Inheritance Tax and Probate form a common problem when someone we know dies: how to settle the Inheritance Tax bill before probate can be secured?

Probate and the “LPR”

Probate is the legal right to deal with someone’s estate (property, money and/or other possessions) after they die. The person or people requiring probate, known as the deceased’s Legal Personal Representative (or LPR), will, with some rare exceptions, need to apply for a ‘grant of probate’ before assets can be sold to cover any Inheritance Tax (IHT) due. The LPR can be one or more people as defined by the deceased’s Will (named in Will as an Executor) or, if there is no Will (or no named Executor in a Will) an application must be made to the court by the individual wishing to apply to be LPR.

Demands on the rise

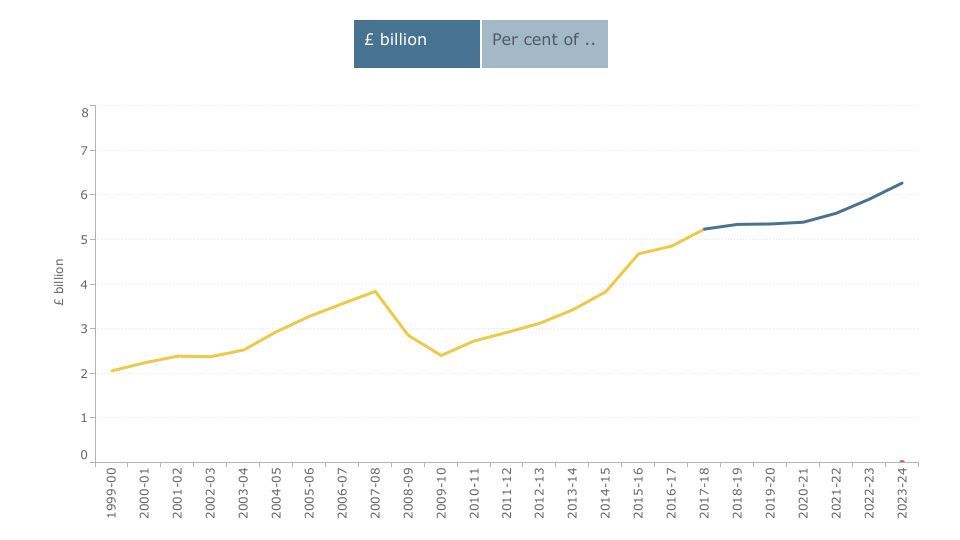

According to data available from The Office for National Statistics, around 4.2% of estates in the UK pay IHT. IHT bills have been rising in recent years and are set to continue according to statistics from the Office for Budget Responsibility (OBR), due to significant upward shifts in property values, equity markets over the past few years since the last financial crisis, and with the stagnation of the IHT threshold (known as the Nil Rate Band).

Inheritance Tax: latest forecast

The taxman will expect LPRs to borrow money or even use their own assets to settle any IHT liability prior to the issue of probate. There are some circumstances where the LPRs may be able to access the deceased’s assets and this would certainly be the case with jointly owned assets such as bank accounts, under the right of survivorship. At the request of the LPR, Banks and Building Societies, under the Direct Payment Scheme, can also usually make payment direct to the taxman when the deceased’s account was in their sole name. The same applies if the deceased held National Savings & Investment products or government stocks (gilts).

LPRs can also pay the tax in 10 yearly instalments plus interest, if the liability arises from a property, and commercial lenders also provide probate loans, which would be repaid from the deceased’s assets once probate is obtained.

Neither of these options may look attractive and there are alternatives with a degree of forward planning. This has become even more prevalent given the proposed hike in probate fees, which has only had a stay of execution, thanks to Brexit delays.

Probate Trust

These are trusts that are set up during lifetime to speed up the payment of the proceeds of an investment upon death. The investment is held by trustees, on behalf of beneficiaries, thereby conferring a separate legal ownership from the deceased themselves. This subsequently circumnavigates the requirement for probate prior to payment by the trustees.

The trust is usually set up on a discretionary basis, allowing a wide range of potential beneficiaries and crucially this can include the settlor (the person gifting the assets into trust). This may be of particular relevance and reassurance to an individual who wouldn’t be comfortable giving all or part of their liquid assets away during their lifetime.

There is, naturally, a trade off in that the value of the trust would form part of the deceased’s estate when valuing their total assets upon their demise under the ‘gift with reservation’ rules. However, the arrangement is likely to save both time and money for the deceased’s LPRs in terms of the probate application process and solicitors fees (if the executors are using a professional to obtain probate). It also ensures that the deceased’s assets are distributed according to their intentions. The settlor has complete flexibility to alter the beneficiaries during their lifetime too, so it is a very effective inter-generational planning tool.

Of course, a more conventional trust arrangement, which excludes the settlor, can also be used, if the individual is comfortable with, or has sufficient assets to make a gift with no “strings” attached, whilst retaining control and flexibility.

It’s worth mentioning as an aside, that whilst very effective from a probate stance, a local authority may view an individual setting up a Probate Trust as a “deliberate deprivation” of assets in the event of the individual subsequently needing long-term care.

Life Assurance In Trust

An individual can usually effect a policy on their lives, which pays out a lump sum on their death to cover the eventual IHT liability on their estate. The cost or premiums for this cover can often be met either through the annual gift allowance of £3,000 or through a series of habitual gifts under the gifts out of normal expenditure exemption (both of these have been widely covered in previous articles). Provided either of the afore-mentioned are satisfied, the premiums and lump sum death benefits would not count as part of the deceased’s estate for IHT purposes.

Furthermore by placing the life assurance plan into a discretionary trust and ensuring that there are living trustees in place, a claim can be made on the life’s assured death without the need for probate.

Once a claim has been paid, the trustees can only use the proceeds to benefit the trust’s beneficiaries. This might include settling an IHT bill on behalf of those beneficiaries to the extent that the same individuals’ legacies under the deceased’s Will are being reduced by the IHT. Alternatively, the trustees could lend funds to the LPRs to pay the IHT, with the estate reimbursing the trust once probate is obtained.

Invest in a pension

Pensions are generally held under master trust, thereby the same principle applies to that of the probate trust meaning payment of death benefits to beneficiaries by pension fund trustees can be made without probate.

Pensions are also very attractive from an estate planning perspective in that they are not taxed in the same way as an estate on death under the IHT regime. Previous articles have also outlined the principle of tax relief and tax efficient growth during the pension accumulation stage. All in all, a very attractive way to save money!

Please speak to your adviser if you’d like any further details with regards these planning opportunities.