“Every good act is charity. A man’s true wealth hereafter is the good that he does in this world to his fellows.”

Molière (1622 – 1673)

There are words in the English language that instantly make us feel uneasy, in a unique league of their own. ‘Disruption’ or ‘damp’ for example have negative connotations and ensure that nothing particularly good will occur whenever they are used. The word ‘tax’ can often be added to this ‘league’, with the exception however for Her Majesty’s Revenue & Customs (HMRC) or the Treasury (smiles all round for them).

Benjamin Franklin uttered the immortal line “…in this world nothing can be said to be certain, except death and taxes”. One form of taxation that marries these two perfectly is Inheritance Tax, commonly known as IHT.

IHT is one of the most controversial taxes in the UK. Essentially it is tax payable on death when a person’s estate exceeds a minimum threshold or ‘nil-rate band’ (currently £325,000 for individuals and £650,000 for married couples and civil partners). An estate comprises a person’s possessions, money and property. The current rate of IHT is 40%, payable on taxable assets over the nil rate band. The nil rate band may be reduced or increased depending upon individual circumstances.

There is an effective way of reducing IHT which is often overlooked; giving to charity. Charitable donations are exempt from IHT. You can donate as much as you like and provided it is to a UK registered charity, there is no IHT due.

This is all well and good during your lifetime, but what if you wish to leave part of your estate to designated charities when you pass on? Firstly, and most importantly, any amounts or possessions you wish to leave should be clearly stipulated in your Will. The reasoning for this is because when probate is applied for, the overall value of your estate is calculated using a three step process in order to determine the charity discount.

If you leave up to 10% of your estate to charity then you could qualify for a 4% IHT discount which means that instead of paying 40% IHT, you will pay 36% on your entire estate. However you need to know the value of different parts of the estate (known as components) because some components may qualify while others will be taxed at the full rate. For the sake of simplicity components will not be covered in this article, we will assume that all components qualify. To calculate whether the donation will meet the charity discount, follow the three step process:

Step 1

Calculate the amount of the chargeable estate that is subject to IHT. The charitable donations are deducted at this stage because they are an ‘exempt transfer’ for IHT purposes. Any agricultural or business property relief is also deducted at this point.

Step 2

Deduct the available nil-rate band from the estate.

Step 3

Add back in the charitable donations to the estate. This provides what is known as the baseline amount. Provided the charitable donations make up at least 10% of the baseline amount, this will ensure that your estate qualifies for the 36% IHT rate across all taxable assets.

It must be stressed that IHT is due only on an estate over the nil-rate band (£325,000 for individuals and £650,000 for married couples and civil partners).

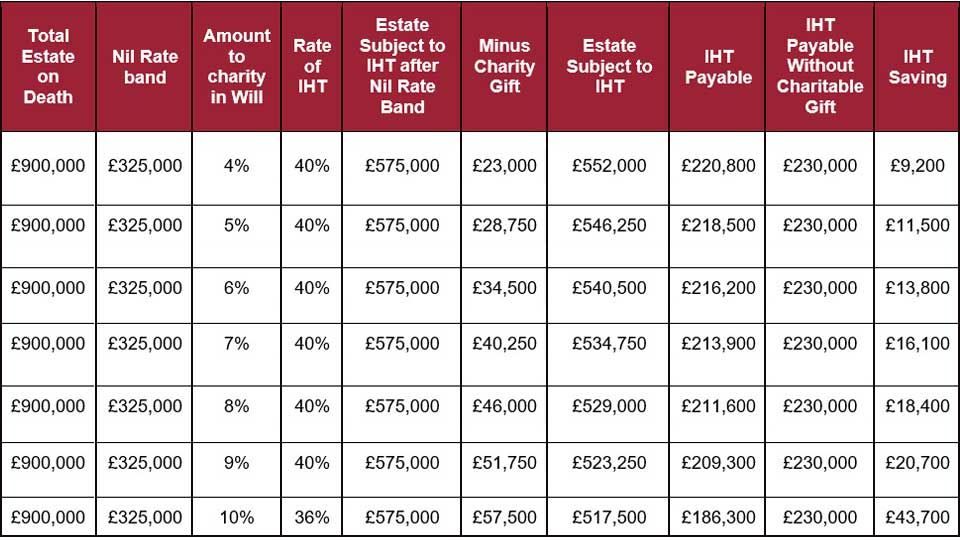

To get an idea of the reduced IHT payable, the table below shows an example of an estate valued at £900,000 and charitable donations left in a Will ranging from 4% to 10%.

Whatever your situation, Courtiers can assist and guide you with your estate planning. Every individual, their family and estate is different in terms of circumstances and assets, therefore each requires a unique approach to mitigating IHT. Tax treatment depends on individual circumstances and may be subject to change in the future.

For further advice and information about Inheritance Tax, Income Tax, Capital Gains Tax or Corporation Tax, please contact us or speak to your Courtiers Adviser.