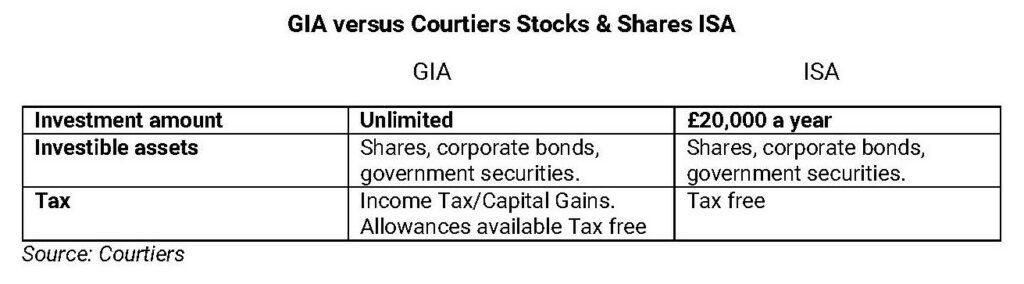

Anyone who has reached their £20,000 a year stocks & shares ISA limit for 2021/22 (or expects to do so) may be wondering what to do with excess funds they wish to invest. With stock markets having made a strong recovery since last year’s collapse and interest rates still at paltry levels, those who have benefitted from soaring share prices will be keen to maximise any opportunity for future gains.

One option is to open what is known as a General Investment Account, or GIA. Courtiers clients may be more familiar with the term Collective Investment Portfolio. A GIA is often held alongside a stocks and shares ISA. Courtiers clients have the option of investing in a GIA, a Courtiers Stocks & Shares ISA or both. Some may hold a stocks and shares ISA outside Courtiers. If this is the case for you and you are interested in transferring it to Courtiers, please speak with your Adviser.

GIA – weighing it up

A GIA is less tax efficient than a stocks & shares ISA. Whereas with an ISA withdrawal, capital gains and the balance are tax free, with a GIA dividends are taxed in the tax year they are received, while capital gains above the capital gains limit (currently £12,300) will be payable when stocks are sold.

The beauty of a Courtiers GIA is that clients have access to exactly the same range of funds as those holding a Courtiers Stocks & Shares ISA. Moreover, unlike an ISA which currently has a £20,000 annual limit per tax year, there is no limit to the amount you can invest in a Courtiers GIA. This can be particularly advantageous for those with a significant lump sum to invest.

On the face of it, a lack of tax efficiency could be enough to turn people away from a GIA. However, this would mean missing out on the opportunity to invest in a wide range of financial assets, including shares, government securities and corporate bonds held in Courtiers funds available through the Courtiers GIA.

An individual decision

Deciding whether to hold a GIA of course will always be an individual decision based on each person’s unique circumstances. Individuals who don’t exceed the annual £20,000 ISA limit, for example, may decide they don’t need one.

On the other hand, an individual who has a lump sum over £20,000 they wish to invest will need to ensure that that part of their investment that takes them above their remaining annual allowance is invested in a GIA.

Advantages of having both an ISA and a GIA

One advantage of holding both an ISA and a GIA is that with careful tax planning, tax-free gains made within a GIA (see below) can be reinvested back into an ISA, allowing an investor to take advantage of all the tax advantages that ISAs offer. Tax planning around CGT was covered in an article last year.

Making use of available allowances

One factor that might tip the balance in favour of opening a GIA is the ability to take advantage of various allowances, which can be used to offset potential taxes.

The most important of these is the Capital Gains Allowance (£12,300 in the current 2021/22 tax year), which individuals can use to offset any capital gains when an investment is sold.

For example, if an individual has £300,000 invested in a Courtiers Fund and is sitting on a capital gain of £50,000, the amount of their portfolio they can afford to sell to ensure the gain realised does not breach their CGT Allowance is £73,800. This figure is reached by working out the CGT allowance as a proportion of unrealised gains, in this example. (£12,300/£50,000), which in percentage terms is 24.6% of the £300,000 the individual has invested.

It should be noted that even when Capital Gains Tax is payable, the 10% starting rates for a basic rate taxpayer and the 20% rate for a higher or additional rate taxpayer respectively are lower than the 20% and 40% rates for taxpayers in the same income tax brackets.

Dividend Allowance – up to £2,000

Where an individual receives income from dividends, the first £2,000 is tax free.

Other allowances

Although rates of interest on cash held in GIAs are generally low, there are a number of other annual allowances that may also be used to offset tax from having a GIA.

Starting Savings Allowance up to £5,000

Up to £5,000 of the interest received from savings held in a GIA can be tax-free. However this depends on an individual’s other income.

Use capital gains losses to your advantage

Individuals who hold their investments in a GIA can also take advantage of the rules on capital gains losses. This allows capital loses to be offset against gains.

Capital gains losses – key points

Capital gains losses that arise in a tax year must be offset against any capital gains for that tax year but the annual exemption is then lost.

If your total taxable gain is still above the CGT tax free allowance, you can deduct unused losses from previous tax years. If they reduce your gain to the tax-free allowance, you can carry forward the remaining losses to a future tax year.

Unutilised capital losses from tax years which are unutilised may be carried forward indefinitely for offset against subsequent tax year capital gains.

For further information about the Courtiers GIA and whether you might benefit from this as an investment vehicle, please speak to your adviser, call 01491 578368 or enquire via the contact form.