If you haven’t already used up this year’s £20,000 ISA allowance and are considering your next move, perhaps you’re wrestling with a question that has long concerned investors. Should I invest the whole of the £20,000 into my stocks and shares ISA in one go, or would it better to drip feed in, say £5,000 every three months or £1,666 every month over the next year?

If you’ve received a tax-free pension lump sum, been left some money or sold your business, you may be pondering the same question.

Drip feeding

The argument in favour of drip feeding investments into the market over a period of time is based on the idea that by investing a fixed amount at regular intervals an investor can take advantage of lower prices when prices drop and that this can result in a lower average cost per share or per unit bought. This type of investment strategy is known as pound-cost averaging, or dollar-cost averaging if you’re in the US.

To take an example, if you invested a £5,000 lump sum in a stock whose shares trade at £10, each share would have cost you £10. However, if you had invested that £5,000 in five £1,000 instalments when prices were £10, £9.50, £9, £9.75 and £10.25 then the average price per share would have been £9.70.

Making a series of investments also reduces the risk around market timing that comes from lump sum investing, particularly the risk that the market will plummet soon afterwards.

Drip feeding your investments in this way has the advantage of being relatively simple to implement. Once you’ve set up, say a direct debit, it happens automatically. Another advantage is that it removes behavioural biases, particularly the tendency for retail investors to cut back investment when markets are falling and to buy more shares or units when markets are rising. On the other hand, you may need to factor in higher transaction costs.

Pound-cost averaging is the way that many people already invest, for example by making monthly payments into their pension, but what evidence is there that it actually works better than investing the same amount in a lump sum?

A study by Fidelity in the US looked at how several different investment strategies would have worked from January 2000 to January 2004, a period that included a bear market – a period when a market experiences prolonged price declines, and the start of the subsequent market recovery. The study found that the best results came from steadily investing $500 every month into an S&P 500 stock portfolio.

Another study, by a Professor in the University of Connecticut’s Department of Finance, found that cost averaging produced better results than lump sum investing. A wealth of other academic studies also support the argument for dollar cost averaging, although importantly only under certain types of market conditions and for investors with specific risk tolerances (more on this later).

Lump sum investing

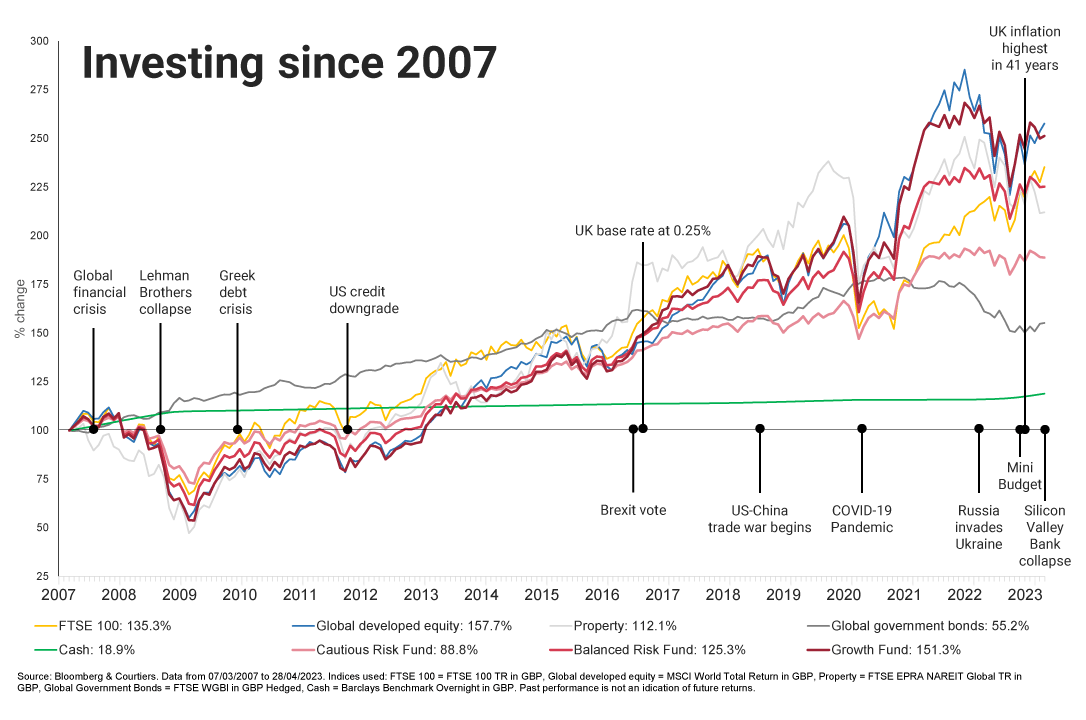

At its simplest, the case for lump sum investing rests on the idea that over time markets tend to go up more than they go down (as shown in the chart below), so it’s better to be exposed to them for the maximum length of time possible. Yes, especially if you get your timing wrong and the market crashes just after you’ve invested a large sum, you could end up losing money from which you might find it difficult or perhaps impossible to recover, but having more invested in the market for longer allows you to take advantage of the power of compounding. And the longer you are invested in the market the greater this compounding effect.

A 2020 report by the Association of Investment Companies found that £7,550 invested as a lump sum in October 2007 just before the global financial crisis would have been worth £15,971 by May 2020.This compares to £12,319 if £50 a month had been invested over the same period. It’s interesting to note that the lump sum strategy did better than drip feeding despite the subsequent market crash, with the strong recovery and subsequent long bull run – a sustained period when a market rises, more than compensating.

Taking the MSCI World index, a research paper published by US-headquartered investment giant Vanguard in 2023 found that between 1976 and 2022, lump sum investing outperformed cost averaging 68% of the time after one year.

Another study by American multinational financial services company Charles Schwab came to a different conclusion. Based on a hypothetical portfolio that tracked the S&P 500 index it found that in terms of financial returns there was very little difference between the two approaches. While the lump sum investor made $135,471 between 2001 and 2020, the dollar-cost averaging investor made $134,856, just $615 less. In 66 of the 76 20-year rolling periods dating back to 1926, the results were broadly the same.

It should be mentioned, of course that past performance should not be taken as a guarantee of how these two strategies might work in the future. Plus, many of these studies relate to the US market, arguably making them less relevant to those who invest predominantly in the UK.

It’s more than just about financial returns

A study by Morgan Stanley Wealth Management (MSWM) concluded that in certain scenarios lump sum investing “may outperform over a seven-year horizon.” Nevertheless, MSWM went on to say that it favoured dollar cost averaging strategy “for the periodic investing of savings.”

MSWM said it went beyond simply comparing the financial returns of the two approaches and considered other factors too. Cost averaging “provides a systematic framework for deploying capital,” it argued. It could also be useful to combat investors’ behavioural biases, and to limit potential regret that comes, for example, from a significant sudden drop in the value of large lump sum investment.

Vanguard took a similar stance not coming down categorically on one side of the argument or the other. Cost-averaging “might be considered for investors with very high aversion to both risk and losses” who might otherwise be tempted to hold a lump sum in cash, it suggested.

I asked Graeme Clark Courtiers Head of Private Clients for his view.

“Whether to invest a lump sum or spread it over a period of time is very much a decision for every individual. It depends on their individual situation and circumstances, for example, not everyone will have a lump sum to invest”, says Graeme. A lot of clients are putting money into the market on a monthly basis often through their pension.

Most Courtiers clients are already in the market, says Graeme and once they’re able to meet their short term needs, the investment strategy they adopt “depends on their long term goals and reasons for investing and their capacity for loss should the market fall.” Graeme adds that some clients, who have a lump sum to invest may prefer to hedge the risk of the market falling by drip feeding their money into the market over a period of time.

“It’s always stated that you shouldn’t try to time the market,” says Graeme – something I wrote about back in 2022.

Summary

Market conditions

Pound-cost averaging works best during periods of volatility or negative returns, while in periods of positive returns the reverse tends to be the case. Intuitively this makes sense and shouldn’t come as much of a surprise.

Timing

Timing is crucial. If you had invested a large lump sum in a FTSE 100 tracker just before the pandemic shook markets in February 2020 you’d soon have been sitting on a large loss, but starting at the same time, if you’d invested the same amount in equal instalments over the next year those losses would have been cushioned. And as the market recovered over the course of 2020 those units bought earlier in the year would have appreciated in value.

Final word

Although numerous studies and academic papers have looked at whether lump sum investing or drip is the better investment strategy, these studies only take you so far. While both approaches have their advantages and disadvantages, for each person, the optimum approach will depend on their individual goals, attitude to risk and risk tolerance, their circumstances, their investment timeframe and of course their financial objectives.