If you’re the beneficiary of a will, you may decide that you would rather it went to someone else. You might prefer that it goes to your children, the grandchildren of the deceased, for example. Or to someone else you feel needs the money more than you do.

One option would be to gift your inheritance to the person or persons of your choice. The big disadvantage is the seven-year rule, which means that with the exception of the £3,000 annual exemption and other allowances, you would need to survive seven years for it to fall outside your estate for inheritance tax (IHT) purposes.

Another option is to make what’s called a Deed of Variation (DOV) to the deceased person’s will. A DOV is a legal document which allows the beneficiaries of an estate to redistribute their inheritance in favour of someone else. In many cases this will be to children or grandchildren, but it can be anyone, even someone not a beneficiary to the will. A DOV can be made irrespective of whether there’s a will or not.

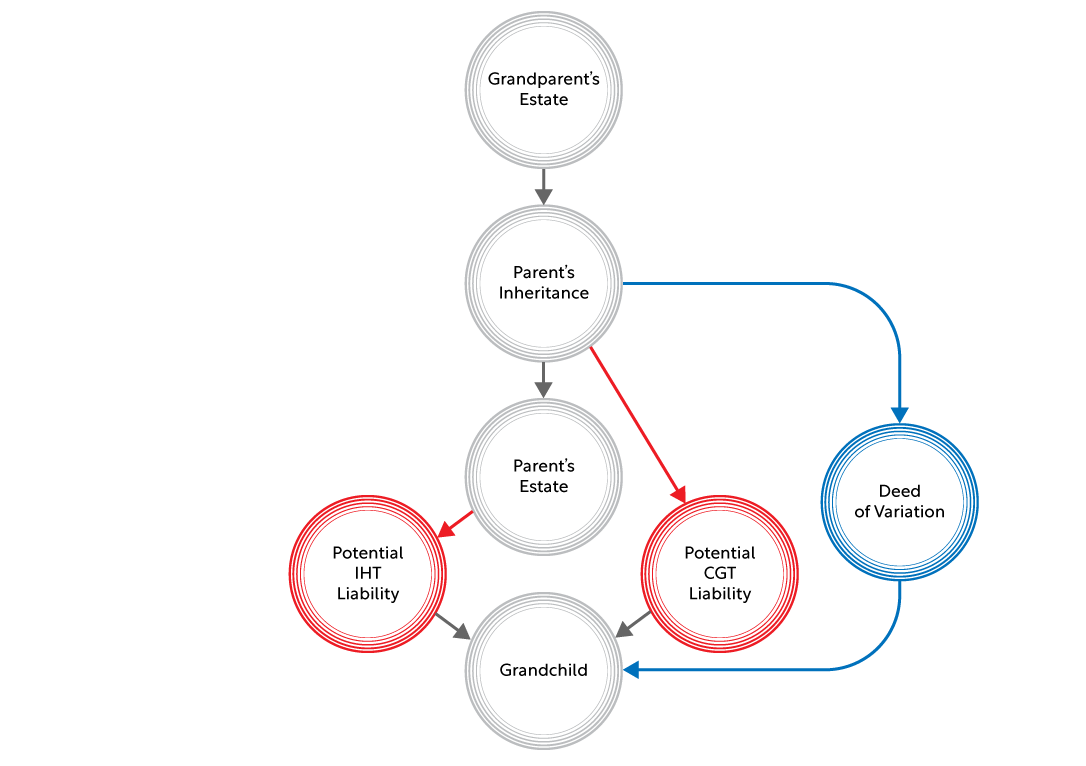

The chart below illustrates how a Deed of Variation can be used to redistribute an inheritance in favour of the next generation in a tax efficient way.

Tax efficient

As long as certain requirements are met, any assets distributed are treated for IHT tax purposes as if the deceased made the gift themselves. As a result, they never fall within the initial beneficiary’s estate. Consequently, there’s no need for the beneficiary to survive seven years before those assets fall outside their estate.

Inheritance Tax

The OBR estimates as many as 6.5% estates could be liable for IHT by 2026 – a number of those as a result of receiving an inheritance. A DOV can be a useful way to avoid this happening.

Capital gains tax

A DOV can also be made in respect of capital gains tax (CGT) – for example if the beneficiary of shares makes a deed of variation to gift them to another member of the family. As with IHT, the gift will be treated as if it was made by the deceased person, so even if the shares have increased in value there will be no CGT charge on the initial beneficiary. Receipts from capital gains tax (CGT) rose by more than £5bn in the past two years to reach £14.9bn in the latest tax year 2021/22.

Charity

Using a DOV to redirect a deceased person’s assets to a charity can cut the IHT on their estate. Where 10% or more of a deceased person’s estate is directed to a charity the rest of the estate can benefit from a reduction in the IHT rate from 40% to 36%.

Strict Conditions

In order that assets can be treated for IHT and CGT tax purposes as if they had been gifted directly from the deceased person to the initial beneficiary’s doner or doners of choice, a DOV must meet certain strict conditions:

- It must contain a statement or statements that those signing the variation intend it to take effect for IHT and/or CGT tax purposes

- It must also include the appropriate statutory references. For more details, please refer to HMRC’s DOV checklist.

- A DOV must be made within two years of a person’s death

- All beneficiaries losing out must agree and be party to it. No beneficiary can be under the age of 18.

- Assets can be passed directly to an individual or passed into a trust

- Where there is no will a DOV must be made under intestacy rules

- No one can be compensated for the amount they give up

- Income tax is not treated in the same way as CGT and IHT and any income, say dividend income from shares, will be treated as the income of the original beneficiary

Summary

A DOV gives the beneficiary of an inheritance the possibility of redirecting it to another person or persons of their choice. It can also be useful in terms of tax and intergenerational financial planning.

While a financial adviser can help with the tax planning aspects of a DOV, it’s advisable to consult a solicitor, who can ensure the documentation is in order and that it gives effect to your wishes.