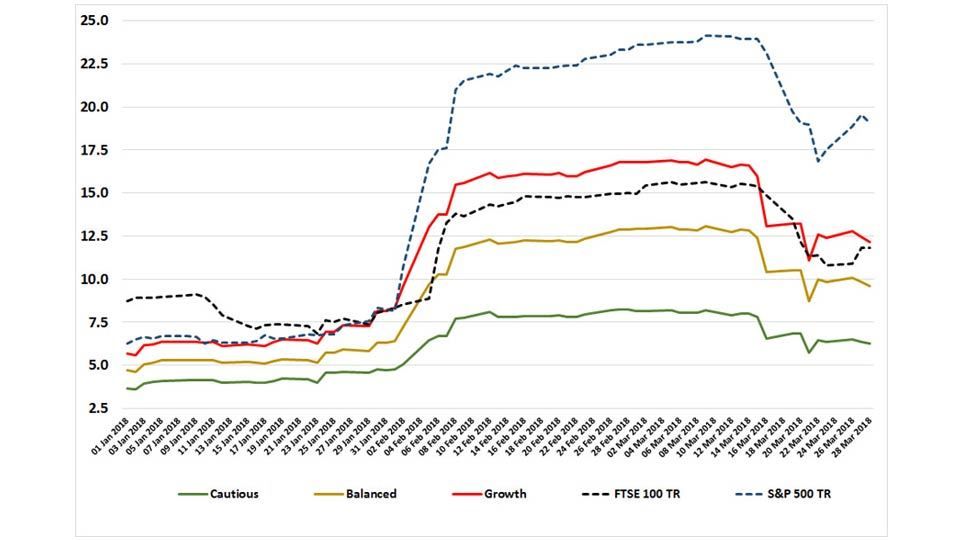

Again, our multi-asset funds behaved as we would expect, which is highlighted by Chart 2.

Chart 2: Funds & Indices 30 Day Vol (Annualised) – 2018 YTD (as at 28/03/2018)

Source: Bloomberg/Courtiers

Cautious fund was a lot less volatile than equity markets generally. Its rolling 30 day volatility (which is the annualised standard deviation of price movements over the previous 30 trading days) rose just above 7.5% through February, and has declined a little since. But the swings in prices for our Cautious fund were less than our Balanced and Growth funds, and much less than those of the S&P 500 index.

The relatively lower short-term volatility of our multi asset funds, and especially for Cautious and Balanced, is due to:-

- Holding a very broadly diversified range of assets

- Hedging against the effects of market downturns through the use of options

We will continue to utilise diversification and hedging whilst at the same time trying to exploit the buying opportunities that the recent market corrections have created.

Happy Easter!